Will Rate Cuts make HDB Housing Prices more Expensive?

Will Rate Cuts Make HDB Housing Prices More Expensive?

As the global economic landscape undergoes significant shifts, particularly with the potential for interest rate cuts, many Singaporeans are left pondering the implications for Housing and Development Board (HDB) flat prices. Lower interest rates typically equate to more affordable borrowing, which can spur heightened demand for property. However, what does this mean specifically for the public housing market in Singapore?

How Interest Rates Influence Property Prices

Interest rates play a pivotal role in determining the cost of borrowing. When central banks, such as the Federal Reserve, reduce rates, home loans become cheaper and more accessible to potential buyers. This dynamic is crucial; as borrowing costs decrease, more individuals are likely to enter the property market, leading to an uptick in demand. In competitive real estate environments, an increase in demand often results in higher property prices as more buyers vie for limited available units. While this correlation is frequently observed in private property markets, the repercussions can extend into the realm of public housing, affecting HDB prices as well.

Current Trends in HDB Prices

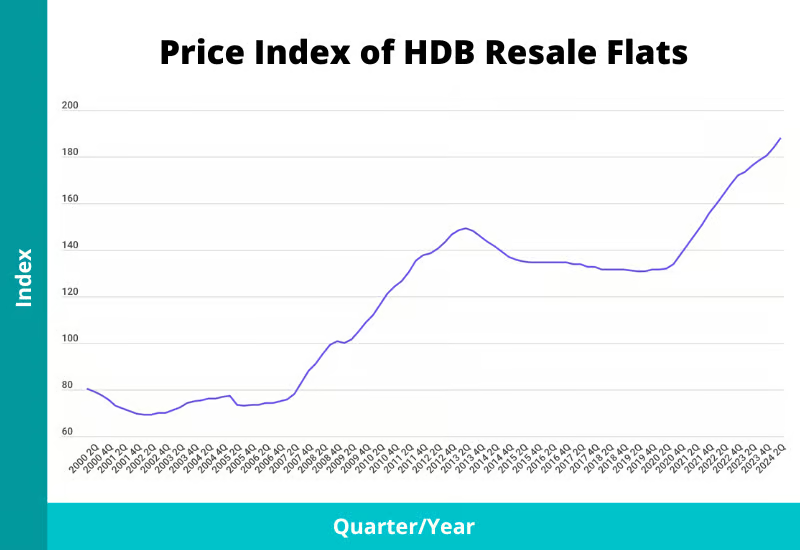

Over the past few years, HDB resale prices have been experiencing a notable ascent, with million-dollar transactions becoming increasingly common. Several factors contribute to this trend, including inflation, supply constraints, and the growing demand for homes in prime locations. Economic dynamics, including rising costs of materials and labor, have compounded these factors, creating a perfect storm for escalating prices. As these trends continue to exert upward pressure on prices, the prospect of interest rate cuts introduces yet another variable into the equation, prompting speculation on future pricing trajectories.

Will Rate Cuts Lead to Higher HDB Prices?

1. Lower Mortgage Rates, Higher Demand

The direct impact of lower interest rates on HDB buyers cannot be overstated. With mortgage rates declining, buyers can benefit from reduced monthly repayments, thereby increasing their purchasing power. This heightened affordability allows potential homeowners to stretch their budgets further, enabling them to bid more aggressively for the same properties. In a housing market where demand already exceeds supply—particularly in sought-after areas—this could exacerbate existing price inflation, pushing resale prices even higher.

Mortgage rates are interest rates charged on a mortgage loan used to buy property. A lower mortgage rate means lower monthly payments for homebuyers, making it easier for them to buy a home.

2. Investor Influence

Interest rate cuts may not only entice first-time buyers but also draw in investors looking to capitalize on the lower borrowing costs. With HDB flats providing rental yields that can compete with certain private properties, investors might see a compelling opportunity to enter the resale HDB market. This influx of investor interest could further intensify competition, ultimately driving prices upward as more buyers engage in bidding wars over desirable flats.

3. Economic Confidence and Spending

Moreover, rate cuts often signal an intention from central banks to stimulate the economy. As borrowing becomes cheaper and economic conditions appear more favorable, consumer confidence typically increases. This boost in sentiment can translate into greater willingness among individuals to make significant investments, including property purchases. An uptick in economic optimism might lead to more Singaporeans opting to buy HDB flats or upgrade to larger homes, resulting in heightened demand across the board. The psychological impact of lower rates can shift consumer behavior, prompting more individuals to act on housing opportunities.

4. Speculative Buying and Market Dynamics

With increased demand from both buyers and investors, there’s a risk that speculative buying could enter the equation, further complicating market dynamics. Potential buyers might rush to secure flats in anticipation of future price increases, creating a feedback loop of rising prices. As competition intensifies, the likelihood of bidding wars escalates, potentially inflating prices beyond reasonable market valuations.

Potential Government Intervention

Given the potential for overheating in the HDB market due to increased demand fueled by lower interest rates, it’s plausible that the government might need to implement cooling measures to maintain affordability and accessibility for the average Singaporean. Some potential interventions could include:

Tighter Lending Limits: The government may opt to adjust the Mortgage Servicing Ratio (MSR) or the Total Debt Servicing Ratio (TDSR) to prevent buyers from overleveraging themselves in a competitive market. Stricter lending criteria could help ensure that buyers can afford their homes without taking on excessive debt.

Increased Minimum Occupation Period (MOP): Extending the MOP for HDB flats could serve to deter speculative buying by requiring owners to live in their units for a longer period before selling. This move could help stabilize the market by reducing the frequency of transactions driven by speculation rather than genuine housing needs.

Additional Stamp Duties: Similar to measures taken in the private property sector, the government could introduce higher Additional Buyer’s Stamp Duty (ABSD) for those purchasing resale HDB flats that exceed certain price thresholds. This would act as a deterrent to speculative investments while ensuring that genuine homebuyers are not priced out of the market.

Additional Buyer’s Stamp Duty (ABSD) is a tax imposed on property purchases in addition to the standard stamp duty, specifically targeting investors and second-home buyers. The government may increase this tax for resale flats to discourage speculative buying and keep the market stable.

Conclusion

While the prospect of interest rate cuts might suggest more affordable borrowing, the ramifications for HDB flat prices could be significant. Increased demand from both prospective buyers and investors may drive resale prices upward, exacerbating affordability concerns for ordinary Singaporeans. If the market continues to heat up, proactive government intervention may be necessary to ensure that public housing remains accessible to all. Ultimately, as the economic landscape continues to evolve, Singaporeans will need to stay informed and adaptable to navigate the complexities of the housing market amidst changing interest rates.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com