Why is Singapore Credit Card Debt still Rising?

Rising Credit Card Debt: A New Record, But No Panic Yet

Credit card debt in Singapore reached an all-time high by the end of 2024, with unpaid balances climbing to SGD 8.3 billion in the last quarter. That’s a 4.9% jump from the SGD 7.9 billion recorded in the third quarter, which itself was a peak since records began in 2014. Compared to the SGD 7.3 billion from the final months of 2023, it’s clear that borrowing is on the rise. However, experts aren’t sounding the alarm just yet. Data from the Monetary Authority of Singapore and Credit Bureau Singapore shows that delinquency rates—where payments are overdue by 30 days or more—are holding steady between 1% and 3%. Assistant Professor Ruan Tianyue from NUS Business School pointed out that the average outstanding balance per person hasn’t shifted dramatically, suggesting the situation remains manageable for now.

Age Groups and Borrowing Trends: Who’s Spending More?

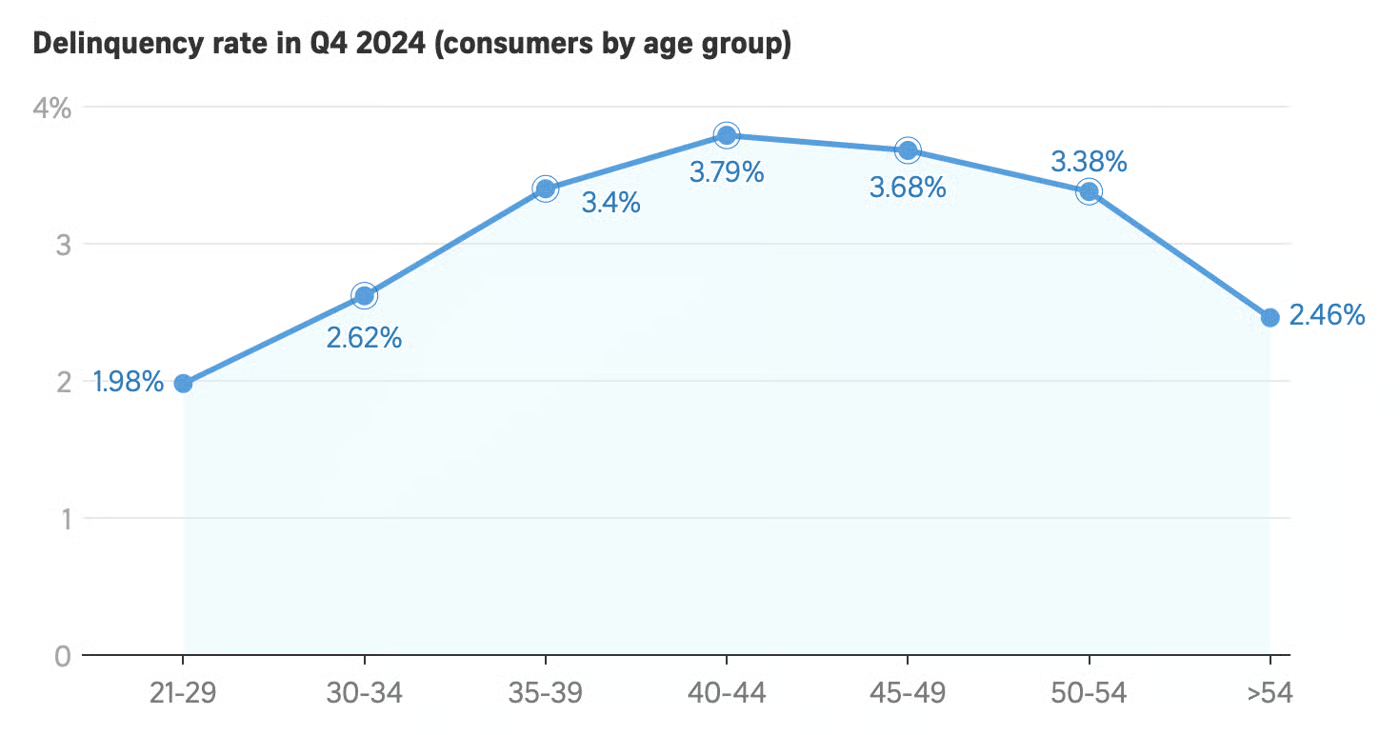

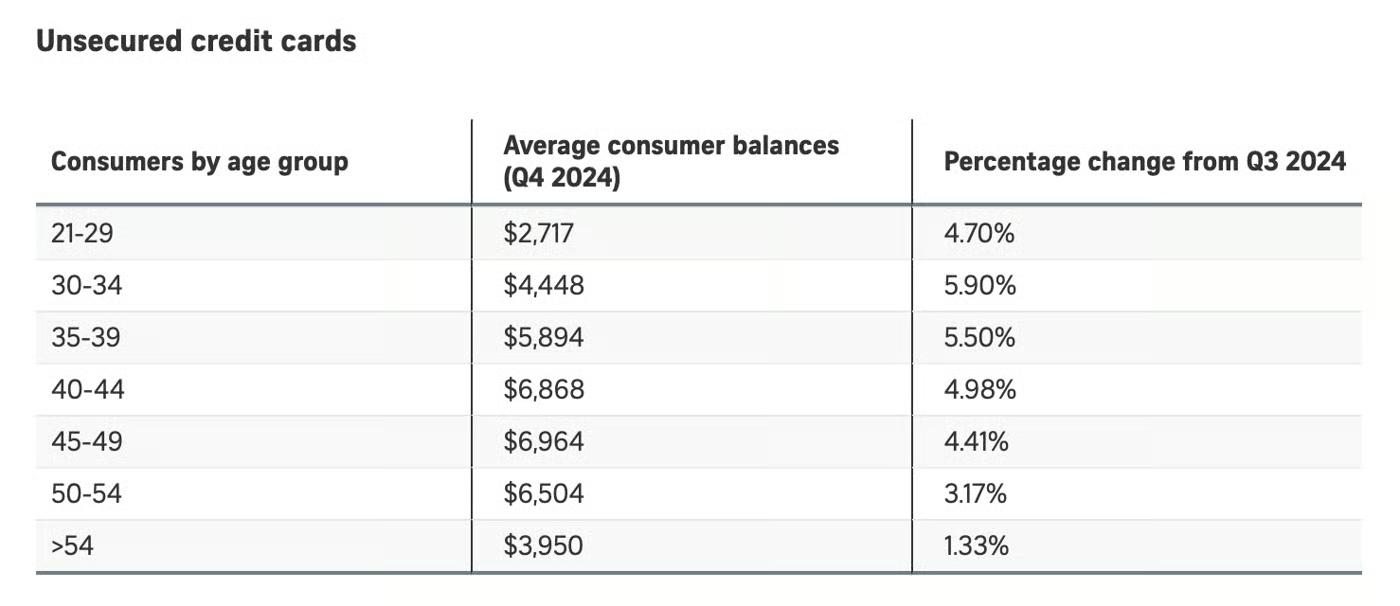

Breaking it down by age, the increases in credit card balances vary. Those aged 30 to 34 saw the sharpest rise, with their average debt jumping 5.9% to SGD 4,448, while the 35 to 39 group wasn’t far behind, up 5.5% to SGD 5,894. Older borrowers, over 54, were more cautious, with just a 1.3% increase to SGD 3,950. Delinquency rates tell a different story: the 40 to 44 cohort topped the list at 3.79%, while younger adults aged 21 to 29 had the lowest at 1.98%. Interestingly, personal loan enquiries spiked by 23.4% in the fourth quarter, hitting 30,200, which Prof Ruan suggests might reflect people swapping credit card debt for loans to ease financial pressure. Whether these borrowers can keep up with repayments will be worth watching in the months ahead.

Economic Pressures and Household Resilience

Why the uptick in debt? Professor Sumit Agarwal, also from NUS, blames the high cost of living. With necessities still needing to be bought, people are leaning on credit cards and loans, though he’s not predicting a wave of defaults. The government’s recent budget measures—like SGD 600 to SGD 800 SG60 vouchers, tax rebates up to SGD 200, and SGD 800 in CDC vouchers per household—aim to soften the blow. Yet, global challenges loom large. Rising US tariffs could stoke inflation, a worry for import-reliant Singapore, keeping prices high. Prof Agarwal argues that boosting economic growth and maintaining low unemployment are key to easing the strain. On the bright side, household net worth rose to SGD 3.1 trillion in Q4 2024, up 8.4% from 2023, showing that most Singaporeans still have a solid financial cushion. Compared to the Covid-19 shock, experts like Prof Agarwal see this as a milder bump in the road.

Struggling with credit card debt? The Citi Platinum Visa Card offers a practical solution with up to 10% rebate on M1 bills and 0.3% on retail purchases, with no expiry on rewards. Requiring a minimum income of S$30,000 and age of 21, it’s accessible for many Singaporeans. New cardholders can enjoy exclusive rewards like a Hinomi Q1 Chair, Sony Camera, or S$370 cash. To tackle debt, prioritise high-interest balances, pay more than the minimum, and leverage rebates to offset spending—easing financial pressure over time.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com