Warren Buffett’s Strategic Moves: Record Cash Levels and Market Caution

Warren Buffett’s Strategic Moves: Record Cash Levels and Market Caution

Warren Buffett’s Berkshire Hathaway has significantly reduced its stake in Apple, trimming the position to around $70 billion by the end of September, compared to nearly $175 billion at the start of the year. This selloff, hinted at in Berkshire’s recent earnings report, marks a notable shift in one of the firm’s largest holdings. Despite the reduction, Apple still represents approximately 25% of Berkshire’s $266 billion equity portfolio.

Additionally, Berkshire offloaded about 235 million shares of Bank of America during the third quarter. These sales were publicly disclosed as Berkshire held over 10% of the lender’s shares, requiring regular reporting.

A Record Cash Pile

Berkshire Hathaway’s cash reserves have surged to an unprecedented $320.3 billion in the third quarter, up from $271.5 billion the previous quarter. Of this total, $288 billion is parked in short-term Treasury bills. The firm has been steadily accumulating cash for the past nine quarters, leaving it with ample “dry powder” for potential investments. This cautious approach suggests Buffett may see limited opportunities for attractive returns in the current market.

The Buffett Indicator Flashes Red

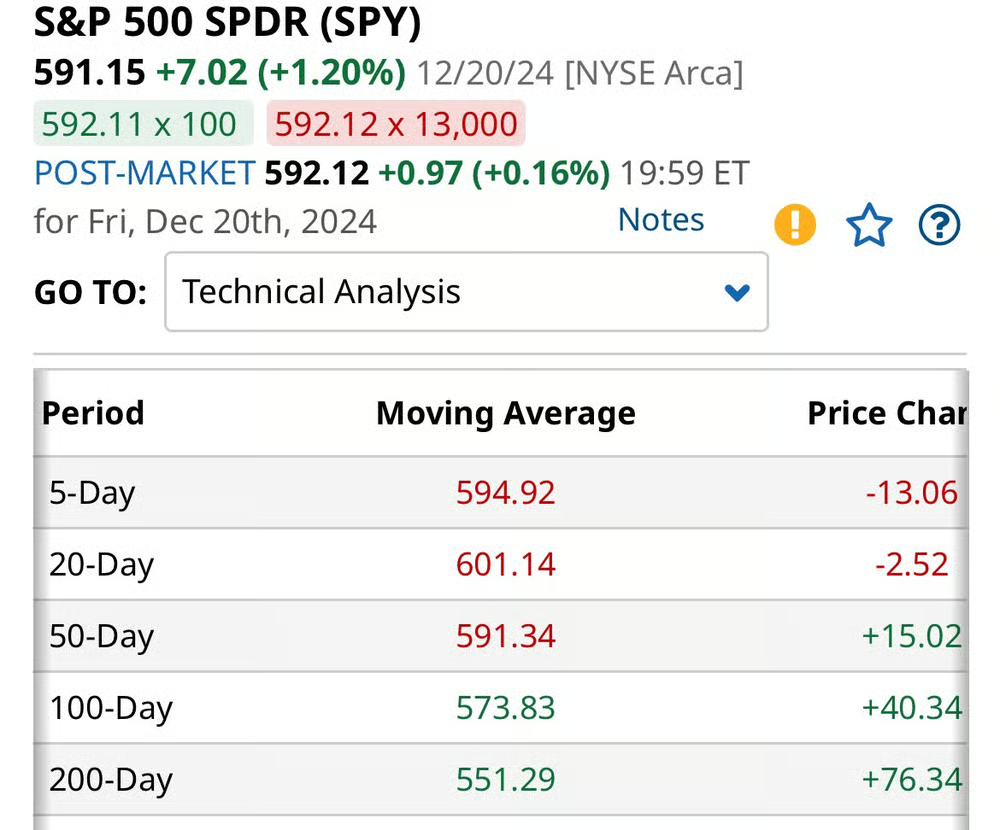

A key metric Buffett monitors is the ratio of stock market capitalization to GDP, often referred to as the “Buffett Indicator.” This ratio recently reached an alarming 198.1% of U.S. GDP, an all-time high. Buffett previously warned that when this ratio approaches 200%, it signals a highly overvalued market.

The current state of the market, coupled with Berkshire’s growing cash reserves, reflects a strategic positioning for potential turbulence ahead. Investors may take this as a cue to reassess their portfolios and adopt a cautious approach.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com