Understanding and Improving Your Credit Score in Singapore: A Comprehensive Guide to Financial Health

In Singapore’s modern financial ecosystem, your credit score is a crucial determinant of your ability to access loans, credit cards, and other financial products. It’s more than just a number—it represents your financial behavior and the level of risk you pose to lenders. While many might feel uneasy about being evaluated based on their financial history, understanding how your credit score works and taking the right steps to improve it can help ensure a healthy financial future. In this comprehensive guide, we’ll explore what a credit score means, how it’s calculated, its impact on your borrowing capacity, and actionable tips on managing and improving it.

What Is a Credit Score and Why Does It Matter?

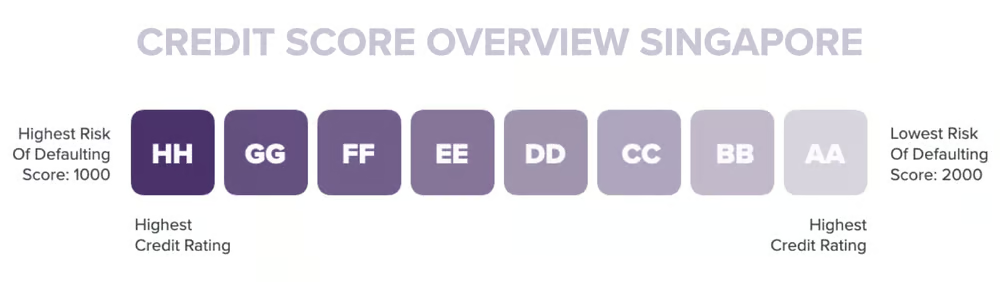

Your credit score in Singapore is calculated by Credit Bureau Singapore (CBS), which aggregates information from various financial institutions, including banks, credit card companies, and lenders. CBS collects data such as your repayment history, credit applications, and outstanding debts. These factors are then used to compute a credit score ranging between 1,000 and 2,000. The higher your score, the lower the perceived risk you pose to lenders.

A strong credit score signals to lenders that you are financially responsible and are likely to repay borrowed amounts on time. This trust can result in favorable loan terms, such as lower interest rates, higher loan limits, or a greater likelihood of loan approval. On the other hand, a poor credit score may result in higher interest rates, reduced loan amounts, or outright rejection of credit applications. In a high-cost country like Singapore, where housing loans and personal financing are common, a good credit score can be a game-changer.

Factors That Affect Your Credit Score

Several factors contribute to the calculation of your credit score, and understanding these can help you take control of your financial profile.

1. Repayment History

Your repayment history is one of the most critical factors that influence your credit score. Timely repayment of loans, credit card bills, and other financial obligations demonstrates reliability. Conversely, late or missed payments are known as delinquencies and are viewed negatively by lenders. In Singapore, CBS retains this data for 12 months, meaning your recent financial behavior plays a significant role in your score.

2. Frequency of Credit Applications

Applying for multiple loans or credit cards within a short period can harm your credit score. Each application is logged in CBS's system, and frequent inquiries may raise concerns among lenders, signaling that you might be overextending yourself financially. This could result in a lower credit score, even if you’re not in immediate financial trouble.

3. Length of Credit History

The length of time you’ve had credit plays a role in determining your score. Longer credit histories with positive repayment behaviors are generally viewed more favorably than shorter or more erratic credit histories. If you’re new to credit, it’s important to build a positive history by starting small and being diligent about repayments.

4. Available Credit and Utilization

The number of credit facilities and how much of your available credit you use can impact your score. Having numerous credit cards or lines of credit may lower your score, particularly if they are maxed out or underutilized. A high credit utilization rate (the percentage of your available credit that you're using) can also signal that you are reliant on credit, which may pose a risk to lenders.

5. Defaults and Legal Proceedings

Any legal proceedings related to debt—such as bankruptcy—will drastically impact your credit score. Defaulting on a loan or credit card debt will also be reflected in your report for several years, making it harder to secure new credit in the future.

The Consequences of a Poor Credit Score

The ramifications of a poor credit score in Singapore can be severe and long-lasting. If your credit score falls into the lower ranges, banks and financial institutions will consider you a high-risk borrower, which could lead to denied loan applications or loans offered at very high interest rates. This means that whether you’re trying to buy a home or a car, or even applying for a personal loan to cover emergencies, your access to credit will be limited and more expensive.

In extreme cases, poor credit management can lead to bankruptcy. If you have defaulted on debt that exceeds S$15,000, your creditors can file for bankruptcy proceedings against you. In Singapore, bankruptcy involves liquidating your assets (excluding protected assets like CPF savings and your HDB flat) to settle your debts, and you will also be required to contribute a portion of your salary to pay off creditors. A record of bankruptcy stays on your credit report for five years after you’ve been discharged, which severely limits your financial freedom.

Strategies to Improve Your Credit Score

Fortunately, even if your credit score has taken a hit, there are concrete steps you can take to rebuild it over time. Patience and consistency are key, but with the right strategies, you can gradually improve your financial standing.

1. Timely Payments Are Non-Negotiable

The most effective way to improve your credit score is to ensure that all your payments are made on time, every time. This includes not only loan repayments but also credit card bills, utility bills, and any other financial obligations. Consider setting up automated payments to ensure you never miss a deadline, which will help you avoid late payment penalties and maintain a positive credit history.

2. Limit Credit Applications

While it might be tempting to apply for several credit cards or loans to cover immediate expenses, avoid doing so in a short span of time. Instead, plan your applications carefully, focusing on securing the best terms for the credit you need. Each application is noted in your credit report, and numerous inquiries can lower your score. If you do need to apply for credit, space out your applications to minimize their impact.

3. Reduce Credit Utilization

Another important strategy is managing your credit utilization rate. This refers to the percentage of your available credit that you’re actually using. Ideally, you should aim to use less than 30% of your available credit to maintain a healthy score. For example, if you have a credit limit of S$10,000, keeping your outstanding balance below S$3,000 is ideal. High utilization suggests you’re overly reliant on credit, which could lower your score.

4. Consolidate Debts to Manage Repayments

If you find yourself struggling with multiple credit card debts or high-interest loans, consider consolidating your debt into a single personal loan with a lower interest rate. This can make repayments more manageable and help you clear your debt faster. The key is to ensure that after consolidating, you don’t fall into the trap of accumulating more credit card debt.

5. Build an Emergency Fund

One of the smartest financial decisions you can make is to build an emergency fund. This fund acts as a buffer during financial emergencies, such as sudden medical expenses or job loss, which can otherwise push you to rely on credit. Aim to save at least three to six months of your income in a readily accessible account. Having an emergency fund reduces the risk of missed payments or defaulting on loans, which protects your credit score in the long run.

6. Check Your Credit Report Regularly

In Singapore, you are entitled to one free credit report per year from CBS. Make it a habit to check your credit report regularly for any discrepancies or errors. If you find any inaccurate information, such as an unpaid debt that’s actually been settled, dispute it with CBS to ensure your report reflects your actual financial behavior.

The Role of Responsible Borrowing and Lifestyle Choices

In Singapore, where the cost of living is relatively high, borrowing is often part of life—whether for housing, education, or even day-to-day expenses. However, responsible borrowing and lifestyle management are essential to maintaining a healthy financial profile.

Live Within Your Means

One of the most important principles of financial management is to live within your means. While credit can provide you with more flexibility, it should not be used to support an extravagant lifestyle that exceeds your financial capacity. Carefully assess your budget and income to ensure you’re not relying on loans and credit to cover unnecessary expenses.

Avoid Rolling Over Credit Card Debt

Credit cards can be a useful financial tool if used correctly, but rolling over debt by making only the minimum payment each month can lead to ballooning debt due to high interest rates. This can severely damage your credit score and result in long-term financial strain. Always aim to pay your credit card bills in full each month to avoid interest and keep your debt under control.

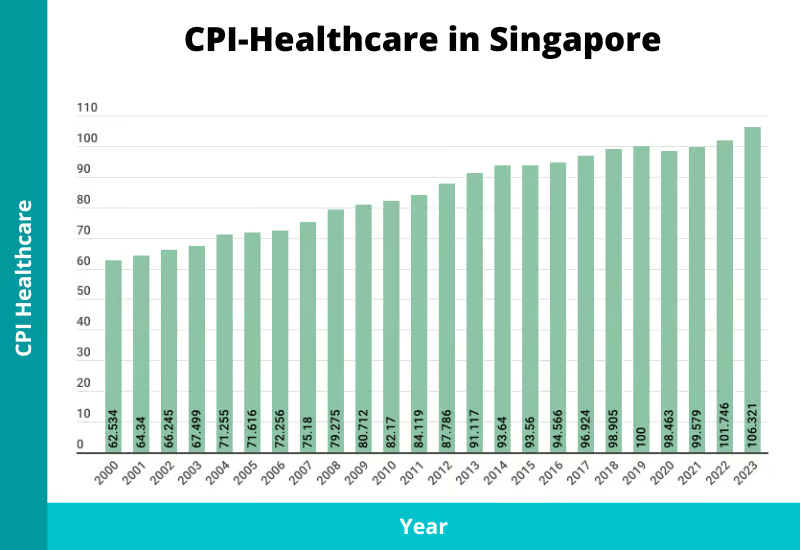

Focus on Insurance and Financial Planning

In a country like Singapore, where unexpected healthcare costs can be substantial, having adequate insurance coverage is essential. Medical emergencies can derail your finances if you're not prepared. With proper insurance, you can avoid having to take on high-interest loans or rely on credit to cover these costs.

Conclusion: A Holistic Approach to Financial Wellness

Maintaining a strong credit score in Singapore requires a combination of disciplined financial habits, responsible borrowing, and long-term planning. Your credit score is a reflection of your overall financial health, and by understanding how it's calculated and taking steps to improve it, you can position yourself for success in securing loans, accessing better interest rates, and achieving your financial goals. As Singapore continues to evolve as a global financial hub, staying informed and proactive about your credit score will be more important than ever.

While it may take time and effort to build or repair your credit score, the rewards—such as financial security, access to better borrowing terms, and peace of mind—are well worth it. Start today by reviewing your credit habits, creating a plan to tackle your debts, and committing to smart financial management.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com