The Looming Threat of Dollar Collapse: Key Indicators and Implications for Investors

The Looming Threat of Dollar Collapse: Key Indicators and Implications

In recent years, concerns about the stability of the US dollar have intensified among economists and investors. With the United States government spiraling deeper into a self-perpetuating debt crisis, many are asking whether the dollar is on the brink of collapse. Several critical indicators signal a potential downturn for the dollar, and understanding these factors is crucial for navigating the current economic landscape.

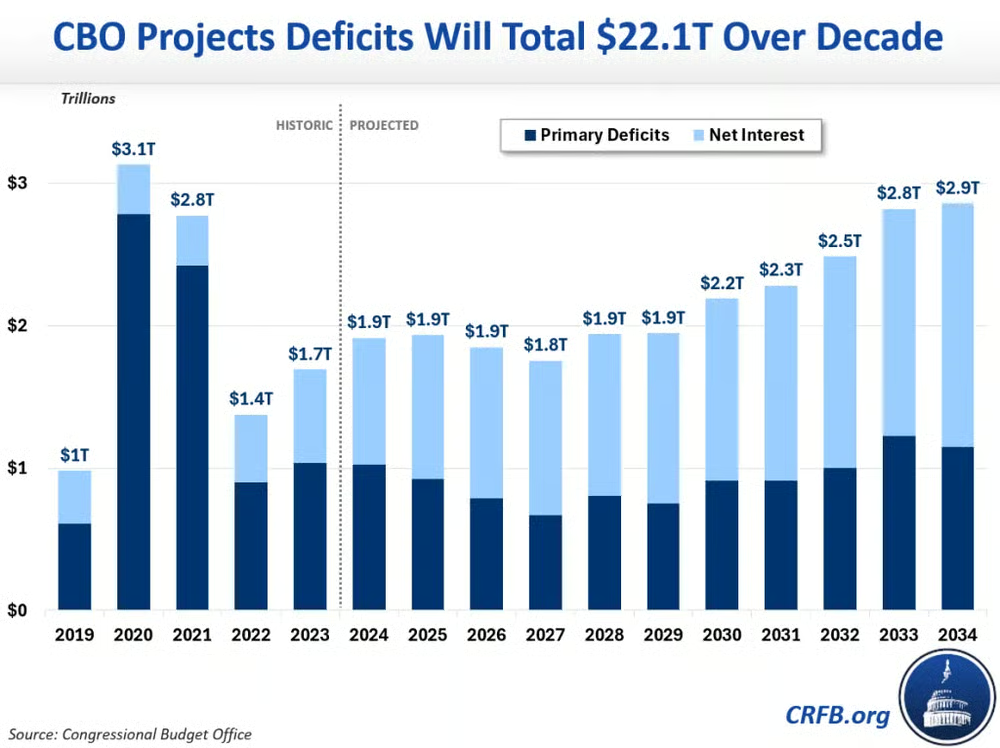

The Alarming Rise of Federal Budget Deficits

One of the primary indicators of a weakening dollar is the alarming trend in federal budget deficits. The US government is projected to accumulate a staggering deficit exceeding $22 trillion over the next decade. This projection is based on unrealistic assumptions, ignoring potential crises such as economic recessions or military conflicts that could necessitate increased government spending. The need to finance these deficits by issuing more debt could undermine investor confidence in the dollar, potentially leading to a currency crisis. Recently, the Congressional Budget Office reported that the federal deficit has surged, driven by mandatory spending programs and rising interest rates, which complicates the fiscal landscape.

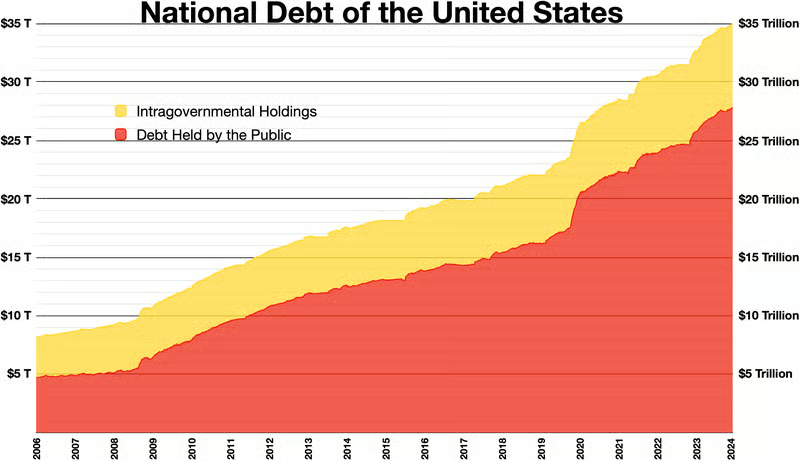

Mounting Federal Debt: A Dangerous Burden

The federal debt in the United States has surpassed $35 trillion, representing more than 123% of the country’s GDP. This ratio is particularly concerning when considering that GDP itself is a flawed measure of economic health, often inflated by counting government spending as a positive contribution. With government spending accounting for a significant portion of GDP, the actual economic productivity supporting this debt is far lower than commonly perceived. As the debt continues to climb, the US faces an increasing risk of default or devaluation, both of which would erode confidence in the dollar. Analysts warn that the current trajectory of debt accumulation is unsustainable, raising the specter of a financial crisis reminiscent of past economic downturns. This precarious situation has led some economists to draw parallels with historical precedents, where countries with high debt-to-GDP ratios faced severe economic repercussions.

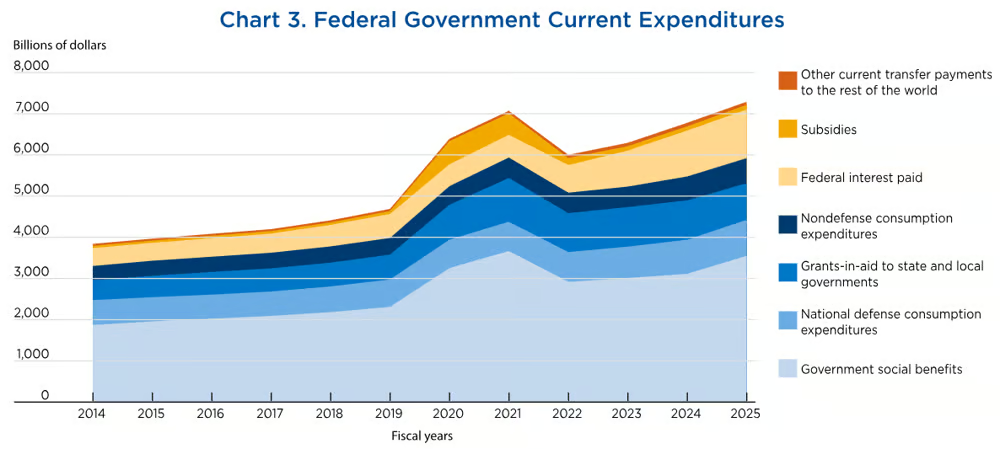

Escalating Federal Interest Expenses

Compounding these challenges is the rising interest expense on federal debt, which has exceeded $1 trillion annually for the first time. This makes interest payments the second-largest expenditure for the US government, trailing only defense spending. If current trends continue, interest expenses could soon surpass Social Security expenditures, placing immense pressure on the federal budget. Recent analyses indicate that the Federal Reserve’s rate hikes have made it increasingly difficult for the government to manage its interest obligations without resorting to further borrowing, thereby deepening the country’s debt spiral and threatening the dollar’s stability. The implications of rising interest expenses are profound, as they may force the government to make tough choices between funding essential services and meeting its debt obligations. This creates a dangerous cycle, where increasing interest payments crowd out critical investments in infrastructure and social programs.

Interest Rates and Monetary Policy Dilemmas

The Federal Reserve has struggled to navigate the delicate balance of interest rates in recent years. Following the 2008 financial crisis, interest rates were kept near zero for an extended period, only to be raised in a bid to combat inflation in the wake of the COVID-19 pandemic. However, as inflation surged to levels not seen in four decades, the Fed responded with one of the most aggressive rate-hiking cycles in history, raising rates from near-zero to over 5% in just 18 months. Yet, the Fed has recently shifted back to monetary easing, suggesting an underlying fear of financial instability that could ultimately undermine the dollar’s value. This pivot has led to concerns about the Fed's credibility in managing inflation expectations, especially as inflation remains stubbornly high in core sectors like housing and energy.

The Fed’s approach to interest rates also reflects a broader challenge faced by central banks worldwide. As they navigate post-pandemic recovery, many central banks are grappling with the dual challenge of stimulating economic growth while controlling inflation. This delicate balancing act can have cascading effects on global markets, especially as higher US interest rates attract capital flows that can create volatility in emerging markets. Moreover, the interconnectedness of global financial markets means that policy decisions made in the US can have far-reaching implications, affecting currency values and economic stability in other countries.

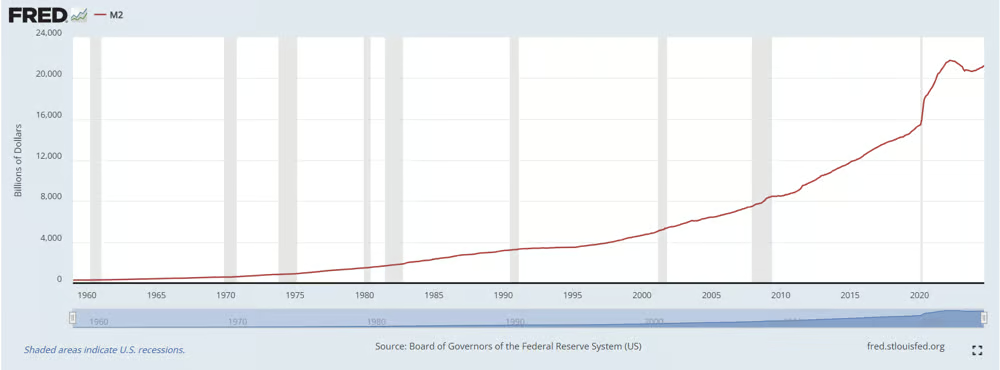

The Implications of an Expanding Money Supply

The Federal Reserve’s response to rising interest costs has led to a significant increase in the money supply. Since 2020, the US money supply has expanded by a staggering 37%, a strategy aimed at managing interest expenses but one that raises serious concerns about inflation and currency devaluation. Historical data indicate that excessive growth in the money supply often leads to hyperinflation, further undermining the dollar's purchasing power and potentially leading to a loss of confidence among both domestic and international investors. Recent inflation reports show that consumer prices continue to rise, suggesting that the effects of monetary expansion are still rippling through the economy, prompting fears of a persistent inflationary environment.

The implications of an expanding money supply extend beyond the US borders. As the dollar continues to be the world's primary reserve currency, other nations are increasingly concerned about the risks posed by US monetary policy. Countries heavily reliant on dollar-denominated debt may face rising costs and potential defaults, leading to broader economic instability in the global market. Some countries are even considering diversifying their foreign exchange reserves away from the dollar, seeking alternatives to mitigate the risks associated with a potential dollar collapse.

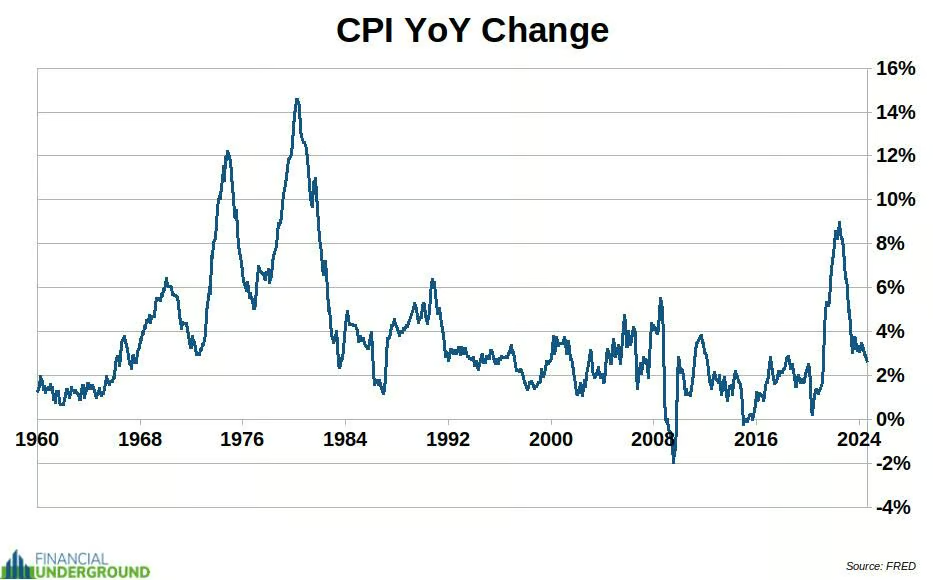

The Role of the Consumer Price Index

Another critical factor to consider is the Consumer Price Index (CPI), which is often criticized for its reliability. The CPI aims to measure inflation by tracking price changes for a basket of goods, but its methodology is frequently seen as politically manipulated. The broad variability in consumer experiences makes it difficult for a single index to accurately reflect the economic realities faced by different demographics. Although the CPI can offer insights into inflation trends, its inherent flaws may obscure the true state of the economy and the associated risks to the dollar. Recent trends indicate that while CPI growth has slowed slightly, certain categories, particularly food and energy, remain highly volatile, causing further concern for household budgets.

Moreover, the divergence between CPI and other measures of inflation, such as the Producer Price Index (PPI), raises questions about the accuracy of official inflation figures. As businesses face rising production costs, any misrepresentation of inflation data can lead to misguided monetary policy decisions that ultimately threaten economic stability. Additionally, as consumers grapple with rising prices, their purchasing power diminishes, leading to decreased consumption and potentially triggering an economic slowdown.

Gold: A Safe Haven in Times of Crisis

Historically, gold has served as a reliable store of value during periods of economic instability. As confidence in fiat currencies wanes, many investors are turning to gold as a hedge against potential currency collapse. The rising price of gold, particularly in the context of increasing monetary easing by central banks, underscores a growing sentiment of insecurity regarding fiat currencies. Recent spikes in gold prices have been attributed to geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, which have heightened fears of economic instability. As these uncertainties persist, the demand for gold is expected to rise, further reinforcing its status as a safe haven asset.

Additionally, the interest in alternative assets, such as cryptocurrencies, has surged as investors seek to diversify their portfolios in response to the potential risks posed by fiat currency instability. While cryptocurrencies come with their own set of risks, their decentralized nature and potential for high returns attract investors looking for non-traditional hedges against currency collapse. This shift toward alternative assets reflects a broader trend of diversification, as investors increasingly seek ways to protect their wealth amid uncertain economic conditions.

Global Implications and Investor Strategies

The potential collapse of the dollar could have far-reaching implications for the global economy. As the dollar remains the world's primary reserve currency, any significant decline could trigger widespread instability, particularly in emerging markets that rely heavily on dollar-denominated debt. Investors should consider diversifying their portfolios to mitigate risks associated with a potential dollar collapse. This may involve allocating assets toward precious metals, commodities, and real estate in regions deemed stable. Financial experts also recommend looking into cryptocurrencies and decentralized finance as alternative hedges against traditional fiat currencies, although these assets come with their own risks and volatility.

Furthermore, geopolitical tensions, particularly between major powers such as the US and China, could exacerbate the risks associated with a dollar collapse. As nations pursue their own monetary policies and explore alternatives to the dollar for international trade, the potential for a multipolar currency system becomes increasingly likely. This shift could erode the dollar's status as the global reserve currency, leading to further instability in international markets. Countries are increasingly discussing the establishment of digital currencies that could operate independently of the dollar, potentially altering the dynamics of global finance.

Geopolitical Dynamics and Trade Relationships

The global geopolitical landscape is undergoing a significant transformation, impacting the stability of the dollar. As the US faces rising competition from countries like China and Russia, these nations are actively seeking to establish trade relationships that bypass the dollar. Initiatives such as the Belt and Road Initiative by China aim to strengthen trade links with multiple countries, allowing them to transact in local currencies instead of relying on the dollar. Such moves can reduce the dollar's dominance in international trade and finance, further eroding its value.

In addition, emerging markets are increasingly diversifying their foreign exchange reserves away from the dollar in favor of other currencies or commodities. This shift poses a challenge to the dollar's status as the world's reserve currency, as more countries seek to insulate themselves from the potential fallout of US monetary policy. The decline in dollar-denominated transactions can have a ripple effect across global markets, leading to heightened volatility and uncertainty.

Inflation Expectations and Consumer Sentiment

Inflation expectations play a crucial role in shaping consumer behavior and investment decisions. When consumers anticipate rising prices, they are more likely to adjust their spending habits, leading to changes in demand that can exacerbate inflationary pressures. Recent surveys indicate that consumer sentiment regarding inflation remains high, with many individuals expressing concerns about their purchasing power and future economic conditions. This perception can influence economic activity, as consumers may reduce spending in anticipation of tighter financial conditions.

Moreover, central banks worldwide are monitoring inflation expectations closely, as they seek to manage monetary policy effectively. If consumers begin to expect higher inflation as a permanent condition, it can create a self-fulfilling prophecy, further fueling price increases. The interplay between consumer sentiment and inflation expectations underscores the delicate balance central banks must strike to maintain economic stability.

The Rise of Digital Currencies and Alternative Payment Systems

The emergence of digital currencies and alternative payment systems is another critical factor that could challenge the dollar's dominance. Central banks across the globe are exploring the issuance of Central Bank Digital Currencies (CBDCs) as a means to modernize financial systems and enhance transaction efficiency. These digital currencies could provide an alternative to the dollar for international trade and remittances, posing a direct challenge to its status as the primary global currency.

The proliferation of cryptocurrencies also adds another layer of complexity to the financial landscape. As more individuals and institutions embrace decentralized finance, the demand for traditional fiat currencies, including the dollar, may decline. This trend may lead to further fragmentation in the global monetary system and potentially reduce confidence in the dollar, especially among younger generations accustomed to digital assets.

The Need for Proactive Measures

As the economic landscape evolves, both individuals and businesses must remain vigilant and adaptable. Investors should actively monitor economic indicators and adjust their strategies accordingly. Building a diversified portfolio that includes a mix of asset classes can help mitigate risks associated with currency fluctuations. Additionally, staying informed about global economic trends and geopolitical developments is essential for making informed investment decisions.

In conclusion, while the possibility of a dollar collapse remains uncertain, the indicators discussed present a compelling case for vigilance among investors. The combination of rising budget deficits, soaring federal debt, escalating interest expenses, and an expanding money supply creates a precarious situation for the dollar. As economic conditions continue to evolve, diversifying investment strategies and seeking safe-haven assets may be prudent steps to safeguard against potential currency devaluation. Understanding these trends and their implications will be crucial for navigating the complexities of the current economic landscape, particularly as global dynamics shift in response to evolving fiscal policies and geopolitical uncertainties. The time to reassess investment strategies and prepare for potential outcomes is now, as the indicators of a dollar collapse continue to mount.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com