Strategic Holiday Bets: AI, Copper, Credit

As the trading year draws to a close, market participants often look past the festive season to position their portfolios for the year ahead. Rather than focusing on short-term holiday trends, major institutional strategists are advocating for aggressive positioning in technology and commodities, anticipating that the current market dynamics have significant runway remaining.

The global macroeconomic strategy team at Citi has released a series of actionable trade ideas that suggest the bull market is far from exhausted. Their outlook combines a continued surge in artificial intelligence (AI) with a resurgence in cyclical sectors, driven by a "reflating" global economy.

Riding the AI Wave Through 2026

Despite concerns regarding valuation stretches in the technology sector, the consensus among these strategists is that the AI theme is still in its expansion phase. The recommendation is not to shy away from the momentum but to embrace it via leveraged positions. Specifically, the team suggests purchasing out-of-the-money call options on the Nasdaq-100 index with an expiration date set for December 2026.

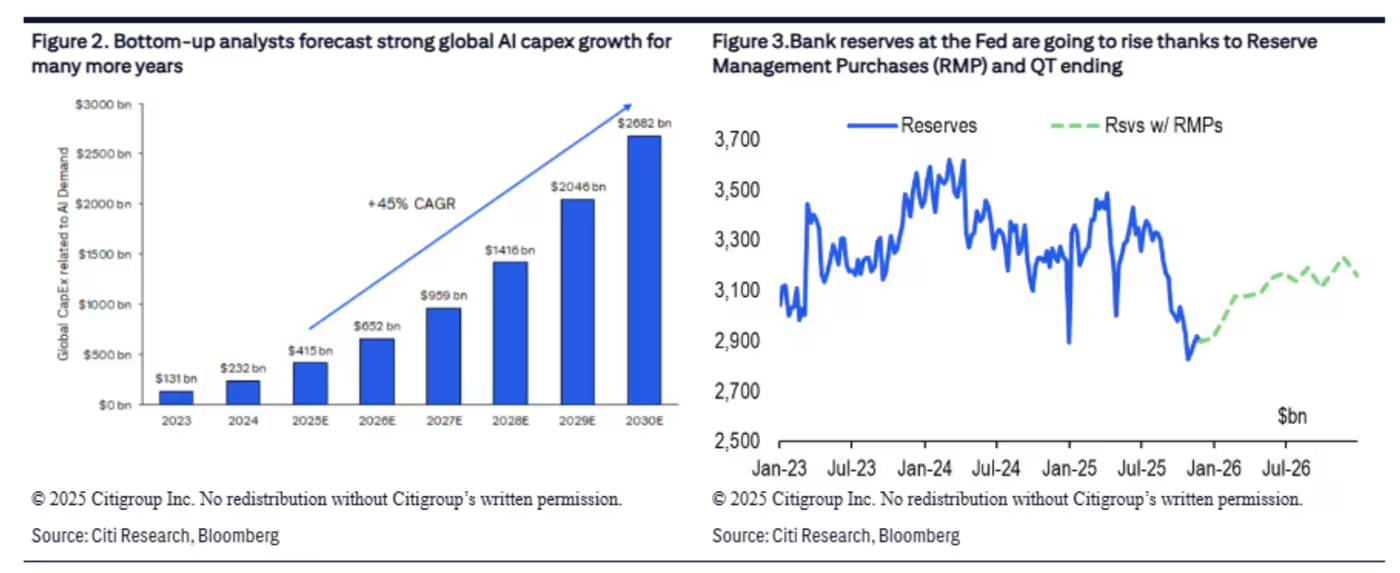

The rationale is grounded in the availability of capital. As long as corporate investment continues to grow and financial system liquidity remains ample, the conditions are ripe for the trend to continue. "We see the AI bubble likely building further in 2026," the analysts noted in their report. Crucially, they argue against exiting the sector too early: "The big sector rotation happens after the bubble peaks, not before. While diversification is likely still helpful next year, tech should be part of the longs."

However, this is not solely a technology story. The strategists foresee a "bullish broadening" where cyclical sectors, particularly financials, begin to outperform defensive plays like consumer staples. This shift anticipates a scenario where economic growth accelerates alongside inflation, creating a favourable environment for banks and financial institutions.

The ‘All Weather’ Case for Copper

Beyond equities, the outlook for global growth in 2026 supports a bullish stance on industrial metals. The strategy team has highlighted copper as a key beneficiary of this projected economic pickup. Unlike equities, which can be sensitive to domestic political cycles, copper is described as an "all weather" trade, offering a degree of insulation from specific US policy shifts while capitalising on global industrial demand.

Investors are advised to consider exposure through copper futures, call options on those futures, or exchange-traded funds (ETFs). This recommendation aligns with the broader expectation of a reflating economy, where demand for raw materials typically intensifies.

This commodity play also serves as a hedge against historical market patterns. The strategists warned that US stock and bond markets often struggle during midterm election years—a phenomenon expected to re-emerge in 2026. Historically, this weakness tends to manifest in the third quarter, particularly when the incumbent party retains control. Holding assets like copper could mitigate portfolio volatility during these anticipated political headwinds.

Fed Policy and Credit Hedges

The path of monetary policy remains a central variable for the year ahead. While there is skepticism that the incoming administration will fundamentally compromise the Federal Reserve’s independence, the expectation is that the central bank will allow the economy to run "hot". Continued rate cuts in a growing economy could reignite inflationary pressures later in 2026.

The implication for the bond market is significant. If inflation expectations rise, investors may demand a higher "term premium" to hold longer-dated US debt, which would weigh heavily on Treasury prices (pushing yields higher).

To navigate this complex environment, the strategists proposed a sophisticated relative-value trade: going long on AI-driven equity while simultaneously shorting AI-linked credit. The logic is that while the AI trade will likely propel indices like the S&P 500 higher, the massive debt accumulation by tech giants—exemplified by companies like Oracle—could lead to widening credit spreads.

The recommended execution involves a long position in the S&P 500 paired with a long position in a basket of investment-grade credit default swaps (CDS). This structure allows investors to profit from rising equity prices while hedging against the deteriorating credit quality of the very firms driving that growth.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com