Singapore’s Middle Class Faces Asset Inflation

For the global upper-middle class, the narrative of economic progression usually follows a linear path: higher wages equate to an upgraded lifestyle. However, in major financial hubs like Singapore, a divergence is emerging where rising incomes are struggling to keep pace with the escalating costs of aspirational assets. Despite a decade of steady salary growth, the goalposts for owning private property and automobiles are moving further away for the top 20th percentile of earners.

In 2024, a household in Singapore’s 80th income percentile earns approximately S$21,488 (US$16,000) per month, or roughly US$192,000 annually. Since 2015, this demographic has seen their income rise by more than 31 per cent, representing a compound annual growth rate (CAGR) of about 3.1 per cent. While this outpaces inflation in many developed economies, it pales in comparison to the asset inflation occurring within the city-state’s borders.

The Property Purchasing Power Gap

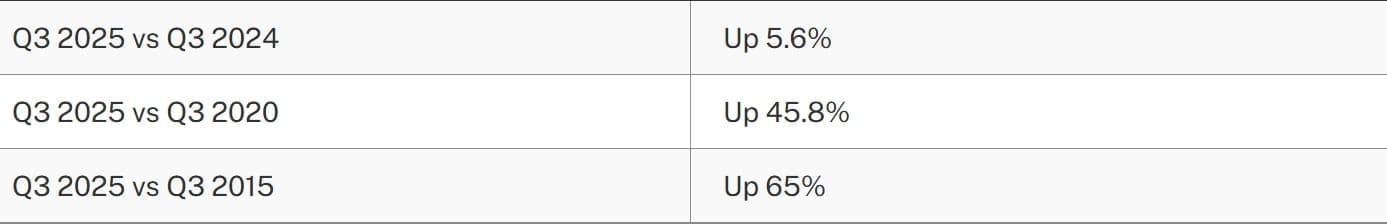

The disparity is most evident in the real estate sector. For many, the transition from public housing to a private condominium is a key milestone of financial success. However, between the third quarter of 2015 and the third quarter of 2025, the price index for non-landed private homes in suburban regions climbed by approximately 65 per cent—a CAGR of 5.1 per cent.

To put this into perspective, a household earning the 80th percentile income in 2015 could comfortably purchase a new 1,000-square-foot suburban condo for around S$1.2 million (US$890,000), representing roughly six times their annual income. Today, a household with a comparable income standing faces a starkly different reality. To maintain that same debt-to-income ratio, they would likely have to settle for a significantly smaller unit, or alternatively, leverage themselves far beyond the prudent six-times annual income benchmark to secure a home of similar size. This phenomenon of "shrinkflation" in living standards suggests that while bank balances are growing, the tangible value they command in the property market is diminishing.

The Rising Cost of Mobility

If the property market is challenging, the automotive market is punishing. Singapore’s unique Certificate of Entitlement (COE) system, which grants the right to own a vehicle for 10 years, has seen premiums skyrocket.

In a bidding exercise earlier this month, the premium for Category A cars (mainstream vehicles) hit S$105,413 (approx. US$78,000). This represents an 85 per cent increase from late 2015, growing at a CAGR of 6.5 per cent. The situation is even more acute for larger, Category B vehicles, where premiums have surged 106 per cent over the same decade to reach S$123,900 (approx. US$92,000). For the upper-middle class, the car has transitioned from a standard convenience to a significant luxury expense, with capital appreciation in vehicle rights vastly outstripping wage growth.

Lifestyle Adjustments and Future Implications

Despite these headwinds, there are mitigating factors that soften the blow. Demographic shifts indicate that household sizes are shrinking, falling from an average of 3.34 persons in 2015 to 3.14 in 2024, which may make smaller condominium units more acceptable. Furthermore, recent dips in home-loan rates offer some respite for borrowers, and the quality of public housing (HDB) and mass transit infrastructure in Singapore remains world-class, offering viable alternatives to private ownership.

However, the question remains whether these rising costs will impact Singapore’s attractiveness to global talent and the local upper-middle class. While tax rates and safety remain strong pull factors, the ability to sink roots and acquire assets is a critical component of economic stickiness. As market forces continue to drive asset prices upward, the "Singapore Dream" is being recalibrated, prioritising access and utility over outright ownership of large spaces and private transport.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com