Singapore’s S$NEER Update

Understanding Singapore’s S$NEER: Recent Policy Shifts and Their Implications

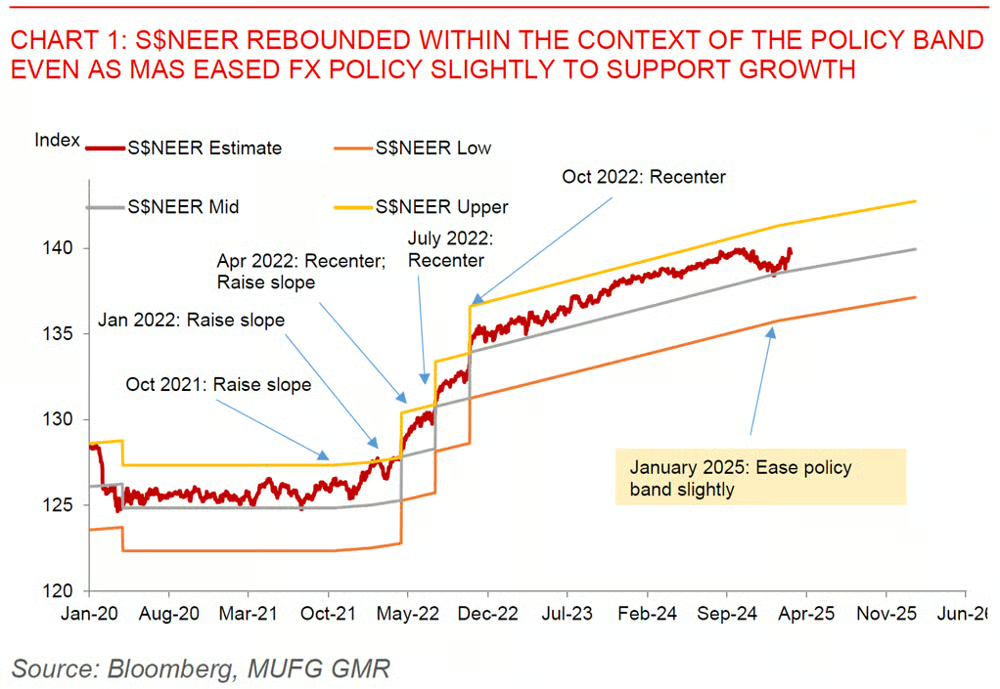

As of May 20, 2025, Singapore’s monetary policy has been shaped by strategic adjustments to the Singapore dollar Nominal Effective Exchange Rate (S$NEER), a cornerstone of the Monetary Authority of Singapore’s (MAS) efforts to balance economic growth and price stability. With global economic growth slowing and inflation pressures easing, MAS has made calculated moves in January and April 2025 to reduce the rate of the Singapore dollar’s appreciation. These changes reflect Singapore’s unique position as a trade-dependent economy, where the exchange rate plays a pivotal role in shaping economic outcomes. This article delves into the mechanics of S$NEER, examines the implications of recent policy shifts, and explores their impact on businesses, consumers, and Singapore’s economic future in today’s context.

The Mechanics of S$NEER

The S$NEER measures the Singapore dollar’s value against a trade-weighted basket of currencies from Singapore’s major trading partners, such as the United States, Japan, and key European nations. Unlike most central banks that rely on interest rate adjustments, MAS uses the S$NEER as its primary monetary policy tool, managing it through a policy band defined by three parameters: the slope (rate of appreciation or depreciation), the width (range of allowable fluctuation), and the center (midpoint of the band). By adjusting these parameters, MAS influences the Singapore dollar’s strength, which in turn affects inflation and export competitiveness. A stronger currency reduces the cost of imported goods, helping to curb inflation, while a weaker currency makes Singapore’s exports more competitive on the global stage.

This exchange rate-based approach is particularly suited to Singapore’s economy, where gross exports and imports exceed three times its GDP, making it one of the most trade-reliant nations globally. The S$NEER framework allows MAS to maintain medium-term price stability while supporting sustainable economic growth. For instance, a stronger Singapore dollar can dampen imported inflation, which is critical given that nearly 40 cents of every dollar spent domestically goes toward imports. However, an overly strong currency can make exports less competitive, potentially impacting industries like electronics and manufacturing, which employ thousands of Singaporeans. Thus, MAS must carefully calibrate the S$NEER to balance these competing dynamics, ensuring that the economy remains resilient in a volatile global environment.

Recent Policy Adjustments in 2025

In January 2025, MAS announced a slight reduction in the slope of the S$NEER policy band, marking the first easing of monetary policy since March 2020 MAS Monetary Policy Statement - January 2025. This decision was driven by a more favorable inflation outlook, with MAS Core Inflation moderating faster than expected, projected to remain below 2% for the year due to low domestic and imported cost pressures. The Singapore dollar had appreciated against most currencies in the S$NEER basket but weakened slightly against the US dollar, reflecting the latter’s global strength. This adjustment signaled MAS’s intent to support economic growth amid expectations of a slowdown in 2025, following a robust performance in the second half of 2024.

In April 2025, MAS further reduced the rate of appreciation of the S$NEER policy band, responding to a weakening external economic outlook and a projected negative output gap MAS Monetary Policy Statement - April 2025. The output gap, which measures the difference between actual and potential economic output, turning negative indicates underutilized economic capacity, prompting MAS to adopt a more accommodative stance. Despite these changes, MAS maintained the width and center of the policy band, ensuring continuity while allowing flexibility. These adjustments reflect MAS’s proactive approach to navigating global uncertainties, such as trade frictions and slowing demand from key trading partners, while maintaining its commitment to price stability. CPI-All Items inflation is expected to average 0.5–1.5% in 2025, down from a previous forecast of 1.5–2.5%, underscoring the low inflationary environment.

Economic Impacts of S$NEER Adjustments

The recent S$NEER policy shifts have significant implications for various sectors of Singapore’s economy, affecting exporters, importers, consumers, and investors in distinct ways.

Exporters

A slower appreciation of the Singapore dollar enhances the competitiveness of Singapore’s exports by making locally produced goods and services relatively cheaper for foreign buyers. This is particularly beneficial for industries like electronics, precision engineering, and logistics, which are critical to Singapore’s trade-driven economy, contributing approximately 30% to GDP through manufacturing exports. For example, a Singapore-based semiconductor firm exporting to Europe benefits from lower relative prices, potentially increasing demand and supporting job creation. However, the policy still allows for gradual appreciation, moderating these benefits to ensure the currency remains strong enough to maintain investor confidence and control inflation.

The export sector faces challenges from global economic headwinds, such as weakening demand in key markets like China and the European Union, which together account for over 40% of Singapore’s non-oil domestic exports. The slower appreciation in 2025 provides a buffer for exporters, but an overly strong currency could still erode competitiveness, potentially leading to reduced revenues and job losses. MAS’s measured approach aims to support export-driven growth while mitigating these risks, ensuring that Singapore remains a competitive player in global markets.

Importers and Consumers

A stronger Singapore dollar typically reduces the cost of imported goods, which is crucial for a nation where imports constitute a significant portion of consumption. For instance, everyday items like coffee, electronics, and clothing become more affordable, and overseas travel, such as to Japan or Australia, becomes cheaper due to favorable exchange rates. In 2024, the Singapore dollar’s strength against the Japanese yen boosted outbound tourism, with over 1.2 million Singaporeans traveling abroad, a 15% increase from 2023. However, the slower appreciation in 2025 means that the downward pressure on import prices is less pronounced, potentially limiting cost savings for consumers.

For businesses reliant on imported inputs, such as raw materials for construction or components for manufacturing, the gradual appreciation ensures stable costs. This stability is vital given Singapore’s reliance on imports for essential goods, with food imports alone valued at S$16 billion annually. While consumers and importers benefit from a stronger currency, the moderated appreciation in 2025 ensures that price increases remain contained, protecting household budgets and business margins from sharp fluctuations.

Inflation

The S$NEER adjustments are designed to manage inflation risks in a low-inflation environment. MAS projects that core inflation will remain below 2% in 2025, supported by declining global oil prices, which have dropped to around US$70 per barrel, and stable food commodity markets. By slowing the Singapore dollar’s appreciation, MAS reduces the risk of deflation while ensuring that inflationary pressures do not escalate. This is particularly important given that imported inflation has historically driven price increases in Singapore, with import prices contributing to nearly half of CPI inflation in high-inflation periods.

However, risks remain. An unexpected rise in global commodity prices, such as a spike in oil to US$90 per barrel due to geopolitical tensions, could increase imported inflation, particularly with a slower-appreciating currency. MAS’s projections indicate confidence in a low-inflation environment, but the central bank remains vigilant, ready to tighten policy if inflationary pressures emerge. Government subsidies on essential services, such as public healthcare and transport, further dampen domestic inflation, expected to keep CPI-All Items inflation within 0.5–1.5% in 2025.

Investment and Financial Markets

A stable and gradually appreciating Singapore dollar signals economic stability, making Singapore an attractive destination for foreign direct investment (FDI), which reached S$190 billion in 2024, a 10% increase from 2023. However, an excessively strong currency can deter FDI by increasing the cost for foreign investors to convert their currencies into Singapore dollars. The 2025 easing of the S$NEER policy reduces this barrier, potentially boosting investment in sectors like technology and finance, which account for 60% of FDI inflows. For financial markets, the policy adjustments provide predictability, reducing currency risk for investors in Singapore’s stock market, where the Straits Times Index grew 8% in 2024.

Conversely, a currency that is too weak could signal economic challenges, potentially deterring investment. MAS’s balanced approach ensures that the Singapore dollar remains a stable store of value, supporting investor confidence. The central bank’s vigilance in monitoring global financial conditions, such as potential tightening due to US Federal Reserve policies, ensures that Singapore remains resilient to external shocks, maintaining its status as a global financial hub.

Balancing Growth and Stability

MAS’s monetary policy is a delicate balancing act, requiring careful calibration to support economic growth while maintaining price stability. The 2025 policy shifts reflect MAS’s confidence in a low-inflation environment, allowing a more accommodative stance to bolster growth amid global uncertainties. Singapore’s economy is projected to grow at 1–3% in 2025, down from 3.5% in 2024, reflecting weaker global demand. By slowing the Singapore dollar’s appreciation, MAS supports export-driven growth, which accounts for 70% of GDP, without triggering inflationary pressures.

However, this approach carries risks. A slower appreciation could lead to higher imported inflation if global commodity prices rise, while a stronger currency could stifle exports, potentially leading to job losses in sectors employing over 500,000 workers. MAS’s strategy of maintaining a modest and gradual appreciation path navigates these risks, with the central bank closely monitoring developments like trade frictions, which could disrupt Singapore’s S$600 billion trade volume, and geopolitical tensions affecting global supply chains.

Today’s Context and Future Outlook

In today’s context, as of May 20, 2025, Singapore faces a complex global environment marked by trade policy frictions, particularly between major economies like the United States and China, and a potential tightening of global financial conditions. The US dollar’s strength, driven by Federal Reserve rate hikes to 5.5% in 2023-2024, has put pressure on Asian currencies, including the Singapore dollar, which weakened by 2% against the US dollar since January. MAS’s decision to ease the S$NEER policy reflects a strategic response to these pressures, aiming to maintain export competitiveness while ensuring price stability.

Looking ahead, MAS must remain agile to address emerging challenges. Potential risks include a further slowdown in global growth, projected at 2.8% by the IMF for 2025, and commodity price volatility, particularly in energy markets. For businesses, the slower appreciation offers opportunities to expand export markets, particularly in ASEAN, which accounts for 25% of Singapore’s trade. Consumers should leverage the stable currency for cost-effective travel and purchases, while investors can benefit from Singapore’s predictable monetary policy. MAS’s next policy review in July 2025 will be critical, with potential adjustments if inflation exceeds the 0.5–1.5% forecast or if global demand weakens further. By maintaining a flexible and vigilant approach, MAS ensures Singapore’s resilience in an uncertain global economy.

Conclusion

The S$NEER remains a linchpin of Singapore’s monetary policy, enabling MAS to navigate the complexities of a trade-dependent economy. The 2025 policy adjustments, reducing the rate of currency appreciation, reflect a strategic response to a slowing global economy and low inflation, supporting exporters while maintaining price stability for consumers. As Singapore faces ongoing global uncertainties, MAS’s agile and balanced approach will be crucial for sustaining growth and resilience. Stakeholders, from businesses to consumers, should stay informed about S$NEER developments to make strategic decisions, ensuring Singapore remains a beacon of economic stability in a turbulent world.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com