Singapore Prices Steady as Inflation Stabilises

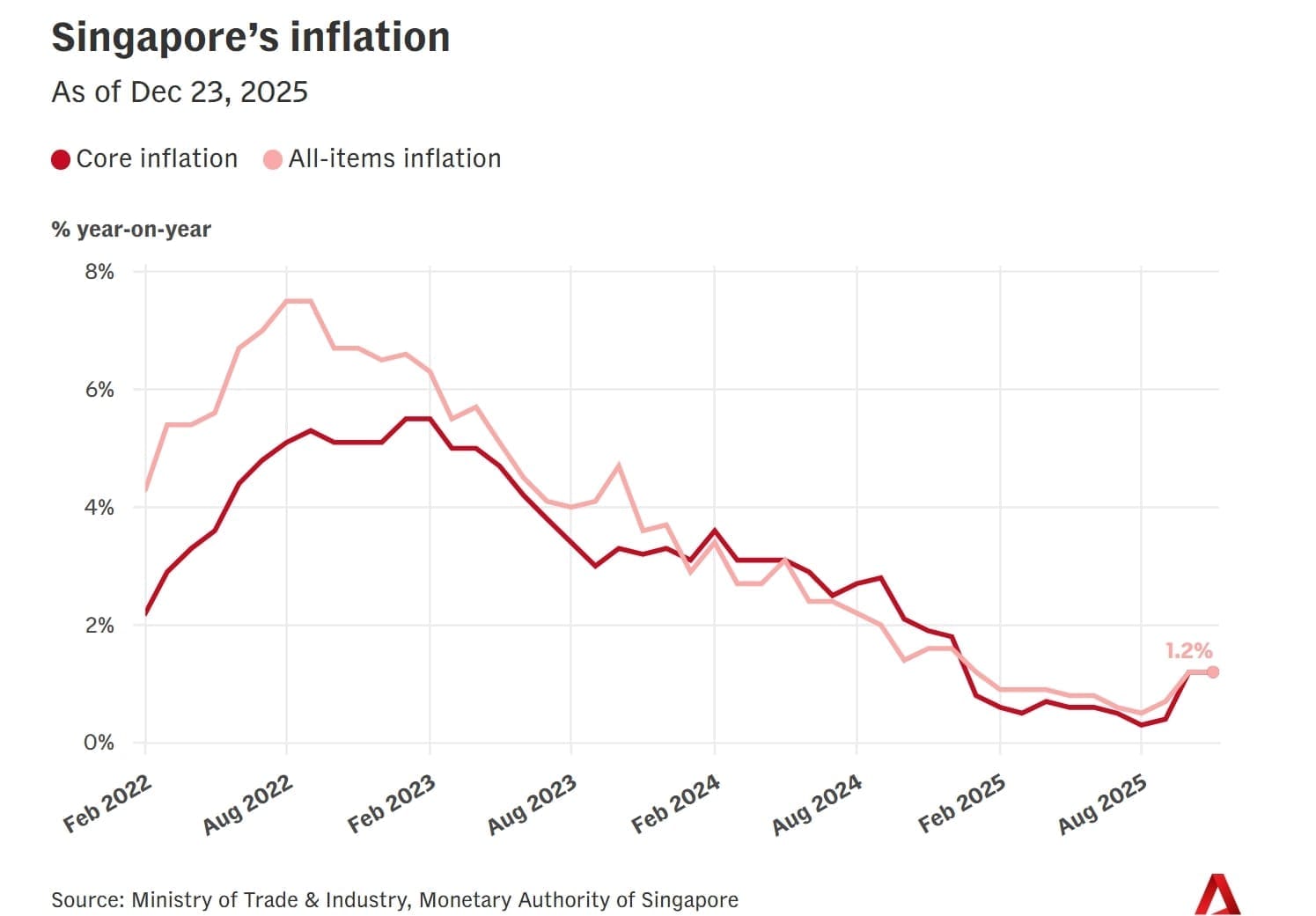

Singapore’s economic barometer held firm in November 2025, offering a signal of stability for Southeast Asian markets even as underlying service costs continue to rise. Official data released on Tuesday indicates that the city-state’s core inflation rate remained unchanged at 1.2 per cent year-on-year, defying expectations for a slight uptick. This data point is critical for global investors tracking Asian trade hubs, as Singapore often serves as a bellwether for broader regional economic health and consumer demand.

The headline figure, which mirrors the 1.2 per cent recorded in October, arrived slightly below the 1.3 per cent median forecast anticipated by economists. This steadiness was driven by a balancing act within the consumer price basket: while the cost of retail goods, electricity, and gas declined, inflation in the services sector edged higher. For capital market observers, this divergence highlights a persistent global theme where goods deflation is being offset by sticky services inflation, complicating the policy path for central banks.

Sector Breakdown: Services vs Commodities

A deeper dive into the November data reveals the conflicting forces at play within the economy. Services inflation ticked up to 1.9 per cent, rising from 1.8 per cent the previous month. The primary drivers were increased costs in point-to-point transport services and health insurance premiums. This stickiness in service costs is a phenomenon observed in major Western economies as well, suggesting that labour-intensive sectors retain pricing power even as broader demand softens.

Conversely, the energy sector provided significant relief. Electricity and gas prices fell more sharply in November, reacting to global energy market dynamics. Retail inflation also dipped to 0.3 per cent, down from 0.4 per cent, as prices for clothing, footwear, and personal care appliances retreated. For investors monitoring commodities, the data aligns with the broader softening of global crude oil prices, which authorities project will fall more gradually throughout 2026 compared to 2025.

Food inflation remained neutral at 1.2 per cent, while private transport inflation eased to 3.5 per cent, aided by a smaller increase in car prices. Accommodation costs also held steady, with housing rents rising at a similar pace to previous months.

Future Outlook and Labour Costs

Looking ahead, the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) maintained their existing outlook, projecting that imported costs will continue to decline, albeit at a decelerating pace. However, the authorities flagged a shift in domestic cost drivers for the coming year.

As administrative factors that have temporarily suppressed inflation begin to taper off, the focus shifts to productivity and wages. The official statement noted, "Unit labour cost growth should begin to increase as productivity growth normalises, while private consumption demand is likely to remain steady." This signals to equity investors that corporate margins could face pressure from rising wage bills in 2026, even if top-line inflation appears benign.

Authorities project core inflation to average around 0.5 per cent in 2025 before ticking up to a range of 0.5 to 1.5 per cent in 2026. This forecasted rise suggests that the current low-inflation environment may be the trough before a modest cyclical upswing.

Global Risks and Market Implications

While the domestic picture appears controlled, external risks remain the primary variable for the 2026 outlook. The trade-dependent nature of Singapore’s economy means it remains highly sensitive to supply shocks and geopolitical developments, which could abruptly reverse the downward trend in imported costs.

Conversely, authorities warned that a "sharper-than-expected weakening in global demand could keep core inflation lower for longer." For global macro strategies, this serves as a reminder that while the immediate inflationary fire has been doused, the risk of demand-side stagnation lingers. If global oil prices face another significant decline, it could further dampen price increases, potentially signalling weaker industrial activity worldwide.

November’s steady print offers a moment of calm, but the projected normalisation of labour costs and potential external shocks suggest that volatility has not been entirely priced out of the market.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com