Revitalizing Singapore's Stock Market: Strategies, Challenges, and Future Outlook

Singapore's stock market has historically played a pivotal role in the city-state’s financial ecosystem, attracting investors from across the globe. However, in recent years, the Singapore Exchange (SGX) has faced multiple challenges, leading to a notable decline in its market vibrancy. To combat this trend, the Monetary Authority of Singapore (MAS) and SGX launched a joint task force in August 2023, aimed at revamping the public equity market. This comprehensive effort is crucial for ensuring Singapore remains competitive as a financial hub amidst global shifts in capital markets.

Historical Context: Declining IPO Activity and Market Liquidity

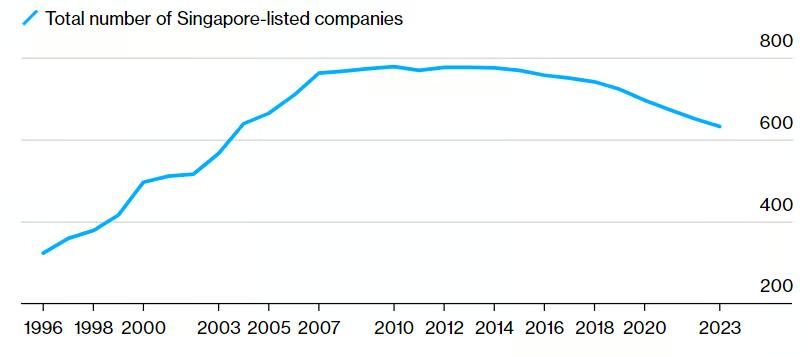

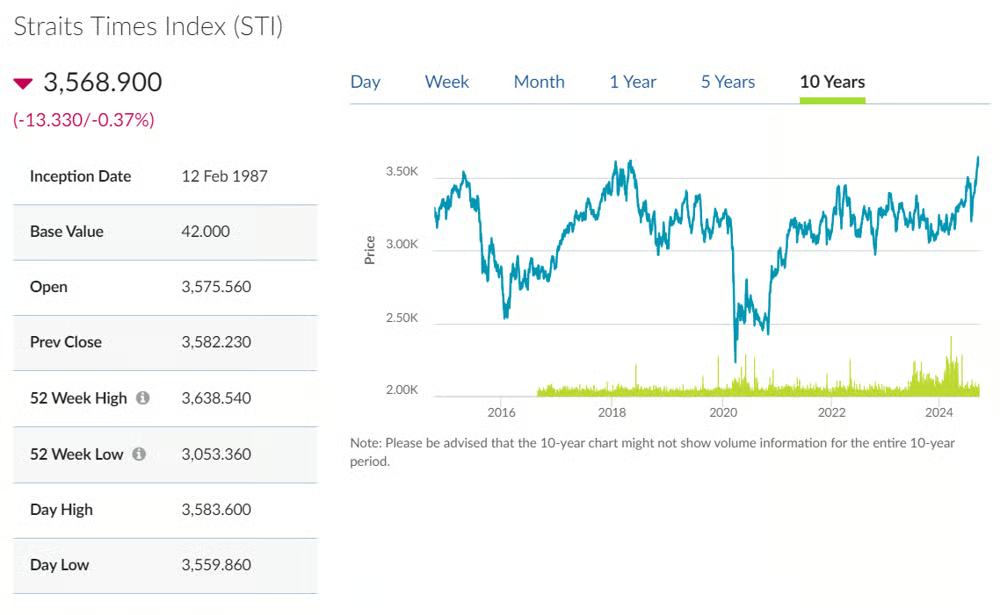

Singapore's IPO market was once a hotspot for both local and foreign companies, with high-profile listings across sectors. However, over the past decade, SGX has experienced a considerable slowdown in IPOs and market activity. Several high-profile delistings, such as from real estate investment trusts (REITs) and companies seeking privatization, have compounded the problem. These trends signal declining liquidity and reduced investor confidence in the local market, a major concern for policymakers and market stakeholders.

In contrast, global financial centers such as Hong Kong and the United States have consistently attracted companies, particularly tech firms, with their deeper liquidity and more attractive valuations. For instance, Hong Kong has been successful in securing major tech IPOs from Chinese giants like Alibaba and JD.com, while Nasdaq has become a magnet for global tech companies due to its innovation-focused market structure. These international rivals have exposed Singapore’s limitations in keeping up with the demands of the evolving global marketplace.

Task Force’s Ambitious Revival Plan

In response to these challenges, the MAS-SGX task force is focused on several core strategies. A key pillar is expanding the pipeline of IPOs, particularly in tech-driven sectors such as fintech, artificial intelligence (AI), and green energy. SGX has historically lacked tech IPOs, which have fueled stock market growth in other regions. This is a critical gap Singapore aims to address.

Beyond tech, sectors such as biotechnology and renewable energy also represent key areas of opportunity. As global markets increasingly prioritize sustainability and innovation, SGX must position itself as a hub for growth industries. This requires not only facilitating listings but also offering post-IPO support to ensure the success of these companies in the long term.

Attracting High-Quality Listings: The Role of Incentives and Governance

To make SGX more attractive, Singapore is considering incentives such as tax breaks and reduced regulatory costs for companies listing on the exchange. Moreover, enhancing corporate governance standards is another key focus. Stricter governance can ensure the quality of listings and provide greater assurance to investors, particularly international institutional investors, who often prioritize strong regulatory frameworks when choosing where to allocate capital.

An innovative proposal within this context is to create a special listing board for tech startups and high-growth companies. This board would have more flexible listing criteria, catering to firms that may not meet traditional profitability requirements but have significant growth potential. Similar to Hong Kong’s Growth Enterprise Market (GEM), such an initiative could open the floodgates for startups eager to raise capital but unwilling to meet SGX’s current listing thresholds.

Enhancing Liquidity and Investor Participation

A critical component of the revival plan involves boosting market liquidity. One approach under consideration is the introduction of dual-class share structures, which have become increasingly popular among tech companies, allowing founders to retain voting control while raising capital. Although controversial due to governance concerns, dual-class structures could prove crucial in attracting IPOs from innovative sectors.

Moreover, SGX is actively working to enhance its product offerings. By expanding the range of exchange-traded funds (ETFs), derivatives, and structured products, the exchange aims to cater to a broader range of investors, from institutional players to retail traders. This diversification is vital to increasing overall trading volumes, which in turn can improve liquidity and price discovery across the board.

Regional and Global Competition: How Singapore Can Stay Competitive

Despite Singapore’s concerted efforts, it faces stiff competition from neighboring financial centers. Hong Kong, for example, remains a dominant player, particularly in securing Chinese IPOs. With the geopolitical tensions between China and the U.S., Hong Kong has continued to thrive as a favored listing destination for Chinese firms. However, Singapore can carve out its niche by leveraging its political stability, legal transparency, and robust regulatory frameworks, especially as firms seek alternatives to more volatile regions.

Singapore’s proximity to key Southeast Asian markets is also a distinct advantage. The region, home to fast-growing economies like Indonesia and Vietnam, presents opportunities for cross-border listings and partnerships. By positioning SGX as the premier exchange for Southeast Asia, Singapore can attract companies that are looking to expand beyond their domestic markets.

Challenges and Uncertainties Ahead

While the task force has laid out a solid foundation for market rejuvenation, it faces significant hurdles. The global macroeconomic environment remains a key challenge, with elevated inflation, rising interest rates, and geopolitical uncertainties curbing investor enthusiasm. Additionally, the inherent volatility in equity markets—particularly in emerging industries such as tech and biotech—adds further complexity.

Singapore’s small domestic market is another constraint. While SGX’s efforts to attract foreign listings are commendable, the limited local investor base presents a challenge in sustaining large-scale capital inflows. Competing with more liquid markets like the U.S. and Hong Kong will require Singapore to offer compelling differentiators—whether through regulatory flexibility, financial incentives, or sector specialization.

The Future: Can Singapore Reclaim Its Place as a Regional IPO Hub?

The future of Singapore’s stock market revival hinges on its ability to adapt to the rapidly changing dynamics of global capital markets. Success will depend on the extent to which the city-state can build an ecosystem that fosters innovation, attracts global players, and ensures sustained market liquidity.

If the task force’s initiatives are successful, SGX could once again become a destination of choice for companies across Asia looking to raise capital, particularly in tech and high-growth sectors. Singapore’s ability to balance innovation with robust governance will be crucial in attracting a diverse range of companies and investors.

However, market recovery will not happen overnight. The road ahead requires sustained efforts from both public and private sector stakeholders, as well as a deep commitment to building a more inclusive and forward-looking capital market. The task force's work is an important step forward, but the ultimate test will lie in the SGX’s ability to execute on these plans amidst a challenging global economic environment.

With strategic focus, investor engagement, and regulatory innovation, Singapore has the potential to reclaim its place as one of the premier financial hubs in the Asia-Pacific region.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com