Navigating the Singapore Property Market: Choosing Between HDB Flats and Condominiums

When considering a home purchase in Singapore, two primary options stand out: Housing and Development Board (HDB) flats and condominiums (condos). Each choice has its advantages and drawbacks, influencing affordability, lifestyle, and investment potential. Understanding the intricacies of both types of properties is essential to making an informed decision.

Affordability and Financial Considerations

HDB flats are generally more affordable than condos, making them a popular choice among homebuyers, especially those on a tighter budget. The Singaporean government supports HDB buyers through various subsidies, including the Housing Grant and the Central Provident Fund (CPF) Housing Grant. These financial aids significantly reduce the cost of purchasing an HDB flat, enabling many first-time homebuyers to realize their dreams of homeownership. With over 80% of Singapore residents living in HDB flats, it’s evident that this option provides not only affordability but also a strong sense of community and belonging.

On the other hand, condominiums typically come with higher price tags. They offer a range of amenities and luxury features, such as swimming pools, gyms, and enhanced security services. However, these perks come at a cost, resulting in higher maintenance fees that homeowners must budget for. When weighing these financial implications, it’s crucial to assess your current financial situation, long-term goals, and the potential for future expenses related to property ownership, such as renovations, maintenance, and property taxes.

Long-Term Goals and Lifestyle

Before making a decision, it is essential to contemplate your long-term goals. Buying a home is a significant commitment that requires careful planning and foresight. Ask yourself what your vision for the future looks like. For instance, if you plan to start a family, an HDB flat may be a more practical choice for your first home, given its affordability and spaciousness. In contrast, if you foresee moving up the property ladder within the next five to ten years, you might choose an HDB flat now with plans to upgrade to a condo later.

Additionally, understanding your lifestyle preferences and family dynamics plays a vital role in your decision-making process. For some, the allure of living in a condo might stem from its modern amenities and vibrant lifestyle offerings. For others, the community-centric environment of HDB flats, with their close-knit neighborhoods, may hold more appeal. Whether you prioritize space for growing children or the convenience of urban living, aligning your home choice with your lifestyle is key to ensuring long-term satisfaction.

Regulatory Considerations

Regulatory factors also influence the decision between HDB flats and condos. The eligibility criteria for purchasing each type of property differ, with HDB flats governed by specific regulations that mandate a Minimum Occupancy Period (MOP). For new HDB Build-to-Order (BTO) flats, the recent introduction of distinct categories—Standard, Plus, and Prime—means that owners of Plus and Prime flats must occupy their homes for at least ten years before they can sell in the open market. This restriction encourages long-term investment and helps curb speculation, allowing property values to stabilize over time.

In contrast, private housing, including condos, does not have such restrictions. However, purchasing a condo means incurring additional costs, such as the Seller’s Stamp Duty (SSD), which can be significant depending on the length of ownership. Understanding these regulations is vital for navigating the property market effectively.

Financing Options

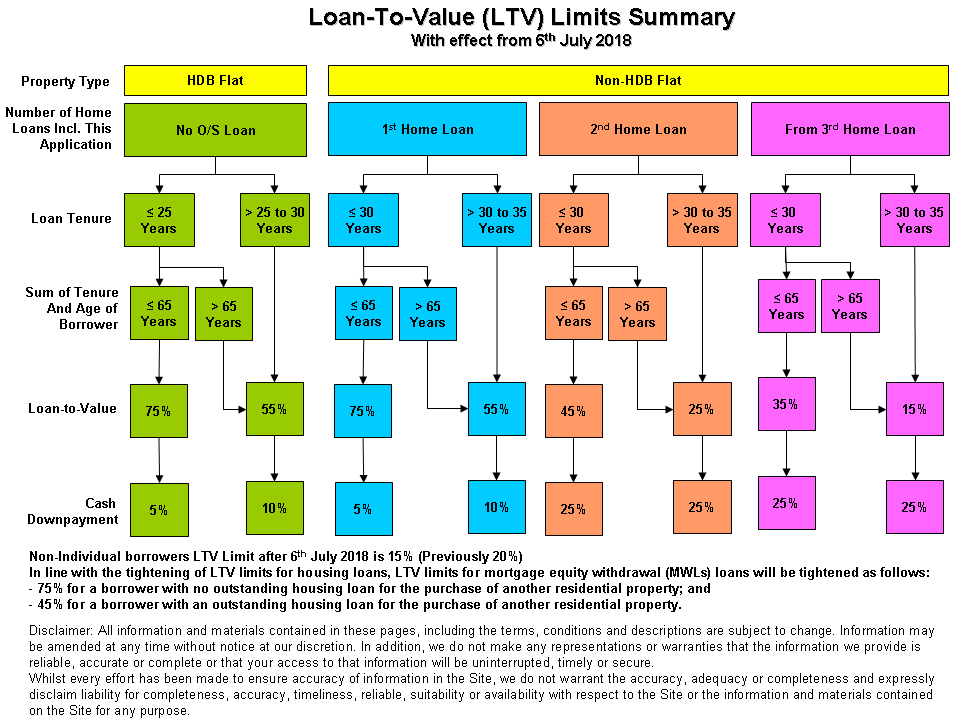

Financing your home purchase is another crucial aspect to consider. When buying an HDB flat, you have the option of securing a HDB concessionary loan or a bank loan. Recent changes have adjusted the loan-to-value (LTV) limit for HDB loans from 80% to 75%, aligning it with the current bank loan limit. This means that buyers can now borrow only up to 75% of the flat's value, requiring a 25% down payment, which can be financed through a combination of cash and CPF savings.

In comparison, when financing a condo, buyers typically need to provide a 25% down payment as well, with the stipulation that 5% must be paid in cash. The remaining amount can be covered by cash and/or CPF savings. Moreover, interest rates differ between HDB and bank loans, with HDB loans pegged at a stable rate above the CPF Ordinary Account rate, while bank loan rates can fluctuate based on market conditions.

The Total Debt Servicing Ratio (TDSR) and Mortgage Service Ratio (MSR) are critical components to consider as well. The TDSR caps how much of your income can go toward servicing debts, including your mortgage, and is set at 55% of your gross monthly income. This regulatory measure promotes responsible lending practices, ensuring that borrowers do not overextend themselves financially. The MSR, applicable primarily to HDB purchases, limits mortgage repayments to 30% of your gross income, emphasizing the importance of assessing your overall financial health when planning your property purchase.

Future Property Value

When purchasing a home, it’s essential to consider the property’s potential for capital appreciation. Singapore’s land-scarce environment typically supports property value growth over time; however, factors such as location, size, and property type play significant roles in determining future value. For example, while HDB flats in central locations may yield higher resale values, condos situated in less desirable areas might struggle to appreciate. If investment potential is a significant consideration for you, analyzing the local property market trends and amenities in various neighborhoods can provide valuable insights.

Housing Index in Singapore increased to 206.10 points in the second quarter of 2024 from 204.50 points in the first quarter of 2024. Housing Index in Singapore averaged 88.54 points from 1975 until 2024, reaching an all time high of 206.10 points in the second quarter of 2024 and a record low of 8.90 points in the first quarter of 1975.

Upgrading from HDB to Condo: A Common Trend

A prevalent trend among Singaporeans is the transition from HDB flats to condos, often fueled by the desire for enhanced amenities, lifestyle improvements, and prime locations. Once homeowners have fulfilled the MOP of five years, they can upgrade without facing restrictions, allowing them to capitalize on their investment in HDB flats and leverage it for the purchase of a condo. This appeal is further accentuated in 2024, as the competitive property market continues to evolve, offering a plethora of modern amenities that enhance the living experience. For many, the upgrade represents a step toward a more luxurious lifestyle, with condos offering modern designs, proximity to essential services, and vibrant community features that resonate with their aspirations.

Downgrading from Condo to HDB: A Strategic Move

While downgrading from a condo to an HDB flat is less common, it can be a financially strategic decision for older couples or individuals looking to lower their monthly liabilities. This move often allows them to tap into the equity built up in their condo, freeing up cash for retirement or other investments. However, sellers face a 30-month waiting period before they can purchase a new HDB flat after selling their condo, which requires careful planning and consideration of one’s financial situation. It’s crucial to weigh the benefits of reducing financial obligations against the implications of a prolonged waiting period, as the real estate market can fluctuate during this time, impacting future purchase options.

Personal Needs and Preferences

Beyond financial factors and investment potential, personal needs and preferences significantly influence the decision to purchase an HDB flat or a condo. For instance, the convenience of living near family members or schools might take precedence over financial considerations for some buyers. Others may prioritize a vibrant community and lifestyle offered by condo living, with easy access to recreational facilities and social activities.

To make a well-informed decision, it's advisable to engage in open discussions with family members or partners about your housing goals and lifestyle preferences. Attending property talks, seeking advice from trusted friends or relatives, and conducting thorough research can also provide clarity in this important decision-making process.

Pros and Cons of HDB Flats and Condos

When evaluating HDB flats, it is crucial to consider the various benefits and drawbacks associated with this type of property. On the positive side, HDB flats are generally more affordable than condos, making them an accessible option for many first-time homebuyers. The financial support provided by the Singaporean government through grants and subsidies significantly reduces the cost of purchasing an HDB flat, allowing individuals and families to enter the property market more easily. Additionally, living in an HDB estate fosters a strong sense of community, as many residents share similar backgrounds and experiences, creating a friendly and supportive atmosphere. Furthermore, HDB flats are often strategically located, providing residents with convenient access to public transportation, schools, and essential amenities. However, there are also downsides to consider. HDB ownership comes with specific regulations and restrictions, such as the Minimum Occupancy Period (MOP) and eligibility criteria, which can limit flexibility for owners. Moreover, while HDB estates offer basic amenities, they often lack the luxurious features and facilities found in condos. Additionally, the resale value of some HDB flats may face challenges, particularly those located in less desirable neighborhoods, which can impact the financial return on investment.

Conversely, condominiums offer a range of advantages, including a wide variety of amenities, such as swimming pools, gyms, and enhanced security services. These amenities contribute to a more enjoyable and modern living experience, appealing to those who value convenience and leisure. Condos also tend to feature contemporary designs and layouts that cater to modern lifestyles, making them an attractive option for younger buyers. Moreover, condos in prime locations may have greater potential for appreciation over time, offering better investment prospects compared to HDB flats. The fewer restrictions associated with condo ownership provide homeowners with greater flexibility in terms of selling and renting out their units. However, there are notable disadvantages to consider as well. Condominiums are generally more expensive than HDB flats, which can place a strain on buyers' finances. The higher purchase prices often translate into elevated maintenance fees, adding to the overall cost of ownership. Furthermore, the sense of community may be less pronounced in condo living, as residents are often more transient and may not interact as frequently compared to HDB estates. This can lead to a more impersonal living environment.

Conclusion

In conclusion, choosing between an HDB flat and a condo in Singapore requires careful consideration of various factors, including affordability, long-term goals, regulatory requirements, financing options, future property values, and personal preferences. By understanding these elements and aligning them with your lifestyle and financial situation, you can make an informed decision that meets your needs. As the Singapore property market evolves, staying informed and adaptable will empower you to navigate the home-buying journey successfully, ensuring that your chosen property aligns with your vision for the future.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com