Navigating CPF Changes: Strategies for a Secure Retirement in Singapore

As of 2025, significant changes to Singapore's Central Provident Fund (CPF) system are set to reshape the retirement landscape for many CPF members. The impending closure of the CPF Special Account (SA) for individuals aged 55 and above marks a pivotal moment in retirement planning for many Singaporeans. While this shift has raised concerns for those who have relied on the SA’s attractive interest rates and withdrawal flexibility, it also presents a unique opportunity for reassessment and optimization of retirement strategies.

Understanding the Impact of Closing the Special Account

The decision to close the CPF Special Account, which currently offers a risk-free interest rate of 4.08% per annum, will primarily affect those members who are "CPF-rich" and have structured their retirement plans around this savings vehicle. For many, the SA has served as a secure, high-yield savings option, with the flexibility to withdraw funds after meeting the Full Retirement Sum (FRS) or Basic Retirement Sum (BRS) through property pledges. The SA Shielding strategy, allowing members to invest amounts above S$40,000 in the SA to enjoy the associated interest, will no longer be viable for members once they reach the age of 55.

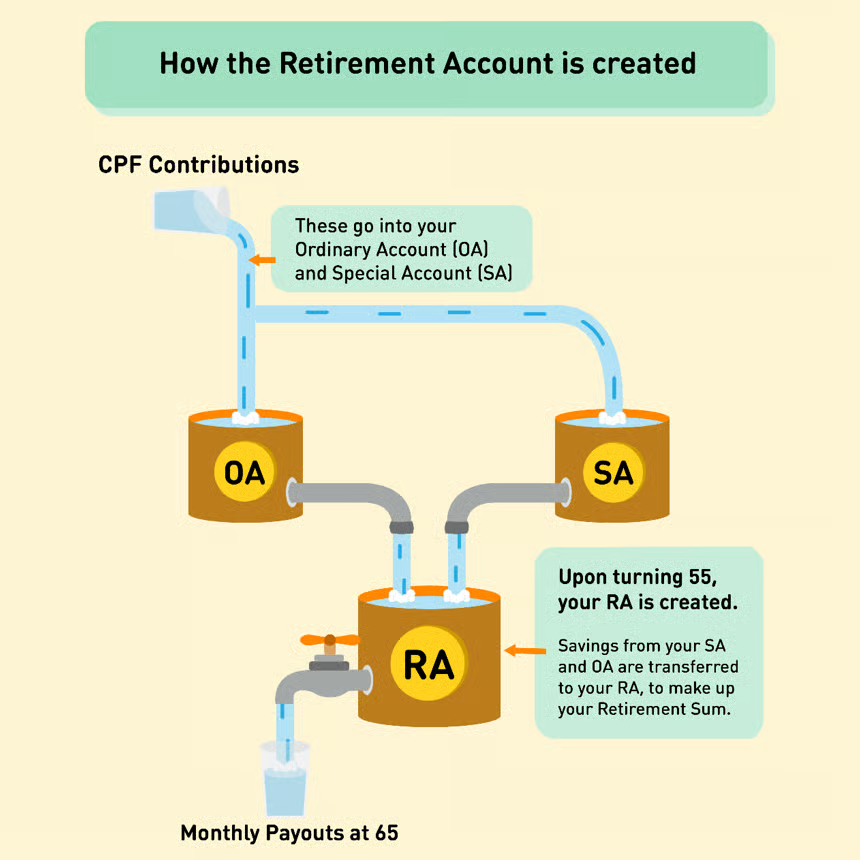

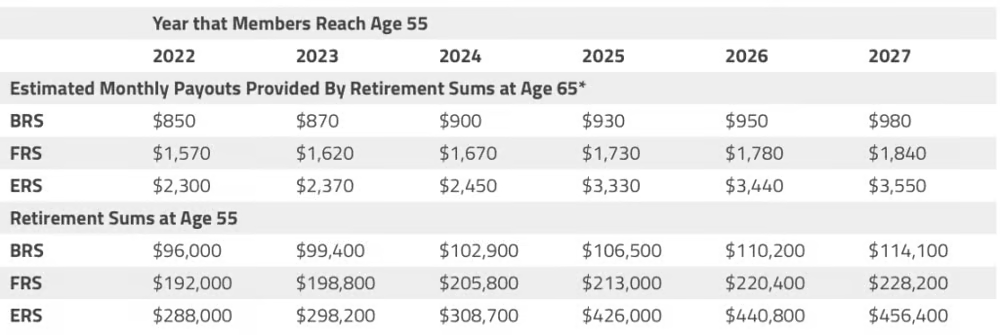

With the upcoming changes, savings from the SA and the Ordinary Account (OA) will be transferred into a newly created Retirement Account (RA) once members reach 55. While this transition means members will earn a lower interest rate of at least 2.5% per annum on their OA funds, the introduction of the Enhanced Retirement Sum (ERS) offers the potential for greater contributions into the RA, significantly increasing monthly payouts during retirement. By 2025, the ERS is projected to be S$426,000, allowing retirees to receive substantial monthly payouts under the CPF LIFE scheme, which aims to enhance financial security in retirement.

The Enhanced Retirement Sum: A New Era of Retirement Planning

Beginning in 2025, CPF members will have the opportunity to top up their RA to a maximum ERS, which translates into a projected ERS of S$426,000. Such a robust RA can significantly impact retirees' monthly payouts under the CPF LIFE scheme, with estimates suggesting that members who maximize their RA contributions could see monthly payouts increase from S$2,300 to approximately S$3,200 by the age of 65. This enhancement illustrates the government's commitment to improving retirement adequacy for all CPF members, promoting the notion that long-term savings should yield higher returns, while short-term savings should expect lower rates.

This shift encourages members to prioritize their retirement savings and view CPF as a lifelong income source rather than merely a vehicle for investment returns. Consequently, it is essential for members over the age of 55 to reassess their retirement strategies proactively.

Rethinking Retirement: Strategies for CPF Members

In light of these changes, several strategies can help CPF members optimize their retirement planning. One key approach is to transfer savings wisely. Members should consider moving their OA savings to the RA to maximize monthly payouts from CPF LIFE. This strategic transfer allows members to benefit from the higher interest rates associated with the RA.

Investing for growth is another critical consideration. While funds in the OA might yield 2.5% interest, members should explore the CPF Investment Scheme (CPFIS) for potentially higher returns. Investing in low-risk options such as Singapore T-bills or corporate bonds can offer greater potential without significantly increasing risk.

For those who require liquidity or wish to diversify their investment portfolios, withdrawing excess savings beyond the FRS can facilitate investments outside the CPF framework. Moreover, focusing on lifelong payouts is crucial. CPF LIFE plans should be approached as insurance products designed to provide steady income rather than merely investment products. It’s vital to ensure that the chosen plan aligns with one’s retirement lifestyle needs.

Given the complexities of retirement planning, seeking professional advice can provide personalized strategies tailored to individual financial situations, risk profiles, and retirement goals.

The Role of CPF LIFE Plans in Retirement Security

As members approach retirement, the choice of CPF LIFE plan becomes critical. The three available plans—Standard, Escalating, and Basic—each cater to different needs. For instance, the Escalating Plan offers lower initial payouts that increase over time, making it particularly useful in combating inflation. In contrast, the Basic Plan allows for higher bequest amounts but typically results in lower monthly payouts. Understanding these nuances is essential for making informed decisions that align with one's financial objectives and longevity expectations.

Furthermore, CPF LIFE operates as a form of insurance. Thus, focusing excessively on potential bequests might detract from the more immediate concern of securing adequate retirement income. With life expectancy on the rise, many members will benefit from choosing plans that provide consistent, reliable payouts instead of solely maximizing returns on premiums.

Preparing for the Future: Financial Literacy and Resilience

The closing of the CPF Special Account is not merely a bureaucratic change; it serves as a critical reminder of the importance of financial literacy and proactive planning. As members navigate this transition, empowering themselves with knowledge about investment options, understanding their risk appetite, and leveraging government schemes to enhance their financial positions is essential. This newfound awareness can lead to improved financial resilience, ensuring individuals are well-prepared for retirement challenges.

While the closure of the CPF Special Account may present immediate challenges, it also opens new avenues for growth and optimization within the CPF framework. By embracing these changes and adopting a proactive approach to retirement planning, members can secure a more stable and prosperous financial future. The key lies in understanding the opportunities presented by the revised CPF structure and making informed choices that align with personal retirement goals.

Optimizing Your CPF Savings Amid Changes to the Special Account

The announcement regarding the closure of the CPF Special Account (SA) for members turning 55 in 2025 has significant implications for financial planning in Singapore. With the Singapore Budget 2024 revealing these changes, it's crucial for Singaporeans to understand how to optimize their CPF savings effectively. For many aspiring to achieve financial independence through the Financial Independence, Retire Early (F.I.R.E.) movement, CPF savings serve as a pivotal component of their retirement planning.

As part of the reforms set to take effect in 2025, members will see an increase in contribution rates for those aged 55 to 65 by 1.5%. Moreover, individuals will have the opportunity to contribute up to S$426,000 to their Retirement Account (RA). The closure of the SA for members aged 55 and above signifies a shift in how CPF savings are managed. Under the new policy, funds from the SA will be transferred to the RA to support monthly payouts in retirement, reinforcing the purpose of CPF savings as a means to secure financial stability during retirement.

In light of these changes, maximizing contributions to the RA is essential. For individuals below 55, cash top-ups of up to S$8,000 to their Special Account and an additional S$8,000 to a loved one’s account are permitted. This strategy allows for significant tax relief, reaching up to S$16,000 annually. Those above 55 can similarly top up their RA, with estimated returns potentially reaching up to 6%.

A significant aspect of this strategy is the Matched Retirement Savings Scheme, which incentivizes members aged 55 to 70 to make cash top-ups with dollar-for-dollar matching up to S$2,000 annually. While these top-ups do not qualify for tax relief, they significantly enhance the retirement savings landscape for seniors. Additionally, seniors with retirement savings below the Basic Retirement Sum are eligible for a one-time Retirement Savings Bonus, providing an extra financial cushion.

Navigating the CPF LIFE Scheme

Understanding the CPF Lifelong Income for the Elderly (LIFE) scheme is vital for retirement planning. This national insurance scheme offers lifelong monthly payouts to Singaporeans aged 55 to 79, tailored to their desired retirement lifestyle. With three plans available—Basic, Standard, and Escalating—members can choose the payout structure that best aligns with their financial goals. The Basic plan offers progressively lower payouts, while the Escalating plan provides a payout that increases by 2% annually, particularly beneficial in combating inflation over time.

Financial projections based on the amount set aside in the RA at age 55 can illustrate the importance of timely contributions. For example, to achieve a monthly payout of S$1,560 to S$1,670, one would need S$308,900 in their RA at age 65. However, if this amount is set aside earlier, at 55, the required sum drops significantly, highlighting the power of compound interest over time.

As members prepare for retirement, diversifying their CPF investment portfolio becomes increasingly important. Under the CPF Investment Scheme (CPFIS), members can invest in various financial products, including unit trusts, insurance products, and bonds. Employing a bond or fixed deposit laddering strategy can be a prudent approach to managing risk while ensuring consistent returns. This strategy involves spreading investments across products that mature at different times, allowing for reinvestment and the potential for continued growth.

While considering investments, it is crucial to conduct thorough research to understand the risks and potential returns of different financial instruments. The interest rates on CPF accounts can be competitive, particularly with the current rates of up to 6% for the RA, making it essential to evaluate whether alternative investments can consistently outperform these rates without introducing excessive risk.

Setting Clear Retirement Goals

Successful retirement planning begins with setting clear and realistic goals. Each individual’s vision of retirement varies, and it’s essential to consider personal circumstances, lifestyle aspirations, and the rising costs of living. As inflation continues to impact purchasing power, ensuring adequate coverage through medical and health insurance becomes paramount. Whether dreaming of traveling the world or opting for a more relaxed lifestyle, individuals should take incremental steps towards their retirement objectives.

The use of retirement calculators can aid in projecting income needs based on current assets and expenses, helping to refine retirement strategies further.

Exploring Supplementary Retirement Options

In addition to CPF savings, exploring other investment vehicles such as the Supplementary Retirement Scheme (SRS) can provide significant tax benefits while accumulating wealth for retirement. Contributions to the SRS qualify for tax deductions, and investment growth within the SRS account is tax-deferred. This strategy can further enhance financial flexibility and provide additional income streams during retirement.

Ultimately, the changes to the CPF system underscore the importance of adaptability and proactive financial planning. By understanding the implications of the closure of the Special Account, utilizing available resources, and developing a comprehensive strategy, individuals can navigate the evolving landscape of retirement savings with confidence. Embracing these changes will empower Singaporeans to achieve their retirement goals and build a more secure financial future.

In conclusion

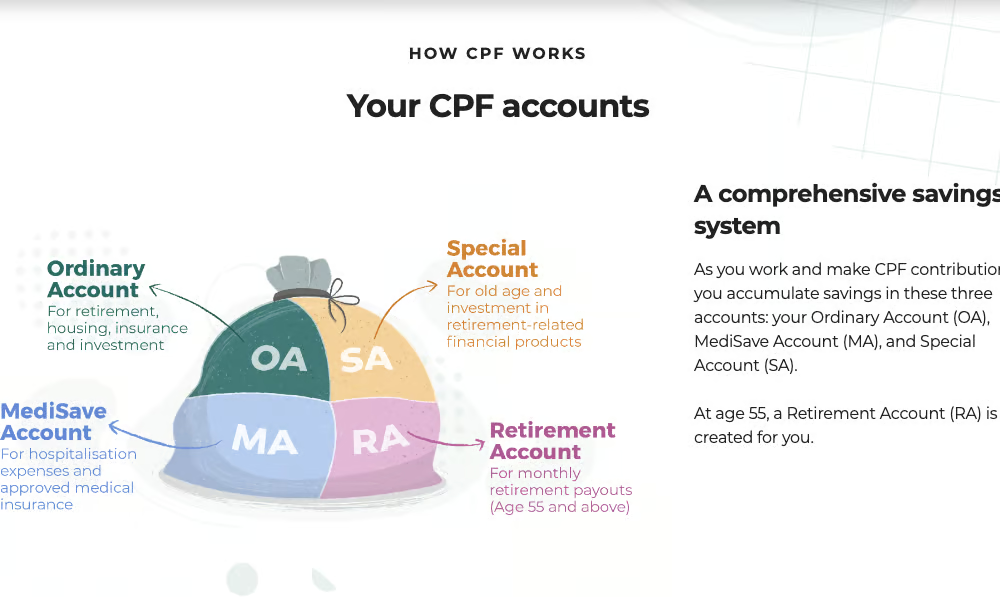

The evolution of Singapore's Central Provident Fund (CPF) system, particularly concerning the Ordinary Account (OA), Special Account (SA), Retirement Account (RA), and Medisave, represents a pivotal shift in retirement and healthcare planning for CPF members. The OA, which primarily supports housing and education, provides a lower interest rate of 2.5%, while the SA offers a more attractive 4.08% interest rate, designed to promote retirement savings. However, the impending closure of the SA for individuals aged 55 and above underscores a strategic realignment toward the RA, which facilitates higher contributions and aims to enhance monthly payouts during retirement through the CPF LIFE scheme. Additionally, Medisave plays a crucial role in safeguarding members' healthcare needs, ensuring that they have sufficient savings for medical expenses during their retirement years. Together, these accounts form a comprehensive framework that encourages members to prioritize long-term financial security and health, ultimately fostering a more resilient and prepared retirement landscape in Singapore.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com