Middle East at War. Oil about to surge?

In the shadow of escalating tensions in the Middle East, particularly with the Israel-Hamas war reaching new heights following significant military actions, the global oil market watches with a cautious eye. While direct impacts on oil production have been less pronounced than one might expect, the nuanced effects and potential for escalation paint a complex picture of economic interdependence and geopolitical risk.

Stability Amidst Chaos

Despite the severity of the conflict, including the assassination of Hezbollah’s top leader by Israel, oil prices have shown surprising resilience. This stability can be attributed to several factors:

• Saudi Arabia’s Strategy: Saudi Crown Prince Mohammed bin Salman’s decisions play a pivotal role. With Saudi Arabia producing below its capacity, there is a buffer in global supply that has kept prices from spiking. However, there is growing speculation that Saudi Arabia might increase production, which could further stabilise or even lower oil prices if not matched by demand.

• Diversification of Supply: The global oil market has diversified significantly since the oil crises of the past. Non-OPEC countries such as the US, Brazil, and Guyana are increasing their output, reducing the Middle East’s stranglehold on oil supply.

• Strategic Reserves and Market Adaptation: The establishment of larger strategic petroleum reserves and improved coordination through bodies like the International Energy Agency (IEA) have better prepared the market for potential shocks.

Potential for Escalation and Its Implications

However, the assassination of Hezbollah’s leader and other military engagements signal a risk of escalation that could dramatically alter this calm. Here’s how:

• The Strait of Hormuz Factor: Iran’s control over this crucial shipping lane remains a significant concern. Any move by Iran to disrupt this route could lead to immediate spikes in oil prices due to the volume of global oil trade it handles.

• Regional Conflict Expansion: If the conflict expands, involving more direct confrontation between Israel and Iran or drawing in other oil-producing nations, the resulting uncertainty could drive oil prices upwards. Analysts have noted that oil could reach $100 per barrel under severe escalation scenarios.

• Market Sentiment: X posts and various analyses indicate that while the market hasn’t priced in an ‘all-out war’, the sentiment reflects a lurking fear of escalation. This psychological aspect can itself cause volatility in oil prices.

Economic Consequences Beyond Production

The war’s impact isn’t confined to oil production but extends to broader economic repercussions:

• Gaza’s Economic Devastation: The local economic impact, particularly in Gaza, has been catastrophic, with drastic drops in GDP and employment, illustrating the war’s harsh economic toll on directly involved territories.

• Global Economic Sentiment: The conflict contributes to uncertainty, which could affect investor confidence, potentially leading to broader economic impacts through inflation, higher energy costs, and disrupted trade routes.

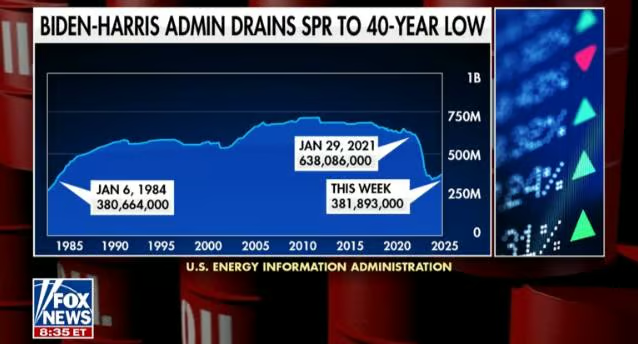

As of September 23, 2024, the US Strategic Petroleum Reserve (SPR) held 380.61 million barrels of crude oil, with a design capacity of 714 million barrels. Established in 1975 after the OPEC oil embargo, it serves as insurance against future supply disruptions.

As of October 1, 2024, The U.S. has bought 6 million barrels of oil for the Strategic Petroleum Reserve for delivery through May 2025,

the Department of Energy said on Monday.

The purchases are part of an effort to replenish stockpiles after President Joe Biden ordered the largest ever sale from the reserve in 2022 of 180 million barrels in an effort to control fuel prices following Russia's invasion of Ukraine.

Biden’s Strategic Petroleum Reserve Moves Spark Debate on U.S. Energy Policy

President Biden’s recent moves involving the Strategic Petroleum Reserve (SPR) have sparked controversy, with some hailing it as a brilliant financial manoeuvre, while others criticise it as a political gamble that undermines national security.

The Biden administration sold oil from the SPR at around $95 per barrel and recently repurchased it at approximately $76 per barrel, a move that some argue represents a well-timed trade yielding significant profits for taxpayers. Supporters point out that this “buy low, sell high” strategy generated billions in savings.

However, critics argue that the SPR’s purpose is not to generate profit but to safeguard national energy security. They highlight that much of the reserve was filled under former President Trump at prices well below $30 per barrel. They accuse Biden of depleting the SPR to dangerously low levels, motivated by political interests—specifically, to lower gasoline prices ahead of the 2022 Midterm Elections. This temporary price drop, they argue, offset the effects of reduced U.S. oil production due to the administration’s energy policies.

Additionally, concerns have been raised about selling U.S. oil on global markets, including to China, while domestic security and energy stability are at risk. Critics warn that the SPR’s depletion for short-term political gain jeopardises America’s long-term strategic interests.

Conclusion

While direct impacts on oil production from the Israel-Hamas conflict have been muted so far, the situation remains volatile. The global oil market’s current stability is a testament to diversified supply sources and strategic geopolitical manoeuvring, particularly by Saudi Arabia. Yet, the potential for escalation looms large, with the capacity to disrupt this delicate balance, signalling that the world must remain vigilant and prepared for sudden shifts in oil dynamics influenced by this enduring conflict.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com