Mega Bond Rally: TLT on the Cusp

The Precipice of a Bond Market Revolution

We stand at a crucial juncture where the narrative of the bond market, particularly the iShares 20+ Year Treasury Bond ETF (TLT), is about to take a dramatic turn. Market analysts have been fixated on the January CPI print, heralding it as a sign of inflation's resurgence, stretching the market's expectations like bubble gum. However, this perspective might be missing the forest for the trees. The job market and housing market are key indicators that suggest a different story might unfold. There's a palpable tension in the air, a sense that the market isn't prepared for what's coming.

The data from recent Google searches on bond market trends, especially for terms like "TLT performance" and "bond rally," indicates a rising interest and perhaps a growing concern or anticipation among retail investors. This interest is not unfounded; the bond market is on the cusp of a significant shift, one that could redefine investment strategies across the board. Moreover, National Income (NI) statistics from recent quarters show a deceleration in personal income growth, hinting at a cooling economy that could favor bonds over equities. When personal income growth slows, consumer spending might follow, potentially pushing down inflation and interest rates, which would benefit TLT.

The Dynamics of Fiscal and Monetary Policy

It's one thing when the Federal Reserve implements an anti-inflation policy, but it's an entirely different ball game when the Treasury does the same. Historically, we've seen little precedence for a synchronized contractionary fiscal and monetary policy, yet here we are, potentially witnessing it for the first time in decades. This dual tightening could severely constrain the private sector, which has been somewhat cushioned by low interest rates for years. The market's ability to underwrite rates above 5% will be tested, potentially leading to a significant recalibration of investment and borrowing strategies.

The interplay between fiscal and monetary policy has been somewhat disjointed until now. While the Fed has been tightening, the fiscal side has remained relatively loose, contributing to persistent inflation. However, with signals now pointing towards a more restrictive fiscal policy, the scenario might change. The implications are profound: if both fiscal and monetary policies tighten, inflation could see a significant decrease in the coming quarters. This scenario, though not openly acknowledged by Fed Chairman Powell in recent hearings due to political sensitivities, could lead to a new normal in economic policy-making. NI data further supports this with a visible reduction in government outlays, suggesting a move towards fiscal restraint.

Powell's Words and the Market's Mood

In his latest public addresses, Powell's mention of Quantitative Easing (QE) and Zero Interest Rate Policy (ZIRP) has raised eyebrows, especially given the consensus among financial Twitter (fintwit) that these tools were relics of the past. His choice of words suggests a nuanced strategy, possibly preparing the market for a shift that might not be as hawkish as previously thought. It's a delicate dance between signaling future policy directions without causing immediate market turbulence.

The current asset allocation trend of 2025 underscores a move towards bonds as the only positive cash flow safe haven. Unlike gold or Bitcoin, which offer no yield, bonds provide both security and income, which in an uncertain economic landscape, is akin to a warm blanket on a chilly night. This shift in investor preference back to bonds, particularly long-term ones like those in TLT, might be the market's way of bracing for impact or capitalizing on what's coming. Moreover, recent surveys from investment firms indicate an increased interest in fixed-income securities, particularly among institutional investors, further supporting the potential for a bond rally.

Short Interest and Market Sentiment

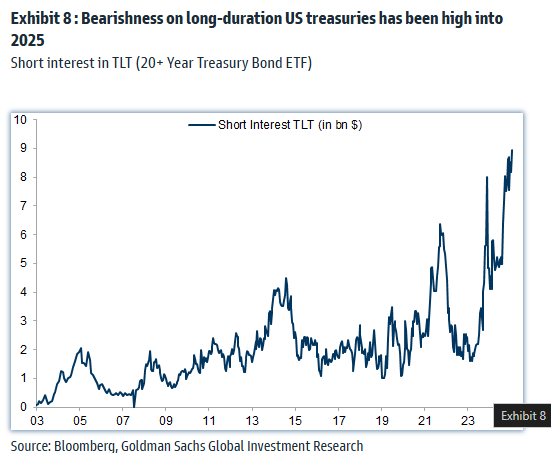

Goldman Sachs has reported that short interest in TLT is near century-highs, painting a picture of a market betting heavily against long-term Treasury bonds. This sentiment is not just a reflection of pessimism about bond prices but also an indicator of how investors might be positioning themselves for a yield curve steepening or even an inversion scenario. However, this contrarian position could backfire spectacularly if the market moves in the opposite direction, signaling a bond rally.

Adding to this analysis, the NI data reflects a dip in corporate profits, which might lead investors to pivot towards safer assets like bonds as corporate bonds yields might not seem as attractive. This shift could precipitate a rush into government securities, reducing yields and thus increasing bond prices, particularly for long-duration bonds like those in TLT.

Technical Analysis: The Fate of TLT

From a technical standpoint, TLT's recent chart patterns tell a compelling story. Friday's candle, touching the upper resistance rail only to close near the day's low, hints at a pivotal moment. A breakout above this resistance would not only be bullish for TLT but could also suggest that the long end of the yield curve is softening, which has significant implications for equities. Conversely, if the resistance holds and TLT reverses, we might see it plummet to levels potentially below 85, or even as low as 81, which would spell disaster for broader market sentiment.

Should TLT break out, targeting levels like 94 and 100 could be on the cards, signaling a robust rally in bonds. However, if the bearish scenario unfolds, the impact on equities and investor confidence could be severe, highlighting just how critical the long end of the yield curve is for market dynamics. When we look at the NI statistics, we see a contraction in business investment, which typically correlates with a flight to safety in investments, further bolstering the case for TLT's potential rally.

Global Economic Influences on TLT

Beyond domestic policy, global economic conditions play a pivotal role in the trajectory of TLT. Recent slowdowns in major economies like China and Europe, evidenced by declining PMI indices and reduced GDP growth forecasts, might drive international investors towards U.S. Treasuries as a safe haven. This global demand could push down yields, thereby increasing the value of TLT. Also, the U.S. dollar's strength, often a refuge in times of global uncertainty, could inversely affect U.S. bond yields, making TLT an even more attractive investment.

The Impact of Inflation Expectations

Inflation expectations have a direct impact on bond yields. Recent surveys show a decrease in consumer inflation expectations, aligning with the NI data's indication of cooling economic momentum. Lower inflation expectations mean that the real yield on bonds, like those held in TLT, becomes more attractive, potentially leading to price appreciation. The bond market's reaction to these expectations can be seen in the narrowing of the yield spread between short and long-term bonds, a precursor to a bull market in bonds.

Betting on the Bonds

Given the current economic indicators, policy directions, and market sentiment, I'm inclined to argue for a bullish stance on TLT. The combination of monetary and fiscal tightening is likely to curb inflation more effectively than markets currently anticipate, leading to a bond rally. Investors should heed these signs, reallocate towards bonds, and prepare for a market where the long end of the yield curve dictates the next big move in financial markets. This isn't just about TLT; it's about recognizing where we stand in economic history and adjusting our sails accordingly. The convergence of domestic and international economic data, alongside policy shifts, paints a compelling picture for those willing to look beyond the immediate noise of inflation spikes and towards the broader economic canvas.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com