Interest Rate Projections for 2025: A Shifting Fed Strategy

Fed Policymakers Signal Inflation Fight Isn’t Over, Tread Carefully to Avoid Labor Market Damage

Two Federal Reserve officials recently emphasized the central bank’s ongoing commitment to controlling inflation while signaling caution to avoid undermining the labor market. Their remarks highlight the careful balancing act needed as the Fed adjusts its monetary policy.

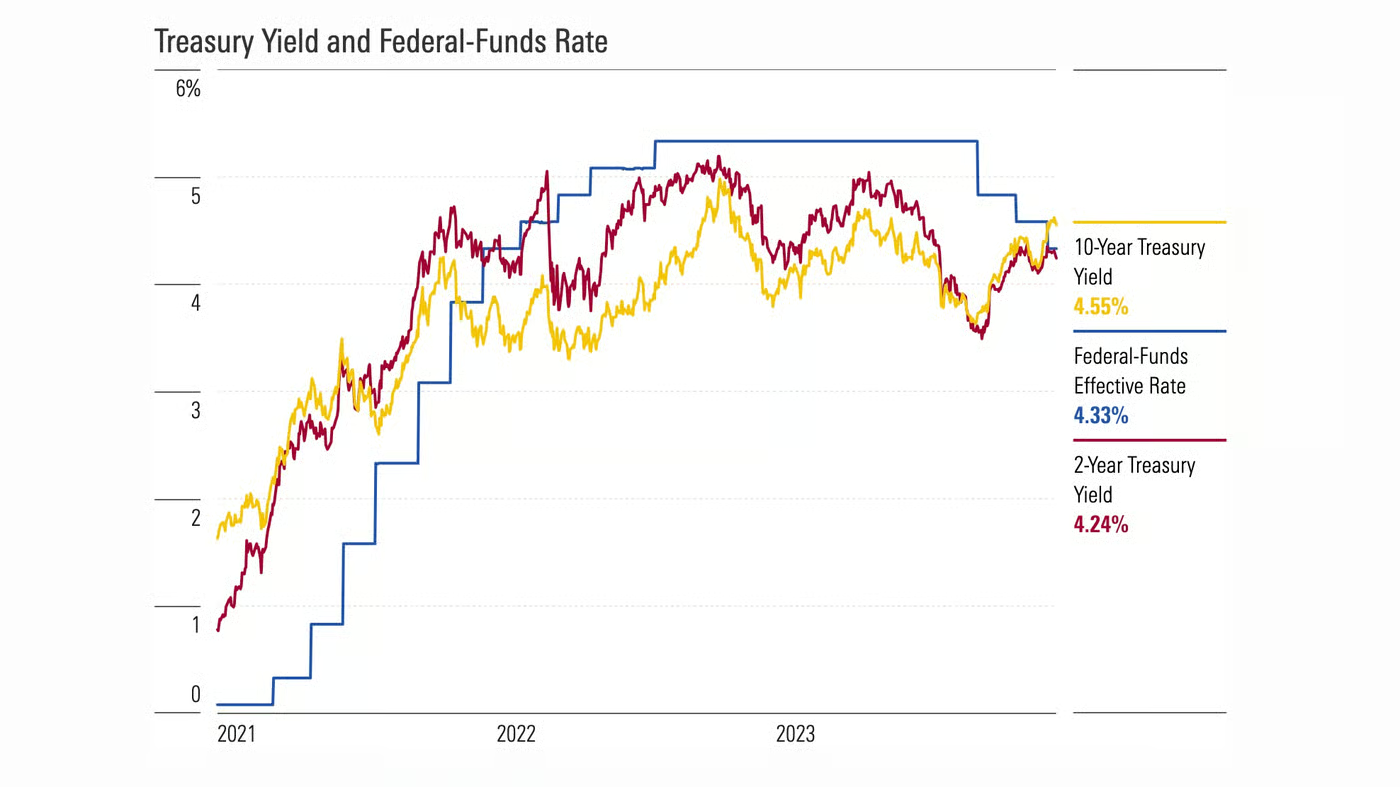

In 2024, the Fed reduced interest rates by a full percentage point, bringing the range to 4.25%-4.50%. Inflation, as measured by the Fed’s preferred index, fell significantly from its mid-2022 peak of about 7% to 2.4% in November. However, this figure remains above the Fed’s 2% target, and progress toward this goal is expected to be slower than previously anticipated.

Speaking at the American Economic Association conference, Governor Adriana Kugler remarked, “We are fully aware that we are not there yet—no one is celebrating. At the same time, we want unemployment to remain stable and not rise rapidly.” In November, the unemployment rate stood at 4.2%, a level that both Kugler and San Francisco Fed President Mary Daly believe aligns with the Fed’s dual mandate of price stability and maximum employment.

Daly added that while some monthly fluctuations in labor data are expected, she does not want to see further weakening in the job market. Both officials avoided commenting on the potential effects of the new administration’s economic policies, such as tariffs and tax cuts, which could stimulate growth but also reignite inflation.

Interest Rate Projections for 2025: A Shift in Fed Strategy

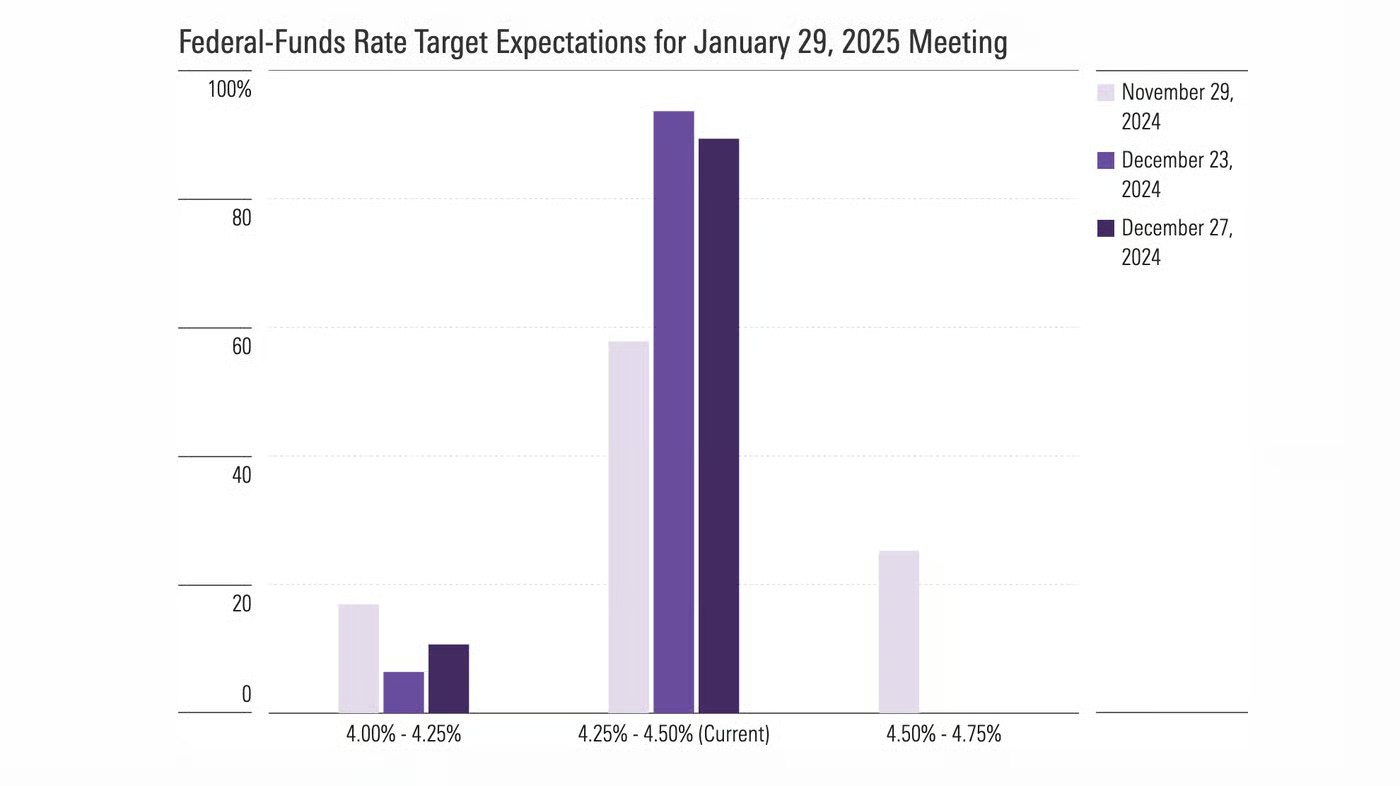

As the Federal Reserve continues to adjust its monetary policy, recent changes to its 2025 rate forecasts reflect a more conservative approach. In December, Fed officials projected only a half-point rate cut for 2025, a significant shift from their September forecast of a full percentage point reduction. This adjustment suggests that the Fed is prepared to slow the pace of easing, with many analysts predicting just two rate cuts next year, or potentially none.

Roger Hallam, global head of rates at Vanguard, noted that political and economic uncertainties could lead to further caution. “A skip in January could easily extend into a longer pause,” he said. Despite ongoing inflation concerns, a robust economy and potential inflationary pressures from new fiscal policies could even lead the Fed to consider rate hikes, though this remains a less likely scenario.

Navigating the Neutral Rate Uncertainty

Underlying the debate over future rate cuts is the concept of the “neutral rate”—an interest rate that neither stimulates nor restrains economic growth. Economists estimate this level to be higher than previously thought, with some suggesting a nominal neutral rate of 1% and a real neutral rate of 3%, assuming 2% inflation.

Fed Chair Jerome Powell hinted during the December meeting that current rates are nearing a level of balance, a reason for the central bank’s cautious stance. “The Fed wants to avoid cutting rates too aggressively and reigniting inflationary pressures,” Powell stated.

Could Rate Hikes Return in 2025?

While rate hikes remain unlikely, some analysts have floated the possibility if inflation surges again or the economy outperforms expectations. However, such a move would require clear evidence that unemployment is stabilizing, according to Don Rissmiller, chief economist at Strategas. “A small uptick in unemployment could trigger a negative cycle, which the Fed wants to avoid,” he explained.

Hallam agreed, suggesting that as long as inflation appears manageable and policy remains restrictive, the Fed is likely to maintain a neutral-to-easing bias.

Will the Fed Hold Steady in January?

As of late December, market expectations leaned toward the Fed keeping rates unchanged at its upcoming meeting, with a small chance of a further 0.25% cut. However, analysts caution against placing too much weight on projections. “Fed forecasting is inherently uncertain,” Rissmiller emphasized. “Current projections could shift significantly in the coming months, depending on economic developments.”

While the Fed’s path forward remains unclear, one thing is certain: policymakers are navigating a complex economic landscape, balancing inflation concerns with the need to sustain a healthy labor market.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com