All You Need to Know: How to Trade VIX Combos

Types of VIX Combo Spread:

1. Ratio Call Spread:

- Objective: To benefit from moderate bullishness in the VIX with limited downside risk.

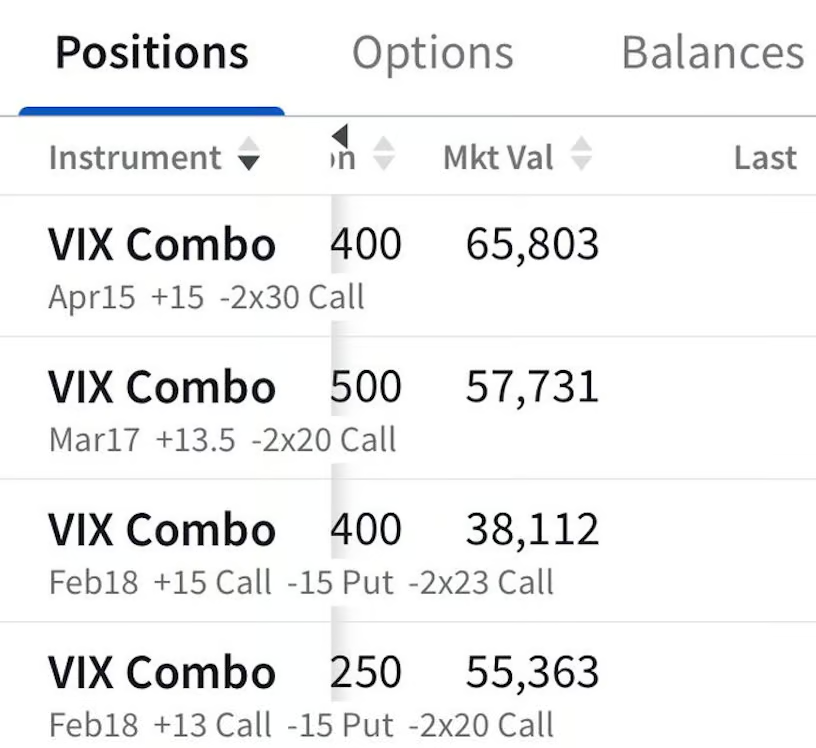

The notation Apr15 +15 -2x30 Call refers to a multi-leg options strategy involving call options on the VIX (or another underlying asset). Here’s what it means:

1. Apr15:

• This indicates the expiration date of the options is April 15. All the options mentioned (+15 and -2x30) will expire on this date.

1. +15:

• This refers to a long call option with a strike price of 15.

• You have bought one call option at this strike price, giving you the right to buy the underlying at $15.

3. -2x30:

• This indicates you have sold two call options at a strike price of 30.

• The “2x” signifies you are short two contracts of the 30-strike call.

• Selling these call options obligates you to sell the underlying at $30 if the price exceeds that level.

What This Strategy Represents

• Position Type: This is a ratio call spread, where the trader buys one lower-strike call (15) and sells two higher-strike calls (30).

• Purpose:

- This strategy is usually employed to capitalize on a moderate rise in the underlying price.

- It reduces the cost of buying the lower-strike call by selling higher-strike calls, though it introduces unlimited risk if the price rises significantly past the sold strike (30 in this case).

• Risk:

- Profit is capped at the upper strike price (30). Beyond that, losses are unlimited because of the short two call options.

- Losses also occur if the underlying remains below the lower strike price (15), as the long call expires worthless.

Example Payoff:

If the VIX is at:

• 15 or below: You lose the premium paid for the long 15 call. The sold 30 calls expire worthless.

• Between 15 and 30: The long call gains value, but your profit is offset by the sold calls as the price approaches 30.

• Above 30: Losses accelerate because of the two short calls, and they can become substantial as there is no upper limit to the VIX.

This strategy is high risk and should only be used when confident the underlying price will stay within a specific range.

Illustration below:

2. Custom Hedged Play:

- The use of varying strikes, such as +13.5 and +15, across different expirations can serve as a hedge against unexpected volatility shifts.

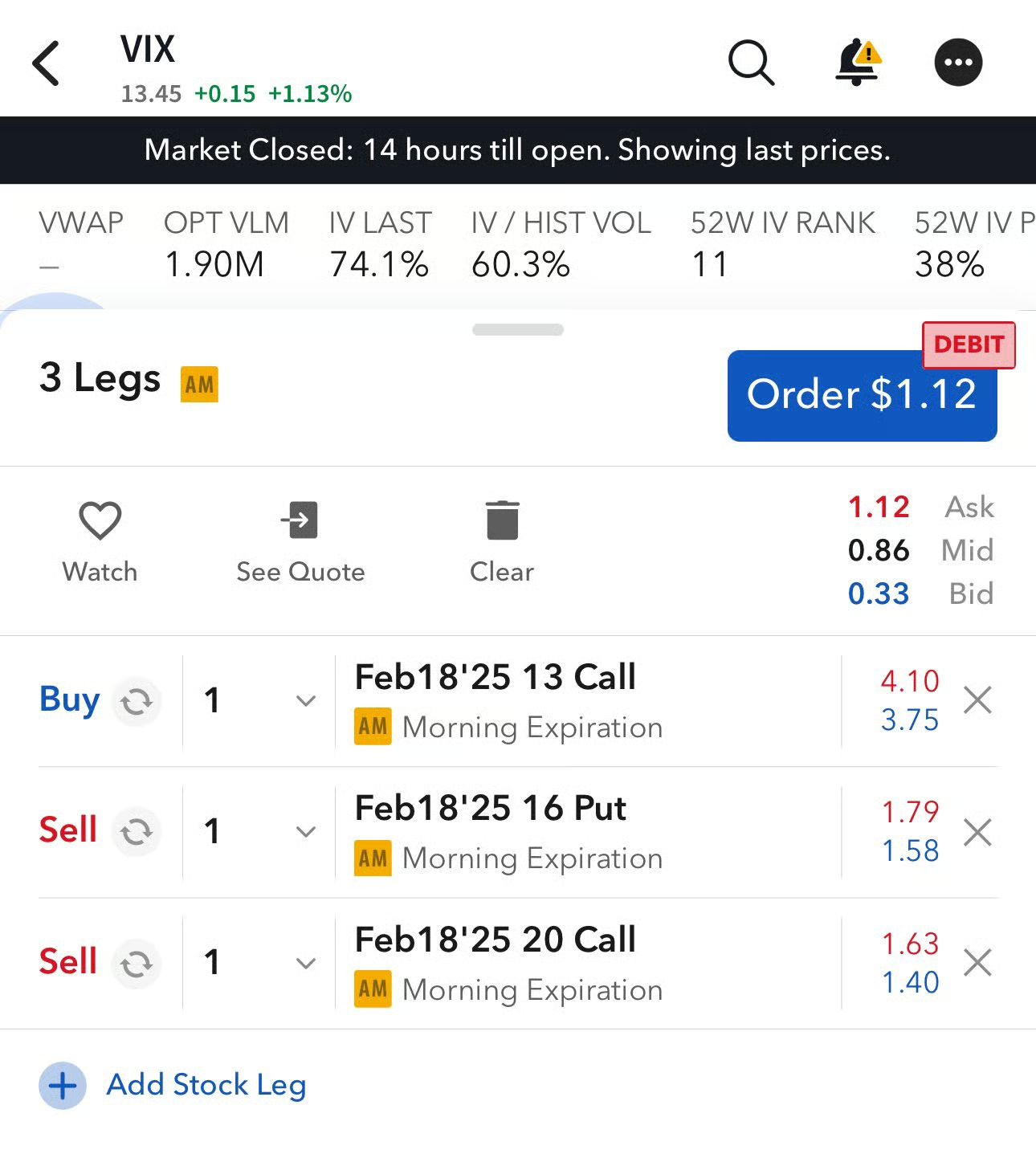

3. Adding a Sell Put:

- Buy 13 Call, Sell 20 Call, Sell 16 Put

Key Insights:

1. Objective:

- Designed to profit from a rise in the VIX index while keeping initial costs low.

- Capitalises on implied volatility skew, making it ideal for traders with a directional bias toward higher VIX levels.

2. Zero-Cost Argument:

- While the setup cost was approximately $0.80 in December, changing market conditions such as increased implied volatility could create scenarios where the net cost becomes negligible.

- A near-zero-cost structure is achievable when the premiums from the sold options (20 Call and 16 Put) offset the cost of the purchased 13 Call.

3. Payoff Breakdown:

- At 16.7 VIX:

- Intrinsic Value: The 13 Call would be in the money, with a value of $16.7 - $13 = $3.70.

- The 16 Put and 20 Call would remain out of the money, incurring no losses or gains.

- Net P&L: $3.70 - $0.80 = $2.90 profit.

- Downside Risk: Losses arise if the VIX falls below 16, as the 16 Put would be assigned. Losses are capped below 13 due to the 13 Call.

- Upside Potential: Profits are capped above 20 because of the sold 20 Call.

4. Margin Requirements:

- This strategy is often preferred because it avoids high margin requirements associated with outright futures positions. The premium structure ensures affordability while providing exposure to directional VIX movements.

Conclusion

Although the cost of this setup was around $0.80 at the time, evolving market conditions may allow for zero-cost or near-zero-cost implementations. This makes it a highly flexible and accessible strategy for those looking to trade the VIX effectively. Stay tuned for deeper insights into market volatility strategies!

$VIX levels and what daily moves they imply:

1. VIX 20: ~1.26% daily movement

2. VIX 30: ~1.89% daily movement

3. VIX 40: ~2.52% daily movement

4. VIX 50: ~3.15% daily movement

5. VIX 60: ~3.78% daily movement

6. VIX 70: ~4.41% daily movement

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com