Growing Concerns Over Stagflation Outweigh Recession Fears

Growing Concerns Over Stagflation Outweigh Recession Fears

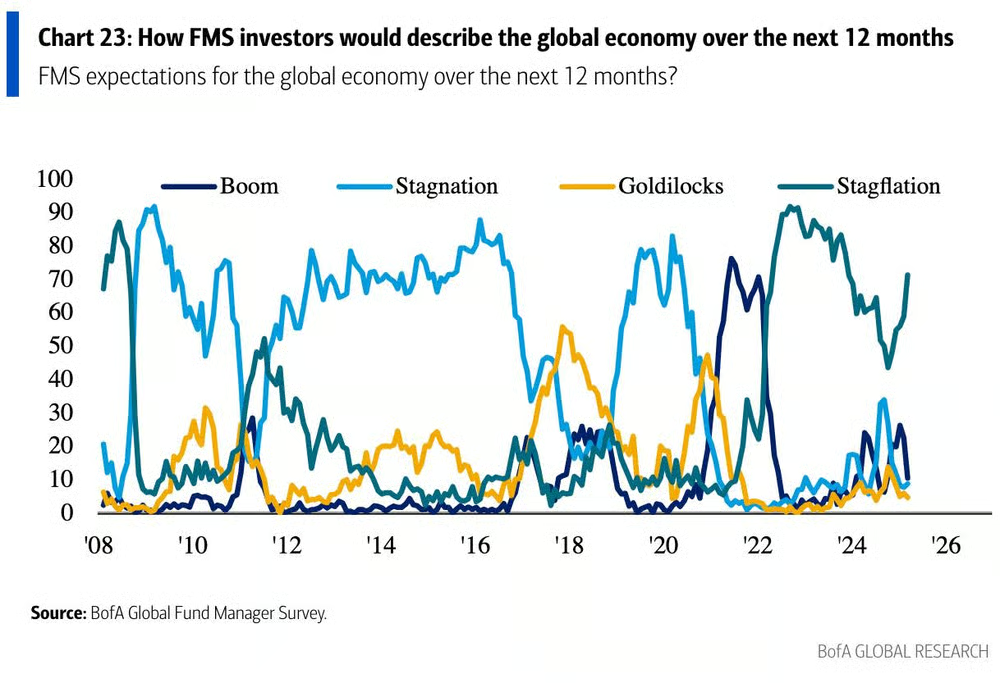

Investor unease is mounting as the spectre of stagflation—a condition many consider more troubling than a standard recession—looms larger. A striking 71% of fund managers now predict this toxic blend of soaring inflation and sluggish growth will grip the global economy within the next 12 months, according to a recent Bank of America survey. This shift in sentiment has prompted a significant retreat from US equities, with money managers slashing their holdings at an unprecedented pace between March 7 and March 13. The possibility of stagflation is sending ripples through financial markets, as it poses a unique challenge that could leave policymakers scrambling for solutions.

Why Stagflation Ties the Hands of Central Banks

Unlike a typical recession, where the US Federal Reserve might slash interest rates to spur economic activity, stagflation presents a far trickier dilemma. With prices climbing alongside stagnant growth, cutting borrowing costs becomes a risky move that could fuel inflation further rather than ignite recovery. This dynamic famously plagued the 1970s, triggering widespread unemployment and economic stagnation. The Fed’s latest meeting only heightened these worries, as it bumped up its 2025 inflation forecast to 2.7% (from 2.5%) while trimming its growth projection to 1.7% (down from 2.1%). Such revisions have amplified fears that history might repeat itself, albeit in a modern guise.

Wall Street’s Rising Alarm and Market Implications

The buzz around stagflation isn’t new, but it’s gaining momentum. UBS Global Wealth Management recently raised its odds of a stagflationary spell in the US to 20%, up from 15%, citing pressures from aggressive trade policies under the Trump administration. While they don’t foresee a full-blown recession, the firm warns that downside risks are growing. Meanwhile, Stifel, an investment bank, has flagged the potential for a “mini-stagflation” episode in the latter half of 2025, which could rattle equity markets anew. Their analysis points to fading growth and stubborn inflation colliding, a scenario that might limit the Fed’s room for rate cuts and spark another wave of stock sell-offs. As these forecasts pile up, investors are bracing for a bumpy ride ahead.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com