Gold and Copper Prices Drop as Trump’s Return Strengthens Dollar

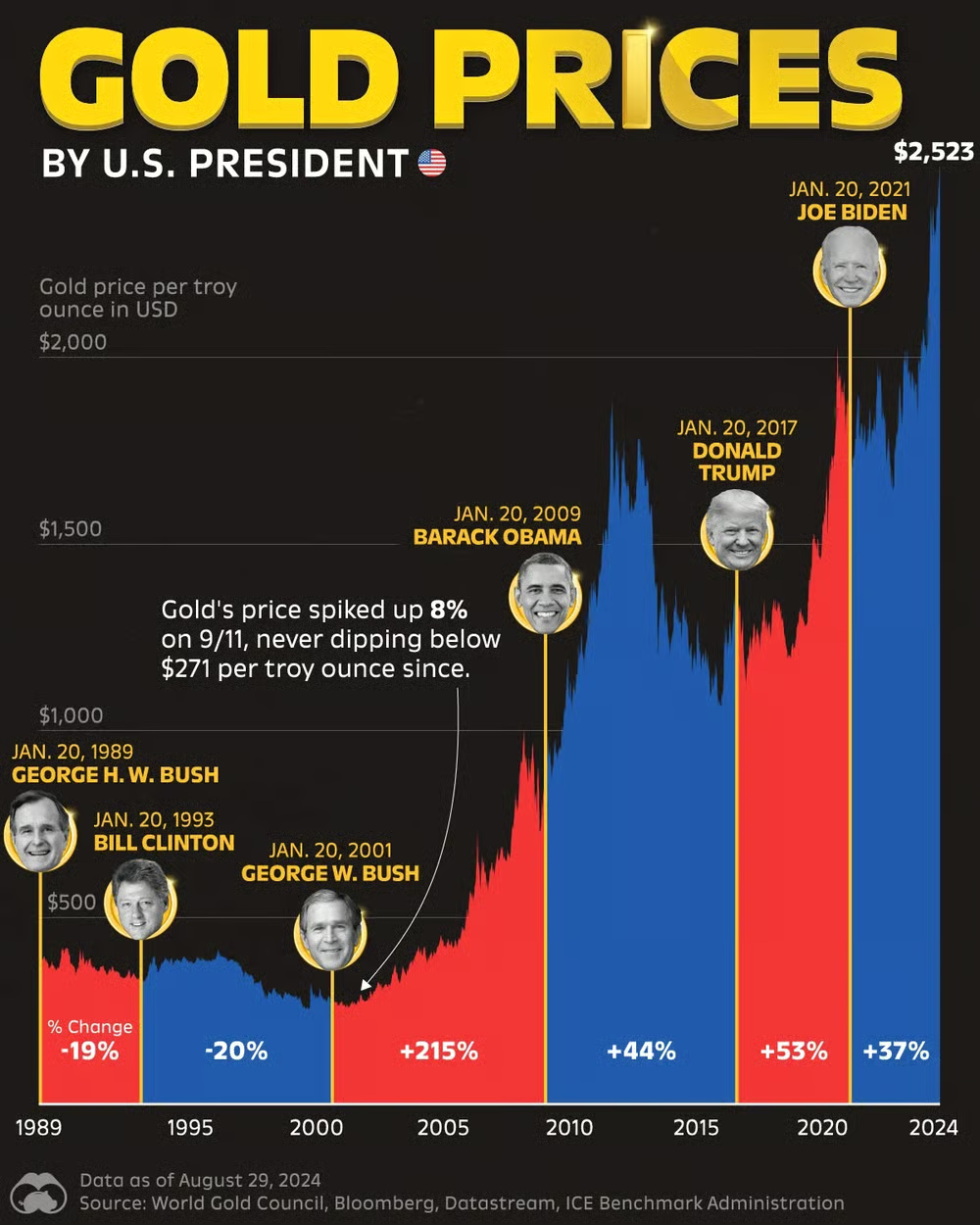

The recent US presidential election results are expected to fuel continued demand for gold, as analysts predict that ongoing trade tensions and uncertainties surrounding the US dollar will drive prices to new highs. Despite a recent dip, experts believe gold is poised to surge, with some forecasting prices reaching unprecedented levels.

Since October, market trends have reflected the impact of “Trump deals,” influencing various sectors. The US dollar has strengthened, while gold prices have risen, and oil and copper have experienced declines. These fluctuations suggest the possibility of a market reversal in the short term.

Shen Jianguang, Chief Economist at JD.com, "The US government has used the US dollar and tariffs as a tool for financial sanctions, causing many countries’ central banks to actively or passively de-dollarise"

Gold’s appeal as a hedge against economic instability, especially in a low-interest-rate environment, has led to its increasing popularity. The precious metal recently hit a record high of $2,769.25 per ounce on October 29, marking a 35% rise for the year. However, a slight dip on Wednesday saw it fall by 3.1%, closing at $2,659.24 per ounce.

UBS analysts have predicted that gold could reach $2,900 per ounce by the end of the third quarter of next year, with a Trump victory likely accelerating this upward momentum. His policies on tariffs, government spending, taxes, and interest rates are expected to continue influencing gold’s price.

Goldman Sachs analysts, too, see prices rising, forecasting a target of $3,000 per ounce by the end of 2024. This surge is partly attributed to the US Federal Reserve’s monetary policies, including its quantitative easing program and massive balance sheet expansion, which have contributed to a weakening global confidence in the US dollar.

Many central banks worldwide are responding to these shifts by diversifying away from the dollar, turning toward gold and virtual currencies as alternatives. This ongoing trend is expected to drive further demand for gold in the long term.

Additionally, Trump’s tariff policies are affecting global trade, particularly with China, where the yuan has already shown signs of depreciation. As a result, gold has become increasingly attractive to Chinese investors seeking protection against currency fluctuations. In the first three quarters of this year, China’s gold consumption dropped 11%, with jewelry purchases declining by 27.53%. However, sales of gold bars and coins saw a 27.14% increase, as investors turn to physical assets to safeguard wealth.

As these economic dynamics continue to evolve, individuals and investors alike are paying close attention to the potential for gold to serve as a buffer against the growing uncertainties surrounding global trade and the US dollar’s future.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com