Valuation of Venezuela’s Oil-Backed Debt

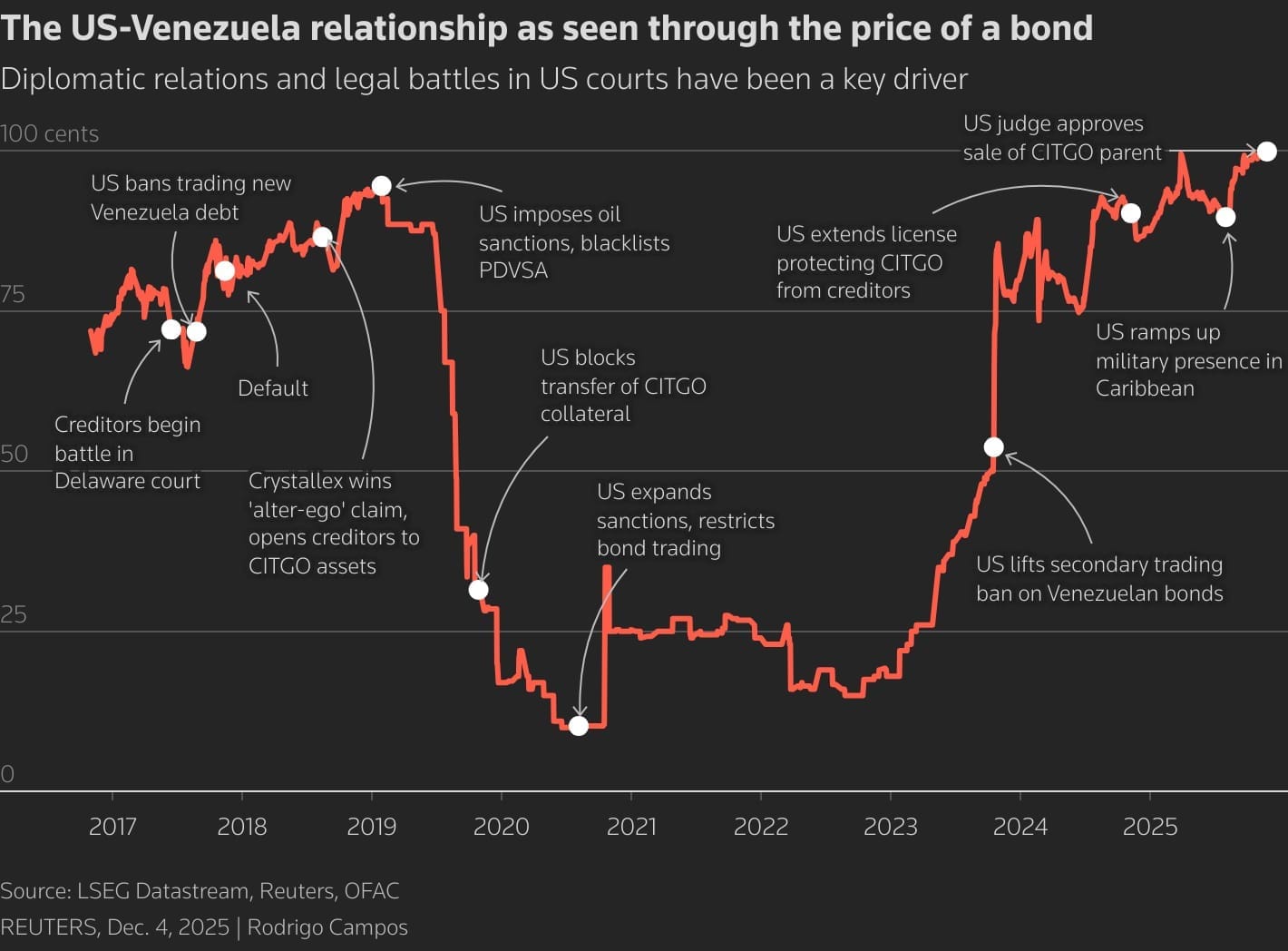

The intersection of sovereign debt, international arbitration, and hard-power geopolitics rarely offers a case study as volatile or instructive as the recent trajectory of Venezuela’s state-backed obligations. For global capital market participants, the recent price action of the Petroleos de Venezuela (PDVSA) 2020 bond serves as a masterclass in how distressed assets can be repriced through a combination of legal restructuring and diplomatic pressure. While the broader Venezuelan debt complex collapsed following the 2017 default, the specific dynamics surrounding the PDVSA 2020 notes have created a unique corridor of value preservation, recently culminating in the bond trading at a premium to par.

The Citgo Collateral and the Alter Ego Ruling

To comprehend the resilience of this specific tranche of debt, one must analyse its structural distinctiveness. Issued in 2016 as part of a debt swap operation, the PDVSA 2020 bond was secured by a pledge of 50.1% of Citgo Holding, the US-based refining arm of the Venezuelan state oil giant. This collateralisation effectively bifurcated the bond from the rest of the country's unsecured sovereign risk. However, payment flows ceased in late 2019 after the opposition-led National Assembly challenged the legality of the bond contract, throwing the asset into a legal grey zone.

The complexity deepened due to parallel litigation initiated by Canadian miner Crystallex International. Having secured a $1.4 billion arbitration award in 2016 regarding the expropriation of assets under the Hugo Chavez administration, Crystallex successfully argued in a US court that PDV Holding—Citgo’s parent—was the "alter ego" of the Venezuelan state. This landmark ruling pierced the corporate veil, rendering the company liable for sovereign debts and triggering a judicial auction process that has fundamentally altered the recovery landscape for creditors.

Elliott Investment Management Enters the Fray

The resolution of this legal deadlock has immense implications for equity and credit markets focusing on distressed opportunities. The court-mandated auction process for PDV Holding shares concluded last month, with the decision favouring Amber Energy, an affiliate of the hedge fund giant Elliott Investment Management.

This acquisition proposal is critical for bondholders. Elliott’s affiliate has allocated $2.1 billion specifically to pay off and extinguish the PDVSA 2020 bond obligations. While the sale remains contingent upon approval from the US Treasury—a step that intertwines financial outcomes with Washington’s foreign policy—the move signals a tangible exit strategy for investors. The involvement of a major distressed-debt player like Elliott suggests a high-conviction belief that the asset’s legal and financial entanglements can be unravelled profitably.

From Distressed Lows to Par Value

The market’s reaction to these developments, compounded by shifting US foreign policy, has been nothing short of historic. In mid-2020, amidst the height of the debt crisis and sanctions, the bond traded as low as 10 cents on the dollar. However, the confirmation that the debt was enforceable under New York law provided the first catalyst for a repricing.

Subsequent diplomatic shifts accelerated this momentum. The easing of specific US sanctions in October 2023 pushed prices above 80 cents. More recently, the ratcheting up of US military pressure on the Maduro administration has acted as the final driver, forcing the market to price in an imminent resolution. Consequently, the bond hit par for the first time in September and closed on Thursday at 100.25 cents on the dollar. For investors, this journey from 10 cents to over par underscores the reality that in emerging markets, legal enforceability and geopolitical leverage are often the ultimate arbiters of value.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com