Fed’s Preferred Inflation Gauge: What’s Ahead This Week

Fed’s Preferred Inflation Gauge and Holiday Trading Highlights:

What’s Ahead This Week (25th November 2024)

After a remarkable post-election surge, Bitcoin (BTC) has reached new all-time highs, nearing the $100,000 milestone for the first time. The cryptocurrency has surged 110% year-to-date, drawing attention from both seasoned and new investors alike.

The week ahead features several key events for investors to monitor. October’s Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation measure, will take center stage on the economic calendar. Updates on third-quarter GDP growth and housing activity will also provide insights. Meanwhile, earnings reports from major names like Zoom, Dell, Best Buy, CrowdStrike, and Macy’s are expected to capture attention.

The Thanksgiving holiday means markets will close on Thursday, with a shortened session on Friday ending at 1 p.m. ET.

Inflation Concerns Persist

Recent data has raised questions about whether the Federal Reserve will move to cut interest rates in December and how aggressive it may be in reducing rates over the coming year. In October, the “core” Consumer Price Index (CPI) held steady at a 3.3% annual increase for the third straight month. Similarly, the “core” Producer Price Index (PPI) rose to 3.1% annually, exceeding expectations.

Federal Reserve Governor Michelle Bowman has voiced caution, noting that progress toward the Fed’s 2% inflation goal has “stalled” recently. Economists anticipate October’s “core” PCE to show a slight increase to 2.8% annually, up from 2.7% in September. Month-over-month growth is expected to hold steady at 0.3%.

Bank of America analysts suggest that if the PCE data aligns with expectations, the Fed may reassess its monetary policy stance. While a December rate cut remains possible, ongoing inflation and resilient economic activity could signal a shallower easing cycle ahead.

Bitcoin Surges Amid Changing Sentiment

While equity markets may see limited action during the shortened trading week, Bitcoin’s rally remains in focus. The cryptocurrency has soared nearly 50% since the recent U.S. presidential election, driven by optimism around a changing regulatory environment.

Bitcoin briefly neared $100,000 per coin last week, spurred by the announcement of SEC Chair Gary Gensler’s upcoming resignation. Investors interpret the move as a positive for the crypto space, reflecting renewed “risk-on” sentiment in the market. Analysts predict Bitcoin could continue its upward trajectory as liquidity and economic growth expectations shift in 2025.

S&P 500 Outlook for 2025

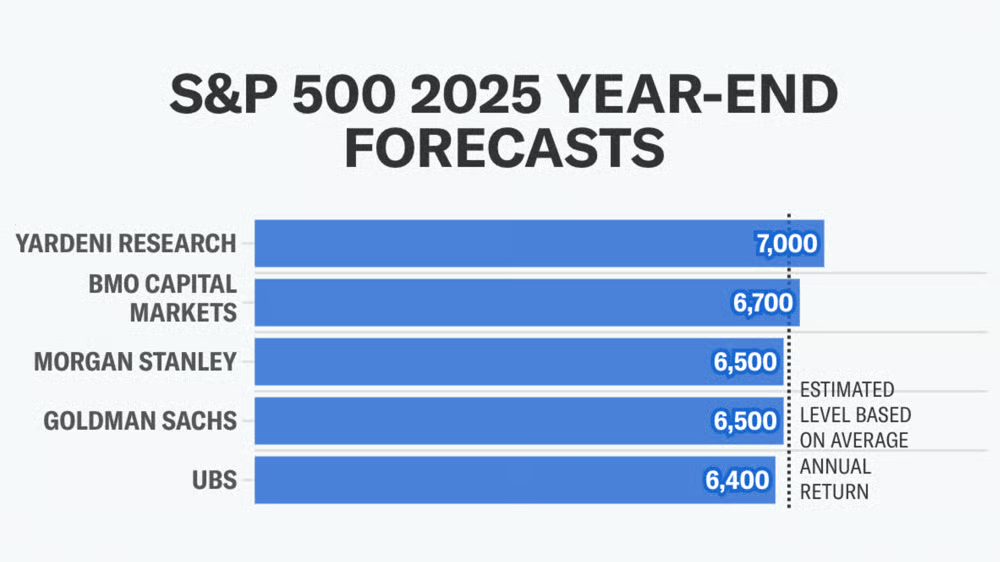

Wall Street analysts are beginning to release their 2025 market forecasts, with most reports painting a bullish picture. Projections for the S&P 500 range between 6,400 and 7,000, aligning with the index’s historical annualized return of around 11%. However, as DataTrek co-founder Nicholas Colas points out, returns can vary widely around this average.

Colas highlights strong economic fundamentals heading into 2025, including a robust labor market, lower interest rates, and anticipated tax cuts under the new administration. These factors could support above-average market performance, with the S&P 500 potentially gaining 15% to close next year near 6,840.

As we move into the holiday season, this week’s inflation data, corporate earnings, and broader market trends will provide critical insights for the months ahead.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com