Essential Tips for a Secure and Fulfilling Retirement: Your Ultimate Guide to Financial Freedom

Retirement is a key milestone in life that represents the shift from active work to a more relaxed phase where one can enjoy the fruits of years of hard work. However, to truly experience the peace of mind and freedom that comes with retirement, careful planning and disciplined execution are essential. Many people worry about outliving their savings or not being able to maintain their desired lifestyle. This is why having a sustainable financial plan for retirement is crucial. In this guide, I’ll explore key principles and strategies to ensure a secure and enjoyable retirement.

Visualizing Your Retirement Lifestyle

The first step to a well-planned retirement is understanding what kind of lifestyle you want to maintain. This involves thinking about your future needs, wants, and personal aspirations. For many, this includes not just basic necessities, but also indulging in experiences like travel or pursuing long-held passions. It's important to assess your lifestyle in three categories: Basic, Moderate, and Luxury. This gives you a realistic view of the expenses involved, allowing you to budget effectively.

As you age, your retirement goals may evolve. When planning for retirement, account for inflation and future healthcare needs. Reassessing your financial goals periodically helps you remain on track and ensures that you adapt to any life changes.

Identifying Your Must-Have Income Floor (MIF)

One vital aspect of retirement planning is determining your "Must-Have Income Floor" (MIF), the minimum monthly income required to meet your basic needs during retirement. Since this is a non-negotiable amount, it’s prudent to rely on stable, guaranteed income sources to fund your MIF. Over time, as your retirement approaches, your risk appetite may decrease. In such cases, building a retirement portfolio focused on stability becomes essential. This can include fixed income products like CPF LIFE, bonds, or annuities.

Your MIF should cover not just your needs but also some of your discretionary spending. To achieve this, you may need to save more aggressively or invest in lower-risk financial instruments that offer reliable returns. These "safer" investments will ensure that your wealth grows while minimizing risk.

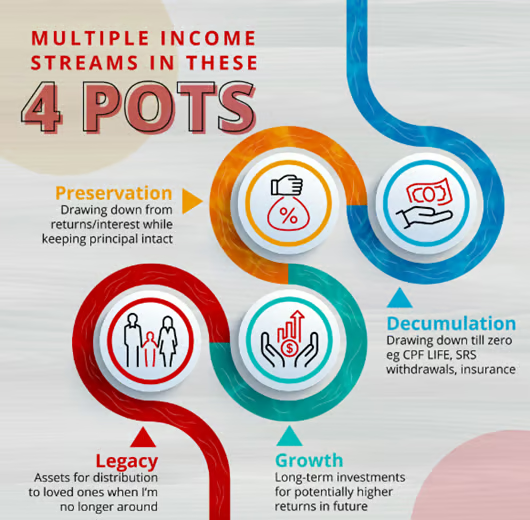

Building Multiple Income Streams

Relying on a single source of income during retirement can be risky, particularly when market volatility or unexpected expenses arise. A diversified portfolio with multiple income streams helps mitigate these risks. The more secure income flows can cover essential living expenses, while the higher-yield but riskier assets can fund luxuries or future medical costs.

Your portfolio should ideally include both guaranteed income flows (such as CPF payouts, bonds, or annuities) and variable income streams from riskier assets like equities, investment funds, or rental properties. A mixed strategy like this offers both stability and growth potential, helping you maintain a steady cash flow while protecting your wealth.

Continuing to Invest in Retirement

Retirement doesn’t mean the end of investing. In fact, given the increasing life expectancy in many countries, it’s important to continue growing your wealth even after you stop working. With rising healthcare costs and inflation, a passive approach to retirement can deplete your savings faster than expected. Invest in a well-diversified portfolio of stocks, bonds, and funds that offer both income and capital appreciation to ensure your financial resources last throughout retirement.

Consider your investment strategy carefully: aim for growth in the early retirement years when you're likely to be more active and incur higher expenses, and shift to more conservative investments as you age. This gradual transition will help you maximize returns while managing risk.

Maximizing CPF Savings

For Singaporeans, CPF (Central Provident Fund) savings are a cornerstone of retirement planning. With risk-free interest rates of up to roughly 4% per annum, CPF offers a reliable way to grow your retirement nest egg. It’s wise to top up your CPF accounts regularly to leverage the benefits of compounding.

Consider making CPF top-ups early in the year to maximize interest accrual. By topping up your CPF Special Account (SA) or Retirement Account (RA), you can increase your CPF LIFE payouts, ensuring a steady monthly income for life. Additionally, explore government schemes such as the Matched Retirement Savings Scheme, which provides a dollar-for-dollar match for cash top-ups, further boosting your retirement savings.

Health and Long-Term Care Planning

A significant portion of retirement planning must include healthcare and long-term care provisions. With the likelihood of increased medical expenses as we age, it’s essential to have sufficient health insurance coverage. Consider maintaining your Integrated Shield Plan and ensuring you’re adequately covered under CareShield Life or similar plans. Statistics show that many retirees may face disabilities or long-term care needs, making these plans invaluable in managing healthcare costs.

Healthcare costs can be unpredictable, but by preparing for them in advance, you can ensure that your retirement savings aren’t eroded by unexpected medical bills.

Strategic Estate Planning

Retirement is not just about enjoying your golden years, but also ensuring that your loved ones are taken care of when you’re no longer around. A sound estate plan helps distribute your assets efficiently and according to your wishes. Setting up a will, CPF nominations, and a Lasting Power of Attorney (LPA) will ensure that your wealth is passed down smoothly and with minimal legal hassle.

Estate planning also provides a buffer for unexpected situations like medical crises or black swan events, helping you preserve your wealth for both your needs and your legacy.

Purposeful Retirement Living

Beyond financial security, it’s important to find purpose and fulfillment in retirement. Many retirees struggle with a loss of identity once they stop working. Engaging in meaningful activities, such as volunteering, traveling, or learning new skills, can provide a sense of purpose. Structuring your days and maintaining an active lifestyle, both mentally and physically, will help you lead a balanced and fulfilling life in retirement.

Incorporating physical activities and social engagements into your daily routine can also boost mental resilience, ensuring a healthier and more enjoyable retirement.

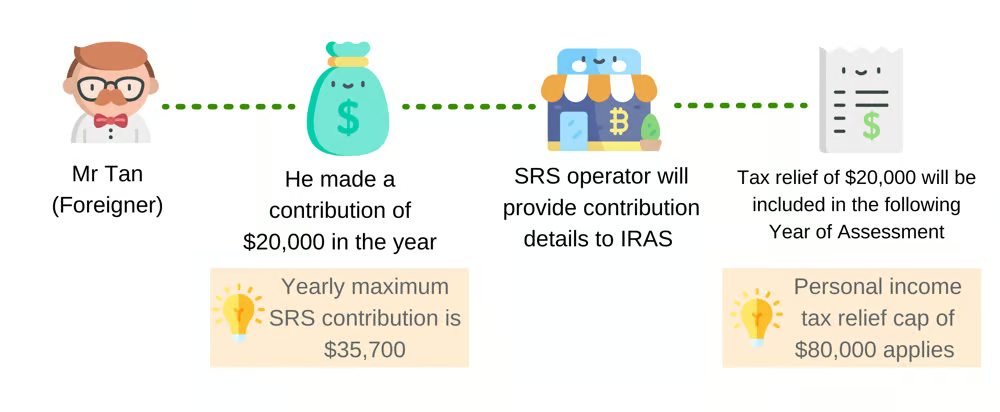

Supplementary Retirement Scheme (SRS)

Contributing to the Supplementary Retirement Scheme (SRS) is another smart move for Singaporeans looking to optimize their tax savings while building a retirement nest egg. With the added flexibility of investing SRS funds in a variety of instruments like insurance, unit trusts, and equities, you can potentially enhance your retirement income. SRS contributions also provide tax relief, allowing you to defer taxes during your higher-income years and pay lower taxes when you make withdrawals during retirement.

Holistic Financial Management

Effective retirement planning requires a comprehensive understanding of your finances. Make use of tools such as SGFinDex, which allows you to consolidate financial information from multiple accounts, providing a clear view of your financial health. Brokerages also offer insights into assets and provide you with cashflow guidance for your future needs too.

With a full understanding of your assets and liabilities, you can make informed decisions about your retirement plan and close any gaps early.

Conclusion: Taking the First Step

Retirement planning is a journey that requires discipline, foresight, and regular reassessment. By incorporating a mixture of guaranteed income, risk-managed investments, and healthcare planning, you can ensure that your retirement years are financially secure and fulfilling. Whether you have abundant resources or more modest savings, taking the first step towards retirement planning is crucial for achieving financial freedom and living a purposeful life in your later years.

The key to a successful retirement lies in thoughtful planning and the willingness to adapt as life unfolds. Start now, take responsibility, and make retirement planning a priority. The future is yours to shape.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com