Effective Strategies for Singaporeans to Combat Inflation

High inflation has become an unavoidable topic in recent discussions around personal finance, particularly as Singapore grapples with economic fluctuations. As of August 2024, Singapore's headline consumer price index (CPI) stood at approximately 5.1%, while core inflation was reported at around 3.2%. These figures, although down from previous peaks, still pose significant challenges to consumers. The recent rise in prices, particularly for essential goods and services, underscores the importance of developing effective strategies to combat inflation.

The Impact of Inflation on Everyday Life

The repercussions of rising prices can be felt in various aspects of daily life, from grocery bills to transportation costs. The rising costs have forced many Singaporeans to reassess their budgets, leading to shifts in consumption patterns. According to a recent survey, around 70% of Singaporeans reported cutting back on non-essential spending due to inflationary pressures. This change has been particularly pronounced following the global economic recovery post-pandemic, where pent-up demand has led to soaring prices for goods and services. Moreover, ongoing global challenges—such as supply chain disruptions and geopolitical tensions—continue to exacerbate inflationary pressures, contributing to increased costs across the board.

Understanding the Broader Economic Context

To fully grasp the implications of inflation, it’s crucial to understand its broader economic context. Rising interest rates implemented by the Monetary Authority of Singapore (MAS) aim to curb inflation but can also slow down economic growth. Additionally, the high costs of energy and raw materials, driven in part by the Russia-Ukraine conflict, further complicate the situation. As a result, consumers are not only feeling the pinch at the grocery store but also experiencing the ripple effects in other areas, such as housing and transportation.

Reviewing and Adjusting Your Expenses

To combat the effects of inflation, it is essential for individuals to regularly review their expenses. Establishing a habit of tracking spending can help identify areas where adjustments can be made. It is beneficial to differentiate between fixed and discretionary expenses; the latter offers more room for reductions. For example, individuals should consider reviewing their subscriptions—cancelling those that are no longer in use, such as gym memberships or streaming services. Research shows that nearly 30% of consumers subscribe to services they rarely use, leading to unnecessary monthly expenses.

Budgeting Tools and Techniques

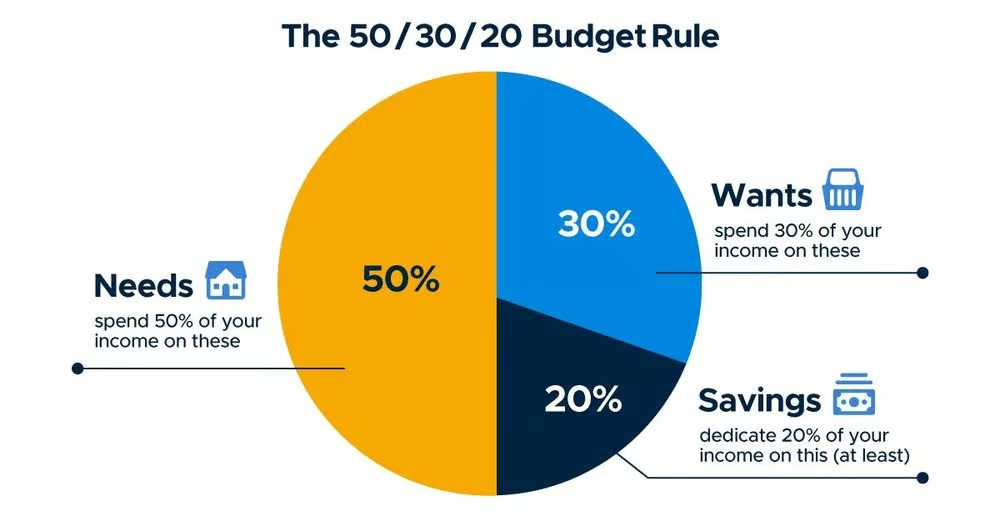

Utilizing budgeting tools, such as digital apps or spreadsheets, can make tracking expenses more manageable. These tools can help create a clear picture of your finances and highlight areas where cuts can be made. Additionally, employing the 50/30/20 rule—allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment—can serve as a practical guideline for managing monthly expenses. Another rule is the 40/30/20/10 rule—

Another rule is the 40/30/20/10 rule—40% on loans, 30% on expenses, 20% on saving or investing and 10% for insurance.

The Importance of Smart Shopping

Shopping smarter is another effective strategy to cope with inflation. Research indicates that consumers are now spending a higher proportion of their income on daily expenses compared to previous years. This underscores the necessity of employing cost-saving techniques. Utilizing bulk buying for non-perishable items, shopping during discount hours, and exploring second-hand marketplaces can substantially cut costs.

Strategies for Savvy Shopping

In addition to these tactics, here are some specific strategies that can enhance your shopping experience and save you money:

Leverage Loyalty Programs: Many supermarkets and retailers in Singapore offer loyalty programs that reward customers for their purchases. Joining these programs can provide access to exclusive discounts and promotions. For instance, the Giant Card and NTUC FairPrice's Link Rewards allow you to accumulate points that can be redeemed for future discounts.

Compare Prices Online: Use price comparison websites and apps, like PricePanda or ShopSavvy, to find the best deals on groceries and everyday items. These platforms can help identify the lowest prices across different stores, saving you money in the long run.

Buy Seasonal Produce: Fruits and vegetables that are in season are often more affordable. Visiting local wet markets or farmers' markets can help you access fresher and cheaper produce.

Inflation-Proofing Your Savings

With inflation at a high level, simply saving in a traditional account may not suffice. For those with a solid savings foundation, it's crucial to look for higher-interest accounts or low-risk investment vehicles that can help preserve wealth over time. Options such as high-yield savings accounts, Singapore Savings Bonds, or even money market funds can offer better returns than standard savings accounts.

Diversifying Your Savings Strategy

Additionally, diversifying savings strategies can further protect your wealth:

Consider High-Interest Accounts: Banks like DBS and UOB offer high-interest savings accounts, such as the DBS Multiplier Account, which can yield interest rates up to 3% per annum when certain criteria are met. This can significantly outpace the inflation rate.

Invest in Inflation-Linked Securities: Singapore Savings Bonds offer a safe way to invest with returns linked to inflation rates. This means that your investment grows in line with inflation, preserving your purchasing power over time.

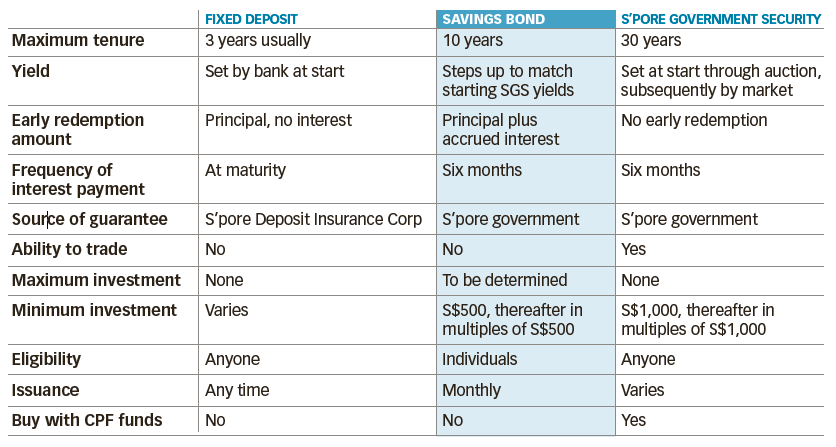

Time and Fixed Deposits: Time deposits and fixed deposits are effective hedges against inflation in Singapore because they provide guaranteed interest rates that can help preserve the value of your savings over time. By locking in funds for a set period, these deposits offer stability and a predictable return, helping to mitigate the eroding effects of inflation on purchasing power.

Singapore Savings Bonds (SSBs) are a safe investment option that allows individuals to earn interest that increases over time, helping to keep pace with inflation. With a guarantee from the Singapore government, SSBs offer flexibility, as investors can redeem their bonds at any time without penalty, ensuring access to their funds while still earning competitive returns.

Taking the Leap into Investing

As inflation continues to affect purchasing power, investing becomes increasingly important. A recent report revealed that customer investments at banks in Singapore increased by over 24% year-on-year, indicating a growing awareness of the need to generate returns that can outpace inflation.

Beginner-Friendly Investment Options

For those new to investing, platforms offering regular savings plans or robo-advisory services can simplify the process. Regular contributions to exchange-traded funds (ETFs) or unit trusts can yield significant returns over time while spreading risk. Banks and brokerages allow you to sign up for automatic investment where they will regularly draw out a fixed sum of money from your account and invest it for you, making these accessible for new investors.

Exploring Advanced Investment Strategies

For seasoned investors, it’s crucial to consider sectors that traditionally perform well during inflationary periods. According to financial analysts, sectors such as commodities, energy, and real estate investment trusts (REITs) tend to be resilient in inflationary environments. Investing in S-REITs, which have historically provided stable dividends between 5% and 6%, can offer a good hedge against rising prices.

Exploring Additional Income Streams

Lastly, finding ways to earn extra income can help to relieve some of the pressure from the increased cost of living. If asking for a pay raise is not feasible, there are various sources of side income worth exploring. Freelancing, tutoring, or using your car for ride-sharing services can help supplement your primary income.

Passive Income Opportunities

Investing in a diversified portfolio of assets can also create passive income streams. Consider options like real estate crowdfunding platforms, which allow you to invest in property with lower capital requirements, or dividend-paying stocks that generate regular income.

Conclusion

As inflation continues to impact everyday life in Singapore, it becomes essential for individuals to adopt proactive financial strategies. By reviewing expenses, shopping smart, protecting savings, investing wisely, and seeking additional income, Singaporeans can better navigate the challenges posed by rising prices. With a thoughtful approach, it is possible not only to weather the storm of inflation but also to build a more secure financial future amid economic uncertainty. By leveraging available resources, maintaining a disciplined approach to spending, and exploring investment opportunities, individuals can empower themselves to thrive despite the financial challenges ahead.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com