Your Ultimate Guide to Investing in REITs in Singapore: Strategies, Metrics, and Tips

Real Estate Investment Trusts (REITs) have become a cornerstone of investment strategies for many Singaporeans. They offer a unique blend of potential returns, passive income, and diversification, making them an attractive choice in today's financial landscape. This guide will provide you with an in-depth understanding of REITs, the benefits and risks associated with investing in them, key metrics to evaluate, and practical steps to get started in the Singaporean context.

Understanding REITs

At their core, REITs are companies that own, operate, or finance income-producing real estate. These trusts pool capital from multiple investors to acquire a diversified portfolio of properties, such as shopping malls, office buildings, industrial parks, and healthcare facilities. In Singapore, REITs are typically listed on the Singapore Exchange (SGX), which allows everyday investors to participate in the real estate market without the need to buy physical properties.

When you invest in a REIT, you purchase shares, which grants you ownership in the underlying real estate assets. One of the most attractive features of REITs is that they are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This structure makes REITs appealing for those seeking regular income, particularly retirees or anyone looking to build a passive income stream.

The Benefits of Investing in REITs

Regular Income Generation: One of the most significant benefits of REITs is the potential for regular income through dividends. The requirement for REITs to distribute a large portion of their income ensures that investors receive a consistent cash flow. This is especially appealing for individuals relying on investment income for living expenses or those planning for retirement. Many REITs have established a track record of increasing their dividend payouts over time, which can be a source of growth for your investment.

REITs provide liquidity that is not typically associated with direct real estate investments. Since they are publicly traded on the SGX, investors can buy and sell shares with relative ease. This feature contrasts sharply with the real estate market, where buying or selling a property can take weeks or even months. The ability to enter and exit positions quickly allows for greater flexibility in managing your investment portfolio.

REITs also offer diversification benefits. By investing in a portfolio of properties across different sectors—such as retail, commercial, industrial, and healthcare—REITs spread out the risk associated with real estate investments. This diversification can be particularly beneficial during economic downturns when certain property types may perform better than others.

Investing in REITs allows you to gain exposure to the real estate market without needing a substantial amount of capital. In Singapore, the minimum investment for a REIT can be significantly lower than purchasing a property outright, making it accessible to a broader range of investors. This aspect democratizes access to real estate investments, allowing more people to participate in the potential growth of the property market.

In addition to regular income, investors in REITs may benefit from capital appreciation. As the underlying properties increase in value, the shares of the REIT may also rise, providing investors with the potential for capital gains. While not guaranteed, many REITs have demonstrated strong performance over time, often aligning with the overall growth of the property market in Singapore.

Risks Involved with REIT Investments

While investing in REITs comes with numerous advantages, it is essential to be aware of the risks involved.

REIT prices can be subject to market fluctuations, influenced by various economic factors. If the broader stock market experiences a downturn, REITs may also see their prices decline, regardless of their underlying asset performance. Understanding market sentiment and economic indicators can help you navigate these fluctuations.

Economic downturns can affect occupancy rates and rental income, directly impacting a REIT's performance. For instance, if businesses are struggling during a recession, office occupancy rates may drop, leading to decreased rental income for office-focused REITs. Investors must consider the economic environment and its potential impact on the sectors in which a REIT operates.

REITs are particularly sensitive to interest rate changes. When interest rates rise, borrowing costs for REITs increase, which can reduce their profitability. Higher rates may also make fixed-income investments more attractive than REITs, leading to a decline in demand for REIT shares. Conversely, falling interest rates can stimulate demand for REITs as borrowing becomes cheaper and investors seek yield in a low-rate environment.

Different sectors have unique risk profiles. For example, retail REITs may face challenges from e-commerce growth, which could lead to declining foot traffic in physical stores. Conversely, industrial REITs may benefit from the growth of logistics and e-commerce, positioning them well for future demand. Understanding the specific dynamics of each sector is crucial when evaluating REIT investments.

The quality of a REIT's management team plays a critical role in its performance. A skilled management team can navigate market challenges, make strategic acquisitions, and effectively manage properties to maximize returns. Conversely, poor management can lead to operational inefficiencies and decreased profitability. When assessing a REIT, consider the track record and reputation of its management team.

Key Metrics to Evaluate REITs

To make informed investment decisions, it’s crucial to understand various metrics that indicate a REIT's performance. Here are some key metrics to consider:

Distribution Yield

The distribution yield is a critical metric representing the annual dividend payment relative to the share price. It is calculated by dividing the annual dividends paid per share by the current share price. A higher distribution yield typically indicates a more attractive income return for investors, but it’s essential to assess whether the yield is sustainable based on the REIT’s financial health.

Funds from Operations (FFO)

FFO is a measure that assesses a REIT's cash flow by adding depreciation and amortization back to earnings. This metric provides a clearer picture of a REIT's operating performance than net income, as it excludes non-cash items that can distort earnings. An increasing FFO can indicate a healthy, growing REIT.

Net Asset Value (NAV)

NAV represents the value of a REIT's total assets minus its liabilities. Comparing the market price to NAV can help investors gauge whether a REIT is undervalued or overvalued. If the market price is significantly lower than the NAV, it may signal a buying opportunity, while a price above NAV could indicate overvaluation.

Occupancy Rate

The occupancy rate measures the percentage of leased space within a property. A higher occupancy rate is generally a positive indicator, suggesting strong demand for the REIT’s properties. Monitoring changes in occupancy rates can provide insights into the performance and competitiveness of the REIT.

Debt-to-Equity Ratio

This ratio shows the proportion of debt used to finance a REIT's assets. A lower debt-to-equity ratio generally indicates less financial risk, while a higher ratio may suggest higher risk due to increased leverage. Understanding a REIT's capital structure is essential when assessing its risk profile.

Geographic and Sector Diversification

Analyzing the geographical spread of a REIT’s assets and the sectors in which it invests can help assess risk and growth potential. A well-diversified portfolio can be more resilient during economic downturns, while concentrated exposure to a specific sector or region can amplify risk.

Practical Steps to Invest in REITs in Singapore

To get started with investing in REITs, follow these steps:

Begin by researching REITs listed on the SGX. Utilize financial news websites, brokerage platforms, and REIT-specific analyses to gather information about different REITs, their performance metrics, and sector focus. Consider attending investment seminars or workshops to deepen your understanding.

Clearly define your investment objectives. Are you focused on income generation, capital appreciation, or a combination of both? Understanding your risk tolerance is equally crucial, as it will help you select the right REITs that align with your financial goals.

If you don’t already have a brokerage account, choose a reputable online brokerage that allows you to trade on the SGX. When selecting a platform, consider factors such as fees, user experience, and the availability of research tools. Some popular brokerage options in Singapore include DBS Vickers, OCBC Securities, and Saxo Markets.

As a beginner, consider starting with a small investment to gain familiarity with how REITs operate and monitor your investment performance over time. This approach allows you to assess your comfort level with market fluctuations and gain valuable experience without overexposing yourself financially.

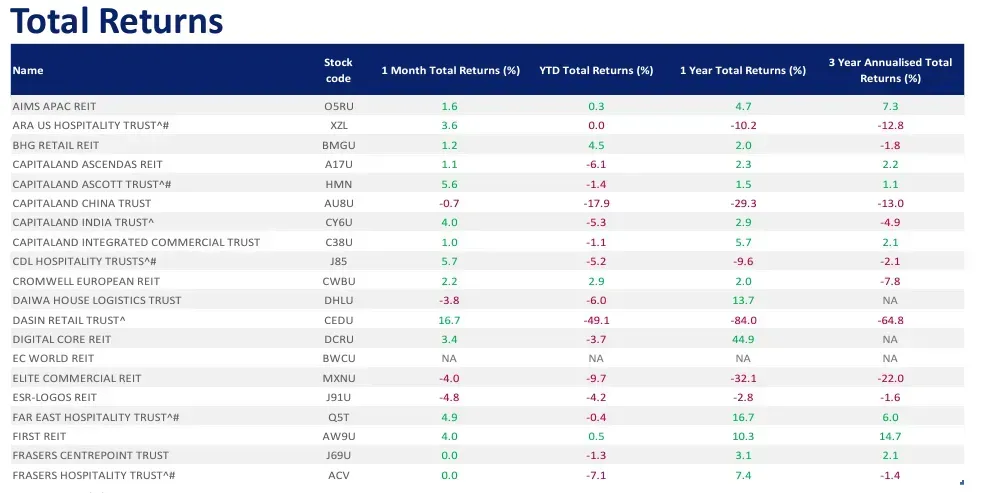

Source: SGX SREITs Chartbook Apr’24

Understanding REITs

At their core, REITs are companies that own, operate, or finance income-producing real estate. These trusts pool capital from multiple investors to acquire a diversified portfolio of properties, such as shopping malls, office buildings, industrial parks, and healthcare facilities. In Singapore, REITs are typically listed on the Singapore Exchange (SGX), which allows everyday investors to participate in the real estate market without the need to buy physical properties.

Additional Singapore Stocks Worth Watching

CapitaLand Investment is one of Singapore’s premier real estate players, boasting a portfolio that includes both commercial and residential assets. The company’s focus on developing sustainable real estate aligns well with Singapore’s green initiatives. CapitaLand’s growth is driven by its ongoing shift from traditional property development to asset management, which offers greater stability and higher returns.

When you invest in a REIT, you purchase shares, which grants you ownership in the underlying real estate assets. One of the most attractive features of REITs is that they are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This structure makes REITs appealing for those seeking regular income, particularly retirees or anyone looking to build a passive income stream.

The Benefits of Investing in REITs

Regular Income Generation: One of the most significant benefits of REITs is the potential for regular income through dividends. The requirement for REITs to distribute a large portion of their income ensures that investors receive a consistent cash flow. This is especially appealing for individuals relying on investment income for living expenses or those planning for retirement. Many REITs have established a track record of increasing their dividend payouts over time, which can be a source of growth for your investment.

REITs provide liquidity that is not typically associated with direct real estate investments. Since they are publicly traded on the SGX, investors can buy and sell shares with relative ease. This feature contrasts sharply with the real estate market, where buying or selling a property can take weeks or even months. The ability to enter and exit positions quickly allows for greater flexibility in managing your investment portfolio.

REITs also offer diversification benefits. By investing in a portfolio of properties across different sectors—such as retail, commercial, industrial, and healthcare—REITs spread out the risk associated with real estate investments. This diversification can be particularly beneficial during economic downturns when certain property types may perform better than others.

Investing in REITs allows you to gain exposure to the real estate market without needing a substantial amount of capital. In Singapore, the minimum investment for a REIT can be significantly lower than purchasing a property outright, making it accessible to a broader range of investors. This aspect democratizes access to real estate investments, allowing more people to participate in the potential growth of the property market.

In addition to regular income, investors in REITs may benefit from capital appreciation. As the underlying properties increase in value, the shares of the REIT may also rise, providing investors with the potential for capital gains. While not guaranteed, many REITs have demonstrated strong performance over time, often aligning with the overall growth of the property market in Singapore.

Practical Steps to Invest in REITs in Singapore

To get started with investing in REITs, follow these steps:

Begin by researching REITs listed on the SGX. Utilize financial news websites, brokerage platforms, and REIT-specific analyses to gather information about different REITs, their performance metrics, and sector focus. Consider attending investment seminars or workshops to deepen your understanding.

Clearly define your investment objectives. Are you focused on income generation, capital appreciation, or a combination of both? Understanding your risk tolerance is equally crucial, as it will help you select the right REITs that align with your financial goals.

If you don’t already have a brokerage account, choose a reputable online brokerage that allows you to trade on the SGX. When selecting a platform, consider factors such as fees, user experience, and the availability of research tools. Some popular brokerage options in Singapore include DBS Vickers, OCBC Securities, and Saxo Markets.

As a beginner, consider starting with a small investment to gain familiarity with how REITs operate and monitor your investment performance over time. This approach allows you to assess your comfort level with market fluctuations and gain valuable experience without overexposing yourself financially.

Keep a close eye on the performance of your REITs, as well as changes in market conditions, interest rates, and economic indicators. Regularly reassess your portfolio to ensure it aligns with your investment goals and make adjustments as necessary.

Continuous education is vital in the investment world. Stay informed about the property market in Singapore, economic developments, and trends affecting REITs. Follow industry news, subscribe to financial publications, and engage with fellow investors to enhance your knowledge and perspective.

Join investment groups or online forums where you can share insights and experiences with other investors. Networking can provide you with valuable perspectives and tips that may enhance your investment strategy.

Conclusion

Investing in REITs can be a rewarding strategy for Singaporeans looking to diversify their portfolios and generate passive income. By understanding the structure of REITs, weighing the benefits and risks, and evaluating key performance metrics, you can make informed investment decisions. With careful research and strategic planning, REITs can serve as a valuable addition to your investment journey in Singapore’s dynamic real estate market. As with any investment, it's essential to remain vigilant, adaptable, and committed to ongoing education to maximize your success in this arena.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com