COE Prices Drop Across All Categories

Declining Prices Across All Categories

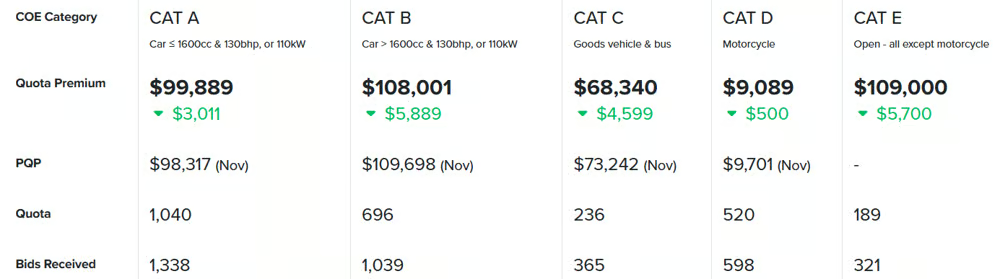

The Certificate of Entitlement (COE) prices for November 2024 have seen a notable dip across all categories in the first bidding exercise of the month. This marks the second consecutive decrease in premiums, signaling a shift in the market after a period of steady increases. As the COE premiums soften, the motor industry in Singapore has begun to assess the implications of this downward trend, especially in light of recent government announcements and changing market demand.

Cat A and Cat B: Price Drop Sparks Mixed Reactions

Category A, which includes cars up to 1600cc and electric vehicles (EVs) with up to 110kW, saw its COE premium fall by $3,011, closing at $99,889. This represents a significant shift from the $102,900 seen in the previous bidding round. The number of bids for Category A decreased by 10.7%, reflecting a decrease in demand, possibly due to the higher premiums in the past few months. While the lower price might seem appealing to some, many prospective buyers are still cautious, considering the premium to be too high for certain vehicle categories.

Category B, for larger cars and more powerful EVs, also experienced a price drop of $5,889, bringing the premium down to $108,001 from $113,890 in the previous exercise. The demand for Category B increased by 6.6%, likely driven by unfulfilled orders from The Car Expo held in October. Despite this uptick in demand, dealers expect that the reduced COE premiums are unlikely to trigger an immediate surge in showroom traffic. For Category B vehicles, the current gap between Cat A and Cat B COEs is at its narrowest in recent years, which might encourage buyers to shift towards larger, more powerful cars.

Categories C and D: Commercial and Motorcycle COEs See Lower Premiums

Category C, which covers goods vehicles and buses, saw the steepest decline in premiums, with the price falling by $4,599 to close at $68,340. This drop of 6.3% from the previous bidding round reflects a reduction in demand for commercial vehicles, which might be tied to the economic slowdown in the region. Similarly, Category D, which covers motorcycles, experienced a 5.2% reduction, closing at $9,089. This price decrease follows a general trend seen across the COE categories, but the market for motorcycles is not expected to experience drastic fluctuations in the near future.

Category E: Open Category Sees Consistent Price Reduction

For Category E, which is the open category that allows for any type of vehicle other than motorcycles, the premium fell by $5,700, closing at $109,000. While Category E premiums are typically associated with larger, more powerful cars, the latest dip continues the trend of declining prices seen across all categories.

Market Insights and Dealer Perspectives

Several industry experts believe that the decrease in COE premiums is partly due to the announcement of additional COEs by the Land Transport Authority (LTA). With 20,000 additional COEs to be made available over the next few years, the supply increase has led to a cooling of demand, particularly for smaller and less powerful vehicles in Category A. Dealers such as Ng Choon Wee, commercial director of Komoco Motors, predict that many potential buyers may continue to wait and observe market trends before committing to a purchase, as prices in Category A are still considered relatively high.

Further, dealers have noted that showroom traffic has been slow since the announcement of the additional COEs, which may be contributing to the overall reduction in bids. "We are seeing fewer customers willing to pay over $90,000 for Category A COEs," said Mr. Lee Hoe Lone, managing director of Premium Automobiles. This cautious approach could reflect uncertainty about future price trends, especially with the possibility of future COE allocations still unconfirmed.

Looking Ahead: The Future of COE Prices in Singapore

The November 2024 COE bidding results suggest a market that is recalibrating after the recent surge in prices. While the market has shown signs of cooling, experts caution that the lower premiums may not lead to an immediate surge in demand. As the final bidding exercise of the year approaches, the industry will be closely watching to see if the trend of lower premiums continues or if prices begin to rise again.

Some dealers, like Sabrina Sng from Wearnes Automotive, suggest that the launch of new models in Category A could stimulate demand, while others like Nicholas Wong from Kah Motor are hopeful that the decline in prices will continue. In particular, many expect that the final COE bidding of 2024 in December could see some upward pressure as dealers aim to clear inventory before the year ends.

As the bidding progressed, potential buyers and sellers alike will need to keep a close eye on the upcoming exercises and prepare for further fluctuations in the COE market.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com