China's Economic Challenges and Opportunities Ahead of 2025

The Current State of China's Economy: Challenges and Prospects as We Approach 2025

As we near 2025, China’s economy stands at a critical crossroads, marked by complex challenges and emerging opportunities. The transition from an economy defined by rapid growth and extensive industrialization to one that prioritizes sustainability, innovation, and consumer spending presents significant hurdles. Key factors influencing this landscape include demographic shifts, international relations, environmental challenges, and a re-evaluation of domestic policies.

Economic Growth Trends: The Impact of Global Factors

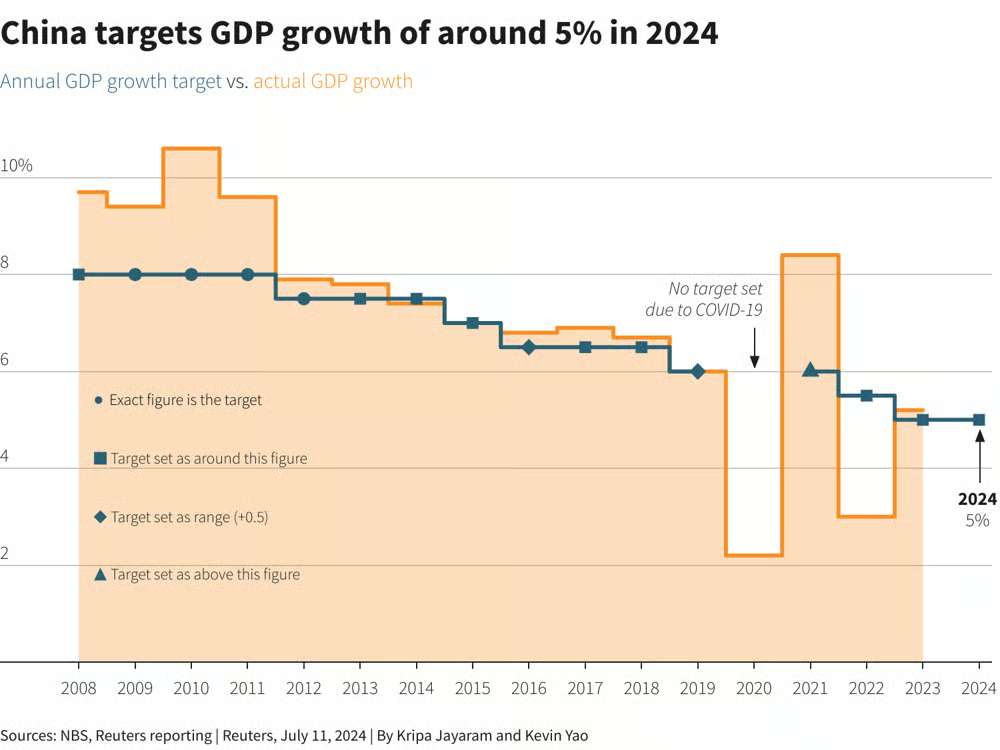

China's GDP growth has shown signs of moderation in recent years, with forecasts for 2024 and 2025 suggesting growth rates of approximately 4-5%. This slowdown indicates a strategic shift towards sustainable growth, reflecting the government’s desire for stability amidst rising challenges. The country's previous growth rates, often exceeding 6%, are unlikely to return, given the global economic landscape, which remains volatile due to geopolitical tensions and inflationary pressures. For instance, the ongoing effects of the pandemic, coupled with supply chain disruptions, have added complexity to China’s economic recovery.

Despite these headwinds, the Chinese government has committed to a growth target of around 5% for 2024, highlighting its focus on stabilizing the economy. The tension between achieving these targets and addressing the underlying structural issues, such as high debt levels and the need for economic reform, will be a delicate balancing act.

The Real Estate Market: Navigating the Crisis

China’s real estate market remains a pivotal issue, facing severe liquidity challenges and a significant crisis marked by defaults among major property developers. With real estate contributing nearly 29% of China’s GDP, the implications of this crisis are profound. The government has responded with measures such as easing mortgage lending restrictions and providing financial support to distressed developers, but the effectiveness of these interventions has been limited.

The long-term consequences of the real estate crisis could reshape urban planning and financial systems within China. As consumer confidence falters and many potential buyers delay purchases, the sector's recovery appears uncertain. This situation emphasizes the need for a shift towards affordable housing solutions and sustainable urban development strategies that address the needs of a changing population.

Shifts in Consumer Behavior: The Rise of Caution

Consumer behavior in China is evolving, influenced by the pandemic and economic uncertainty. The increased savings rate, which has hovered around 40%, reflects a shift towards financial prudence among households. This change has resulted in decreased growth in retail sales, particularly in sectors reliant on discretionary spending. As consumers prioritize essentials over luxury goods, businesses must adapt their strategies to align with these new spending patterns.

In response, the Chinese government has implemented policies aimed at stimulating domestic consumption, including tax reductions and incentives for local purchases. However, fostering a culture of consumption while managing household debt will be crucial for economic stability. The effectiveness of these policies will be instrumental in determining the trajectory of China's economic recovery as we approach 2025.

Export Challenges: Adapting to a Changing Global Landscape

China’s export sector, once a cornerstone of its economic success, is currently grappling with numerous challenges. A decrease in global demand, particularly from key trading partners, has led to a significant decline in exports. This situation is exacerbated by tariffs and trade barriers imposed by Western nations, further complicating the landscape for Chinese exporters.

To counteract these challenges, China is actively diversifying its trade relationships and seeking new markets in Southeast Asia, Africa, and Latin America. This shift aligns with the government's dual circulation strategy, which aims to strengthen domestic consumption while expanding international trade networks. However, the success of this approach will depend on China’s ability to navigate complex geopolitical landscapes and foster favorable trade conditions.

Technological Innovation: A Key Driver for Economic Growth

Amidst economic challenges, China’s commitment to technological innovation continues to shine as a beacon of potential growth. Significant government investments in sectors such as artificial intelligence, renewable energy, and advanced manufacturing aim to transition the economy from low-cost production to high-value innovation. The "Made in China 2025" initiative underscores this strategic focus, targeting the elevation of domestic industries and a reduction in dependence on foreign technology.

In light of recent international pressures and sanctions, the push for technological self-sufficiency has intensified. The intersection of technology and economic policy will play a critical role in shaping China’s economic landscape moving forward. However, fostering innovation while ensuring data security and privacy remains a challenge that requires careful navigation.

Demographic Changes: The Aging Population Challenge

One of the most pressing long-term challenges facing China is its rapidly aging population. With a declining birth rate and an increasing proportion of elderly citizens, the nation is at risk of experiencing workforce shortages and rising healthcare costs. This demographic shift threatens economic growth and social stability, prompting the government to reconsider policies related to family planning and workforce participation.

To address these challenges, the government is exploring various solutions, including financial incentives for families to have more children and initiatives to promote immigration. Additionally, adaptations in the labor market to accommodate older workers will be essential in mitigating the impacts of an aging population. The successful navigation of these demographic challenges will be crucial for maintaining economic momentum in the coming years.

Environmental Sustainability: Committing to a Green Future

As China seeks to balance economic growth with environmental sustainability, it faces the dual challenges of pollution and resource depletion. The government has set ambitious targets for carbon neutrality by 2060, requiring a significant transition to a greener economy. Investments in renewable energy, electric vehicles, and energy efficiency initiatives are central to this strategy.

However, achieving sustainability is fraught with challenges. Balancing economic growth with environmental protection necessitates comprehensive policy frameworks that address the interests of various stakeholders, including industries that may resist regulatory changes. The success of China’s environmental policies will be critical in determining its economic future as global climate change initiatives gain traction.

Financial Sector Stability: The Role of Reform

The stability of China’s financial sector is vital for the broader economy, particularly in light of the ongoing real estate crisis and rising debt levels. Recent regulatory reforms aim to strengthen the banking system, improve risk management, and enhance transparency. However, the financial sector faces significant challenges, including non-performing loans and the potential for systemic risks.

The government’s focus on financial stability is essential as it seeks to maintain investor confidence and ensure sustainable economic growth. Strengthening regulatory frameworks and promoting prudent lending practices will be crucial in fostering a resilient financial environment.

Global Economic Integration: China's Position in the World Economy

As global economic dynamics continue to evolve, China’s position on the world stage remains pivotal. The country’s efforts to strengthen economic ties through initiatives such as the Belt and Road Initiative reflect its ambition to play a leading role in shaping global trade and investment patterns. By enhancing infrastructure connectivity and fostering economic cooperation with partner countries, China aims to create new opportunities for growth.

However, the effectiveness of these initiatives will depend on the geopolitical landscape and the ability to navigate tensions with major economies. The delicate balance of fostering international collaboration while addressing domestic concerns will be a key factor in determining China’s economic future.

Conclusion: Charting a Course for the Future

As we approach 2025, China’s economy is navigating a multifaceted landscape defined by both challenges and opportunities. The interplay of economic growth trends, real estate instability, shifting consumer behaviors, export challenges, technological innovation, demographic shifts, environmental sustainability, financial stability, and global economic integration will shape the country’s economic trajectory in the coming years.

While the government is actively pursuing policies to foster a more sustainable and resilient economy, the success of these initiatives hinges on its capacity to address structural issues and adapt to changing global dynamics. As China continues to evolve, its economic landscape will remain a focal point for observers worldwide, influencing not only its citizens but also the broader global economy. The ability to transform current challenges into opportunities will be crucial in ensuring that China’s economic future is both prosperous and sustainable.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com