Canadian Dollar Slumps as Job Market Weakens and Rate Cut Bets Surge

Falling Yields and Job Market Fears Signal New Challenges

The Canadian dollar (CAD) is currently facing a period of heightened volatility as bond yields slide, labor market conditions deteriorate, and markets increase their bets on aggressive monetary policy shifts by the Bank of Canada. Recent developments suggest that Canada is navigating a delicate economic path, and the Loonie's decline reflects investor fears over internal challenges, U.S.-Canada yield spreads, and global macroeconomic pressures.

This downturn for the CAD, driven by a mix of employment concerns, falling bond yields, and market speculation regarding interest rate cuts, has wider implications for Canada's economic recovery and its dependence on commodity exports, particularly oil. Adding complexity to this situation is the potential influence of G7 nations and their approach toward managing global energy markets.

Canadian Dollar Faces Market Pressure

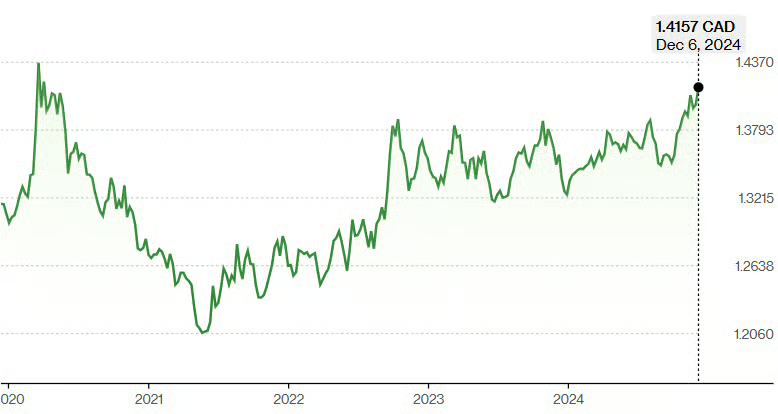

The Canadian dollar fell 1% against its U.S. counterpart, trading at approximately C$1.4165 on Friday. This represents its lowest level since April 2020 and places it on the cusp of its weakest level this year. The sharp drop reflects market expectations for a significant monetary easing by the Bank of Canada (BoC) as economic growth weakens and employment figures highlight emerging challenges in the labor market.

Bond yields, often a key driver of currency strength, are also contributing to the CAD’s struggles. Canadian two-year government bond yields fell 15 basis points to 2.89%, marking their lowest level since September. These bond movements underscore a sharp market pivot as expectations of a half-percentage rate cut by the BoC have grown, with a near 80% likelihood assigned to such a reduction as of the latest trading activity. This follows recent labor market trends suggesting continued economic weakness.

The expectation of a rate cut is now supported by widespread market sentiment, with major Canadian banks such as Scotiabank and Bank of Montreal aligning with predictions of a 50-basis-point reduction. This would bring borrowing costs down to 3.25%, a significant shift given the prior policy stance intended to combat inflation. The interest rate cut would aim to stimulate the economy by making borrowing cheaper, but it also reflects investor concerns that the BoC could be prioritizing short-term economic growth over inflationary pressures.

Labor Market Woes Highlight Weakness in the Canadian Economy

Canada’s labor market data have intensified fears about economic growth and stability. Although Canada saw the addition of 51,000 new jobs in November, this figure masks a troubling trend: the unemployment rate climbed to 6.8%, its highest level since 2021. This suggests that while new jobs were created, they are insufficient to offset the growing pool of unemployed individuals, particularly among long-term job seekers.

Sarah Ying, head of currency strategy at CIBC Capital Markets, noted that these labor market trends point to the likelihood of continued economic challenges. The rise in unemployment coupled with the drop in labor market participation highlights potential structural changes within the Canadian economy. Some analysts argue that the BoC could respond by implementing more accommodative monetary policies to combat these pressures, as tightening financial conditions could exacerbate the situation further.

The widening gap between jobs created and the rising unemployment rate could also signal sectoral shifts, particularly away from cyclical industries reliant on manufacturing or commodity exports. This has led to some economists fearing a prolonged downturn for Canada if the structural issues in the labor market are not addressed.

Market Sentiment and Bond Spread Disparity Driving Investor Caution

Investor confidence has taken a hit in light of the rising unemployment rate and falling bond yields. Traders are amassing significant short positions against the Canadian dollar, with recent figures suggesting about 159,000 Loonie contracts—equivalent to $11.3 billion—held by speculative traders betting against its recovery. This bearish positioning reflects concerns that the Canadian economy will likely remain under pressure in the near term due to weaker growth and monetary easing.

Additionally, the spread between U.S. and Canadian government bond yields has grown to 120 basis points, the most since 1997. U.S. Treasuries are yielding significantly more than their Canadian counterparts, reflecting investor preferences for perceived economic strength in the U.S. compared to Canada. This U.S.-Canada yield spread suggests a fundamental lack of confidence in Canadian growth prospects amid persistent inflationary risks and the pressures of labor market challenges.

Such disparities in bond yields have only exacerbated market sentiment against the CAD, driving its recent volatility. This trend highlights that Canadian bond yields continue to lag behind their U.S. peers due to slower economic growth expectations and investor concerns about prolonged periods of monetary easing.

Oil Market Pressures: Is the G7 Manipulating the CAD through Global Energy Strategies?

Canada’s economic fortunes are intrinsically tied to oil markets. Oil exports represent a significant driver of the Canadian economy, with Western Canadian Select (WCS) oil prices and global trends impacting the CAD directly. Recent data suggests that oil prices are trending downward, driven by fears of slowing global demand, geopolitical uncertainties, and monetary tightening by other major economies.

This opens the door to speculation that major G7 nations might be indirectly pressuring the Canadian dollar to maintain oil prices at lower levels. With oil being a major input for global inflation, a weaker CAD could ease energy costs worldwide by reducing Canada’s export price competitiveness. While speculative, this dynamic could weigh on CAD performance in the medium term, as it could lead to lower revenues for Canadian oil exporters, thereby impacting the loonie’s valuation.

The CAD has historically performed as a commodity-linked currency, and its fortunes often fluctuate in response to global oil market dynamics. However, this dual reliance on global commodity trends and domestic monetary policies leaves it vulnerable to both internal challenges (such as labor market weakness and monetary easing) and external forces (like coordinated G7 economic strategies aimed at curbing oil market volatility).

Outlook: Is the CAD Poised for Further Weakness or Stabilization?

Looking forward, the Canadian dollar faces a bumpy road ahead. A combination of labor market pressures, falling bond yields, expectations of rate cuts, and geopolitical pressures surrounding oil prices suggests that the CAD could face continued headwinds. While short-term monetary easing could help stabilize economic activity, it risks further weakening the currency by reducing investor confidence in Canada’s inflation-fighting ability.

For investors and policymakers, the key question will be whether the Bank of Canada can balance short-term economic pressures with its long-term inflationary targets. A rate cut might provide temporary relief, but as inflation trends remain unpredictable, confidence in monetary stability could be fragile. Additionally, structural labor market weaknesses could exacerbate these challenges unless addressed by proactive economic reforms.

The coming weeks will be pivotal. The BoC’s next policy move on December 11 will likely set the tone for Canadian monetary policy in the near term. Investors will keep a close watch on the decision, the spread between Canadian and U.S. bond yields, and commodity price trends, particularly oil, to gauge whether this recent CAD volatility will continue or begin to reverse.

For now, the Canadian dollar appears on the precipice of further weakness, shaped by investor bets, monetary expectations, and internal labor market stress. Canada’s ability to weather these headwinds will determine whether the CAD can regain stability in the long term or if the challenges will persist into 2024.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com