Bitcoin or MicroStrategy: Which Is the Better Investment?

Bitcoin or MicroStrategy: Which Is the Better Investment?

After a remarkable post-election surge, Bitcoin (BTC) has reached new all-time highs, nearing the $100,000 milestone for the first time. The cryptocurrency has surged 110% year-to-date, drawing attention from both seasoned and new investors alike.

But there’s a crypto stock outperforming even Bitcoin this year: MicroStrategy (MSTR). With a staggering 462% gain in 2024, MicroStrategy’s aggressive Bitcoin acquisition strategy is paying off big. The question is, which is the smarter investment right now?

MicroStrategy’s Bold Bitcoin Strategy

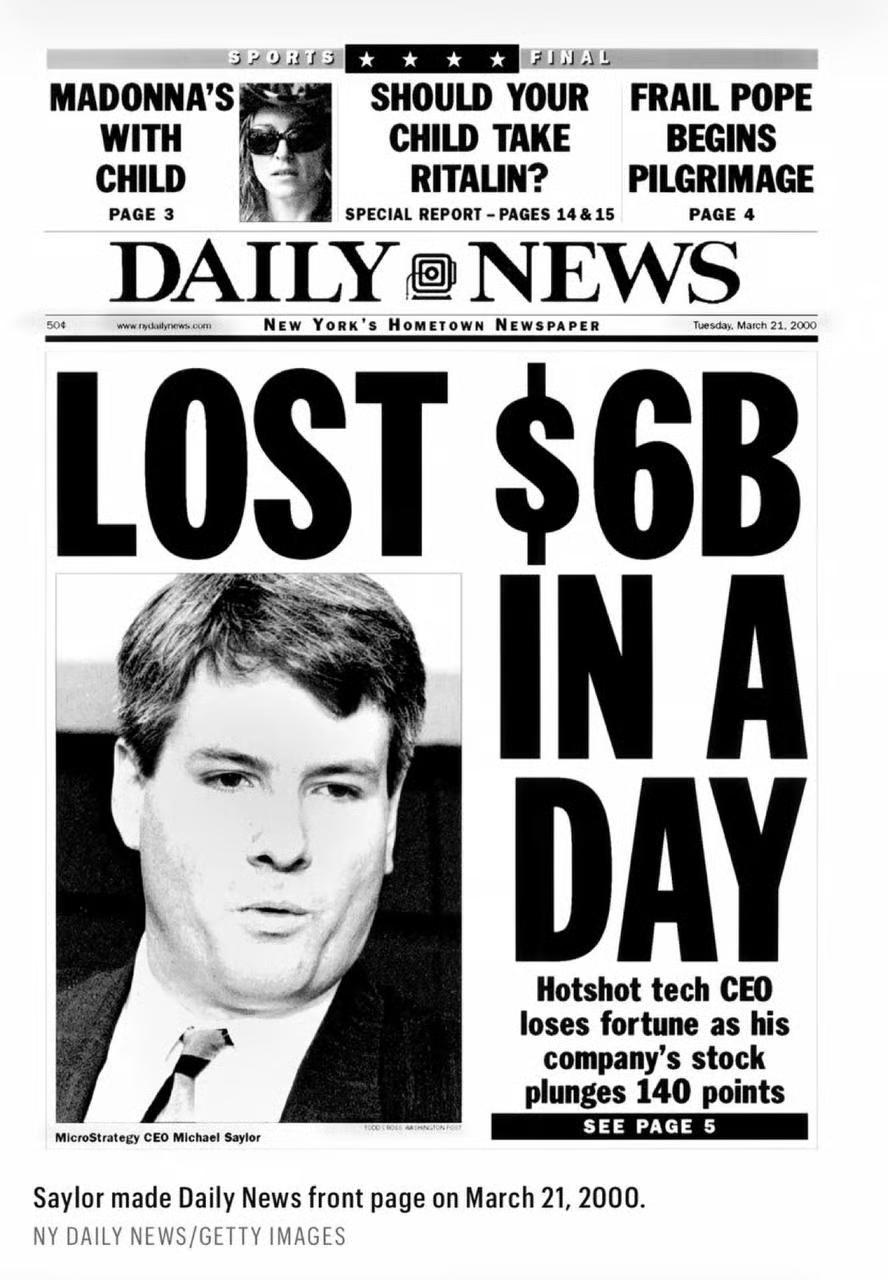

MicroStrategy has undergone a massive transformation since 2020 when it became the first publicly traded company to adopt Bitcoin as a core component of its capital allocation strategy. Fast forward four years, and the company has amassed a whopping 331,200 bitcoins, valued at approximately $30 billion at current market rates. To put that into perspective, its Bitcoin holdings surpass the cash reserves of major corporations like Nike and IBM.

The company’s buying spree has been relentless. Between October 31 and November 17, it acquired over 78,000 bitcoins, and it has plans to add $42 billion worth of Bitcoin over the next three years. MicroStrategy even describes itself as a “Bitcoin Treasury Company,” measuring success with a new performance metric: Bitcoin Yield. Essentially, the company is positioning itself to outpace Bitcoin’s growth.

The Risks of MicroStrategy’s Strategy

Before spot Bitcoin ETFs launched earlier this year, investors often bought MicroStrategy as a proxy for Bitcoin exposure. However, with ETFs providing direct access to Bitcoin, MicroStrategy has had to differentiate itself by doubling down on its Bitcoin strategy, even leveraging debt to fund purchases.

While the returns have been phenomenal—placing MicroStrategy among the top-performing stocks of 2024—this aggressive strategy isn’t without risks. Critics have raised concerns about the assumption that Bitcoin’s price will always rise. Bitcoin is known for its volatility, and a sharp price drop could significantly impact MicroStrategy’s heavily leveraged balance sheet.

Bitcoin’s Cyclical Nature

Bitcoin’s price tends to follow a four-year halving cycle, creating periods where ecosystem companies outperform or underperform the cryptocurrency. For example, in 2023, Bitcoin mining stocks like Riot Platforms (RIOT) outshined Bitcoin with gains of up to 455%. However, the narrative flipped in 2024, with Riot down more than 20% while Bitcoin surged 110%.

Over the long term, Bitcoin remains a reliable choice for buy-and-hold investors. It allows investors to avoid the complexities of navigating market cycles or evaluating company strategies. While MicroStrategy’s bold moves are impressive, they come with considerable risks tied to Bitcoin’s price fluctuations.

The Verdict: Bitcoin vs. MicroStrategy

For long-term investors looking for simplicity and stability, Bitcoin remains the better choice. Its proven track record and dominance in the cryptocurrency market make it a solid asset to hold through market cycles. MicroStrategy’s performance, while spectacular, carries higher risk due to its leveraged strategy and dependence on Bitcoin’s price.

While MicroStrategy’s strategy might appeal to those seeking amplified returns, it’s essential to weigh the risks of investing in a company with such concentrated exposure to a volatile asset. For most investors, the straightforward approach of owning Bitcoin directly may be the more prudent option.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com