Big Tech’s pulls market down: High Hopes, Higher Costs

Big Tech’s AI Investment Push: High Hopes, Higher Costs

In a bid to keep up with soaring AI demand, major tech players like Microsoft and Meta are ramping up spending on AI data centers. Both companies recently disclosed increased capital expenditures, driven by AI infrastructure needs, with Google echoing similar intentions. Meanwhile, Amazon, set to release its quarterly report, is anticipated to mirror these projections.

This massive AI investment spree comes at a cost, putting pressure on profit margins—a trend that has caught Wall Street’s attention and impacted Big Tech stock performance. Despite strong quarterly earnings, Meta shares dipped by over 3%, Microsoft by 6%, and Amazon saw a 3% drop. Analysts note that sustaining and scaling AI capabilities is costly, with GlobalData’s Beatriz Valle explaining, “Getting capacity is expensive, and it’s now a race among tech giants.”

Microsoft’s capital spending surged by 5.3% to $20 billion this past quarter, marking a significant jump compared to pre-2020 spending. Meta also forecasts “significant acceleration” in AI-related expenses in the coming year, while Microsoft cautioned about potential capacity constraints at its Azure cloud business, which could slow growth.

The tech sector is grappling with bottlenecks, as AI chip demand outpaces supply. Nvidia and AMD report challenges in meeting AI chip orders, potentially limiting data center expansion. Yet, industry leaders like Meta CEO Mark Zuckerberg remain optimistic, drawing parallels to the early days of cloud computing. He stated, “Building out the infrastructure may not be what investors want to hear, but the opportunities are vast.”

As Big Tech navigates this balancing act between aggressive AI ambitions and investor expectations, they emphasize the long-term value AI investments are likely to deliver.

Wall Street sees declines amidst earnings reports

Wall Street saw declines on Thursday after Microsoft and Meta warned of mounting AI costs, dampening enthusiasm for major tech stocks that have driven much of this year’s market growth. Despite both companies surpassing earnings expectations, Meta shares fell by 2.8% and Microsoft’s dropped by 5.1% following Wednesday’s post-bell reports.

The 10-year Treasury yield also ticked up, now above 4.3%, adding pressure on equities. Additionally, the Fed’s preferred inflation metric, the Personal Consumption Expenditures (PCE) price index, increased by 0.2% in September, aligning with expectations. However, core PCE came in at 2.7%, slightly above forecasts, and consumer spending rose more than anticipated.

“Investors are focusing more on Microsoft and Meta’s earnings than the latest economic data,” noted Peter Cardillo, chief market economist at Spartan Capital Securities. He added that the inflation numbers may increase the Fed’s likelihood of holding off on rate cuts next week, potentially fueling mid-term investor concerns.

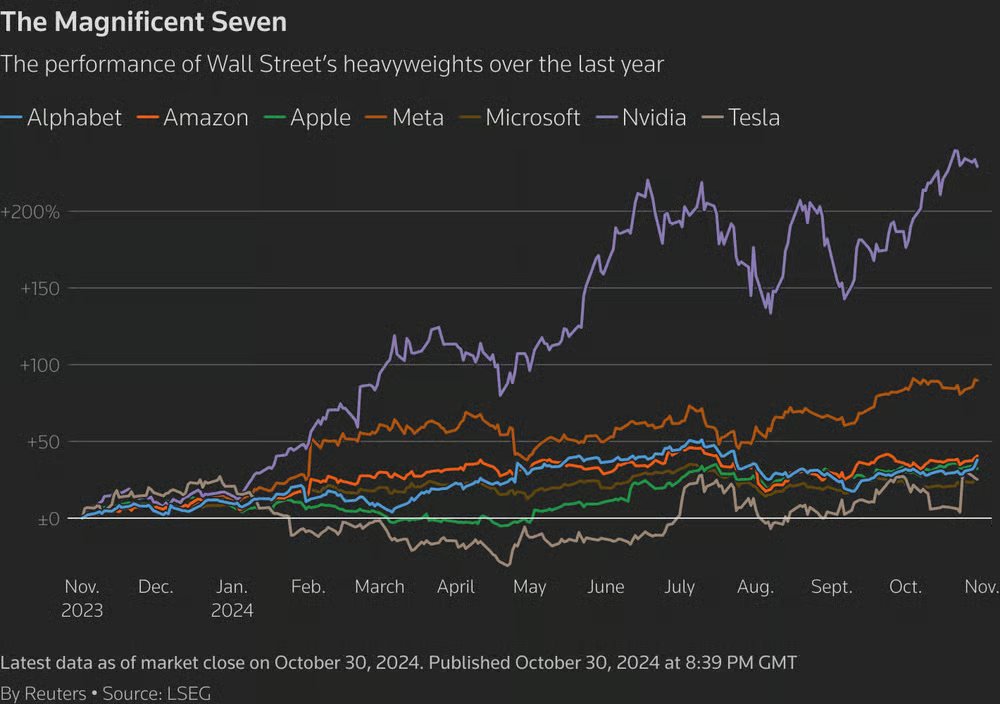

Ahead of Friday’s nonfarm payroll data, unemployment claims dropped to 216,000 last week. Both Microsoft and Meta revealed that rising capital expenditures due to AI investment could impact profitability, leaving investors wary as they look for quicker returns. The tech-heavy “Magnificent Seven” stocks also slipped; Nvidia lost 2.8%, Amazon fell by 1.7%, and Apple dipped by 0.4% ahead of its own upcoming earnings report.

Despite AI-related bets propelling the market to record highs earlier this year, lofty valuations have tempered investor optimism. Meta and Microsoft’s forecasts highlighted the challenges tech companies face in meeting growth and profitability expectations. As a result, the Dow Jones fell 184.51 points (0.44%), the S&P 500 dropped 50.05 points (0.86%), and the Nasdaq Composite lost 261.19 points (1.40%).

Despite new data, traders remain confident in the Fed’s likely rate cuts in November and December. The tech sector dropped by 2.1%, while strong results from ConocoPhillips lifted the energy sector by 1%. This week’s declines placed the S&P 500 into negative territory for October, while the Nasdaq showed slight gains. The Dow, meanwhile, appeared poised for over a 1% loss. The VIX rose to a three-week high as investors brace for further volatility from corporate earnings, the U.S. presidential election, and the Fed’s November meeting.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2026 RealisedGains | All Rights Reserved | www.realisedgains.com