5 Essential Insurance Policies for Financial Security in Singapore

Navigating the insurance landscape in Singapore can feel overwhelming, especially with the numerous policies available. The key to building a comprehensive financial safety net lies in understanding which insurance policies are essential for protecting yourself and your loved ones. In this guide, we’ll delve deeper into the five crucial types of insurance you should consider: health insurance, disability insurance, critical illness coverage, life insurance, and personal accident plans.

We’ll also include insights from current research and common trends in the insurance industry, especially in the Singaporean context, to give you a clearer understanding of what each policy covers and why they are necessary.

Why Insurance Matters in Singapore

Singapore is known for its high cost of living, and this extends to healthcare and unforeseen financial emergencies. While the government provides basic healthcare coverage through programs like MediShield Life, this coverage may not be sufficient for certain private healthcare needs or other financial crises. Insurance policies are designed to bridge these gaps, offering security and peace of mind in times of illness, accidents, or loss of life.

Without proper coverage, a single unexpected event can result in substantial financial hardship. The importance of these five policies is not just about ticking a box of responsibility but about ensuring that you and your family are safeguarded from life’s uncertainties.

Health Insurance: The Foundation of Financial Protection

Health insurance covers medical expenses that arise from illness or injury. In Singapore, every citizen and permanent resident is automatically covered under MediShield Life, a basic health insurance plan that offers coverage for large hospital bills and specific outpatient treatments.

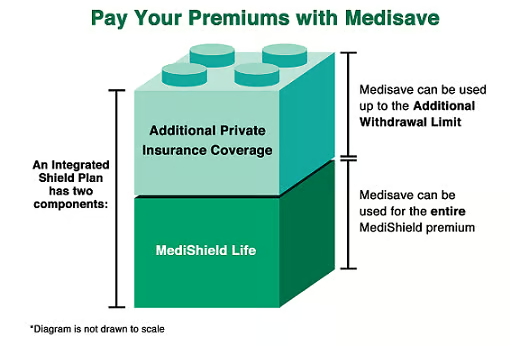

However, many Singaporeans choose to supplement MediShield Life with an Integrated Shield Plan (IP), a private insurance policy that covers hospital stays in private hospitals or higher-class wards in public hospitals. An IP is critical for those who prefer private healthcare or wish to have greater flexibility in choosing healthcare providers.

Why You Need It:

Healthcare costs can be incredibly high, especially when it involves serious illnesses or long hospital stays. MediShield Life is designed to cover basic needs, but it doesn’t fully cover private hospital stays or treatments. If you prefer treatment at a private hospital or want to stay in a more comfortable ward (e.g., A or B1), an IP can significantly reduce your out-of-pocket expenses.

Additionally, many Singaporeans opt to add riders to their IPs. A rider can reduce the out-of-pocket amount, lowering the co-pay from 20% to just 5% or even eliminating it. This means that if you face a serious medical condition, you can avoid hefty upfront payments.

Recent Trends in Health Insurance:

According to recent trends, many Singaporeans have been purchasing health insurance earlier in life, sometimes in their early 20s or even late teens. This is because younger individuals typically get better premium rates and coverage before developing any health conditions. There is also an increasing interest in health insurance plans that cover mental health treatments, recognizing the rising mental health concerns in today's society.

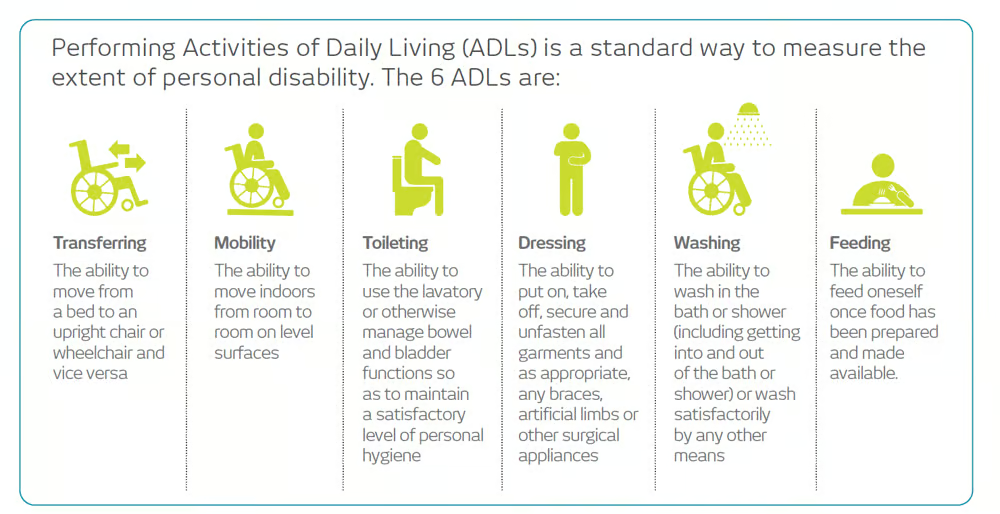

Disability Insurance: Replacing Lost Income

Disability insurance replaces a portion of your income if you are unable to work due to a disability. This insurance is particularly relevant for those whose income depends on their physical capabilities, such as athletes, performers, or even those in physical labor industries.

Why You Need It:

While you may already have health insurance to cover medical bills, disability insurance ensures that you continue to receive a steady income if you are physically unable to work. The loss of income during such periods can lead to long-term financial difficulties, and having disability insurance can bridge that gap.

Disability insurance usually covers around 70-75% of your monthly income, which is generally sufficient to meet your day-to-day living expenses. For instance, if you earn SGD 5,000 monthly, disability insurance would provide you with about SGD 3,500 per month if you are unable to work.

Recent Trends in Disability Insurance:

There has been a growing awareness among Singaporeans about the need for disability insurance, particularly among freelancers and gig economy workers who do not have employer-sponsored benefits. Given the rise of flexible working arrangements, many individuals are now seeking disability insurance to cover the financial uncertainties that come with self-employment.

Critical Illness Insurance: Safeguarding Against Severe Health Issues

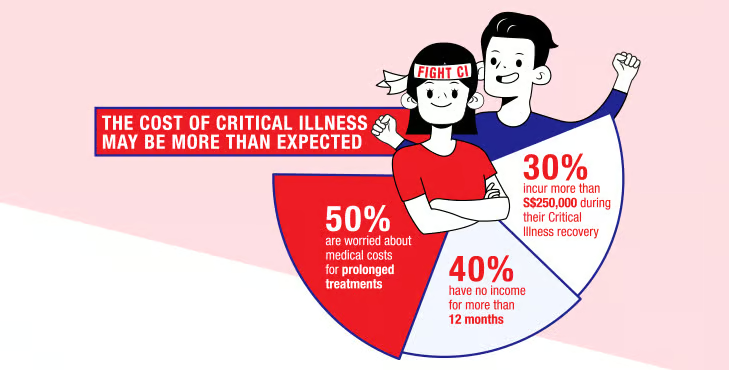

Critical illness insurance provides a lump sum payout upon diagnosis of a severe illness such as cancer, heart attack, stroke, or organ failure. The payout is designed to help cover any non-medical costs associated with long-term recovery or ongoing treatment.

Why You Need It:

A diagnosis of a critical illness can be financially devastating. Not only do these conditions often require expensive treatments, but they may also render you unable to work for extended periods. A lump-sum payout can help cover a wide range of expenses, including medical bills, rehabilitation, or even alternative therapies.

Many policies offer coverage that extends beyond the major critical illnesses, including early-stage cancers or less severe heart conditions, which may still require costly treatments and affect your ability to work.

According to industry experts, the recommended coverage amount is usually 5 to 7 years of your annual income. This ensures you have enough time to focus on recovery without worrying about your financial obligations.

Recent Trends in Critical Illness Insurance: In recent years, there has been a rise in the purchase of multi-claim critical illness plans, which allow multiple claims for different conditions. This is particularly important given that individuals who suffer from one critical illness often face a higher risk of developing other conditions in the future.

Life Insurance: Providing for Your Loved Ones

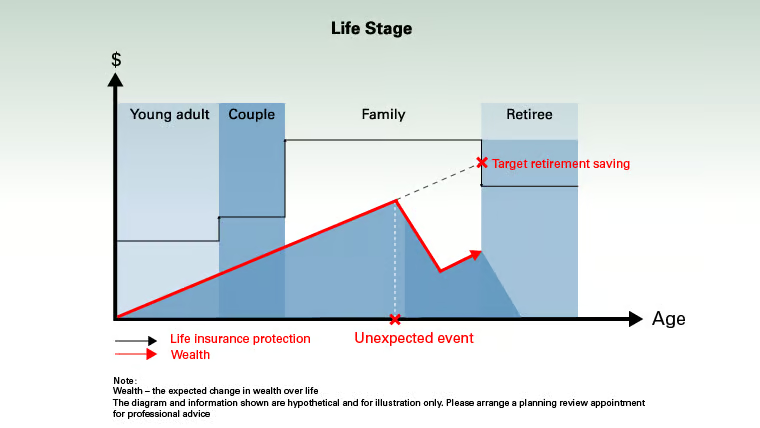

Life insurance provides financial protection for your family in the event of your death. In Singapore, life insurance policies also often cover Total Permanent Disability (TPD), which includes situations such as becoming permanently incapacitated or losing the ability to perform key functions.

There are two main types of life insurance: term life and whole life. Term life insurance covers you for a specific period, while whole life insurance offers lifelong protection and usually includes an investment or savings component.

Why You Need It:

Life insurance is essential for those with dependents. Whether you have children, a spouse, or elderly parents relying on your income, life insurance ensures that they can maintain their standard of living even if you are no longer there to provide for them. The payout from a life insurance policy can help cover living expenses, education costs, or even pay off outstanding loans such as a mortgage.

Experts recommend purchasing enough life insurance coverage to replace 5 to 10 years of your income, depending on your family’s needs and lifestyle. This gives your dependents ample time to adjust and recover financially.

Recent Trends in Life Insurance:

Term life insurance has seen growing popularity in Singapore due to its affordability and straightforward nature. Many Singaporeans prefer to combine term life insurance with other investment vehicles, opting for cheaper premiums and directing their savings towards higher-yield investments.

Personal Accident Insurance: Extra Coverage for the Unexpected

Personal accident insurance provides a payout if you are injured or disabled due to an accident. It also covers medical expenses related to accidents and often offers additional benefits such as hospitalisation income and payouts for permanent disabilities or accidental death.

Why You Need It:

While other types of insurance cover specific areas like health or income loss, personal accident insurance focuses on accidents. This is particularly important if you lead an active lifestyle or engage in outdoor activities where accidents are more likely to occur.

Personal accident insurance is typically affordable, with premiums as low as SGD 20-30 per month, making it an easy addition to your overall insurance portfolio.

Recent Trends in Personal Accident Insurance:

In response to increasing health concerns, many insurers have started bundling personal accident insurance with infectious disease coverage. This includes protection against illnesses like dengue fever and HFMD, which are common in tropical climates like Singapore.

Choosing the Right Insurance for Your Needs

Choosing the right insurance depends on your lifestyle, financial goals, and risk tolerance. When reviewing policies, it’s crucial to assess your individual needs and budget. Talking to a financial advisor can also help you understand how different policies complement each other, ensuring you are neither underinsured nor overinsured.

Conclusion

Insurance is a critical part of a solid financial plan, especially in Singapore where healthcare and living costs are high. By understanding the importance of health, disability, critical illness, life, and personal accident insurance, you can ensure that you and your loved ones are protected from life’s uncertainties.

Regularly reviewing your policies and adjusting them as your life circumstances change will help you maintain the right level of coverage. With the right insurance in place, you can focus on building a secure and prosperous future for yourself and your family.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com