10 Essential Steps to Avoid Debt and Secure Financial Health in Singapore

Managing personal finances effectively is crucial, especially in a vibrant economic hub like Singapore. With its high cost of living and competitive financial landscape, residents must be proactive in avoiding the pitfalls of debt. The age-old adage "prevention is better than cure" resonates deeply in this context, particularly concerning credit management. Many Singaporeans find themselves trapped in a cycle of debt due to impulsive spending or significant one-time purchases, making it essential to cultivate good financial habits.

Understanding the Credit Trap

The credit trap refers to a situation where individuals accumulate debt primarily through credit cards and loans without a clear plan for repayment. In Singapore, the allure of easy credit and enticing promotional offers can lead many to overlook the long-term consequences of their borrowing habits. The key to avoiding this trap lies in understanding the root causes of debt accumulation and developing strategies to mitigate financial risk.

The Easier Path: Prevention Over Cure

As with health, financial well-being is best achieved through prevention. By instilling discipline in your financial habits and saving for emergencies, you can protect yourself from falling into the credit trap. The following ten strategies are actionable steps to help you maintain a healthier financial profile in Singapore.

1. Assess Your Loan Servicing Capacity

Before committing to any loan, it's vital to evaluate your financial situation comprehensively. In Singapore, a prudent approach is to ensure that your total annual debt payments do not exceed 35-45% of your take-home pay. Additionally, the percentage of income allocated to non-mortgage debts should remain under 20%. Regularly reviewing your cash flow, income, and expenditure can help you avoid overcommitting and ensure financial stability in the long run.

Maintaining a healthy debt-to-income ratio is essential for financial health and can significantly impact your ability to secure future loans. Tools like the Debt-to-Income (DTI) ratio calculator can help you assess your situation effectively.

2. Choose the Right Type of Loan

Selecting the appropriate loan type can drastically reduce the amount of interest you pay. In Singapore, education loans typically have lower interest rates than credit cards. If you plan to finance your studies, explore government-subsidized education loans or options offered by reputable banks.

Similarly, if you need funds for renovations, specialized renovation loans may offer better terms than credit card financing. Understanding the benefits of your credit cards is also crucial; opt for cards that align with your spending habits, whether for travel, groceries, or cashback, and use them strategically to maximize benefits without accruing unnecessary debt.

3. Commit to Full Payment of Credit Card Bills

Credit cards in Singapore usually carry interest rates of 24-26% annually. Therefore, always aim to pay your credit card bills in full and on time. This practice not only helps you avoid interest and late fees but also allows you to benefit from cashback and reward programs. Paying only the minimum can lead to years of debt and increasing balances due to daily compounding interest.

Late payments and defaults have risen, highlighting the need for diligence in managing credit card repayments. By paying your balance in full, you can effectively manage your finances and avoid the stress associated with accumulating debt.

4. Consider Loans with Lower Rates

If you find yourself struggling with high-interest credit card debt, consolidating your debt through a personal loan with a lower interest rate is worth considering. Many financial institutions in Singapore offer personal loans at competitive rates, often much lower than credit card interest rates. This option allows you to simplify your repayments and reduce overall interest payments.

By paying off your credit card balances with a personal loan, you can alleviate financial pressure. Research shows that consumers who consolidate their debts often experience improved financial health and reduced stress levels. Be sure to read the fine print on loan agreements to avoid hidden fees or unfavorable terms.

5. Set Up Payment Alerts

Utilizing technology to your advantage can significantly enhance your financial management. Set up payment alerts through your bank's mobile app or online banking platform to remind you of upcoming due dates. Many banks in Singapore offer automatic payment features, allowing you to schedule payments and avoid late fees. This proactive approach is especially beneficial for those managing multiple accounts and helps you stay organized.

Many consumers still rely on manual payment methods, which increases the risk of late payments. By automating your payments and receiving reminders, you can ensure timely transactions and maintain a positive credit history.

6. Reduce Your Credit Limit

If you find it challenging to control spending, consider lowering your credit card limit. Request your credit card issuer to set your limit to a more manageable amount, such as one month’s salary. This restriction can help curb impulsive purchases and instill better spending habits. If you need to make a large purchase, you can always request a temporary limit increase, allowing for flexibility while maintaining control.

Consumers with lower credit limits are less likely to accumulate excessive debt. This strategy can also encourage you to live within your means, which is a fundamental principle of sound financial management.

7. Build an Emergency Fund

Establishing an emergency fund is a cornerstone of sound financial planning. Aim to save at least three to six months' worth of living expenses. Start small by saving a percentage of your income each month, gradually increasing your contributions as your financial situation improves. This safety net will provide peace of mind and protect you from relying on credit during unexpected financial challenges.

The importance of having an emergency fund cannot be overstated. A significant number of residents lack sufficient emergency savings, emphasizing the need for financial literacy and proactive planning. By creating an emergency fund, you can reduce the likelihood of falling into debt during unforeseen circumstances, such as medical emergencies or job loss.

8. Review Your Lifestyle Choices

Evaluate your lifestyle and spending habits regularly. Small changes can lead to significant savings over time. For example, consider using public transport instead of taxis or limiting dining out to special occasions. Be conscious of how you use credit facilities; they should not be viewed as a means to finance a lifestyle that exceeds your income. Living within your means is crucial for achieving long-term financial health.

With the rising cost of living in Singapore, managing discretionary spending is more important than ever. By reassessing your lifestyle choices, you can identify areas where you can cut back and redirect those funds toward savings or debt repayment.

9. Invest in Insurance

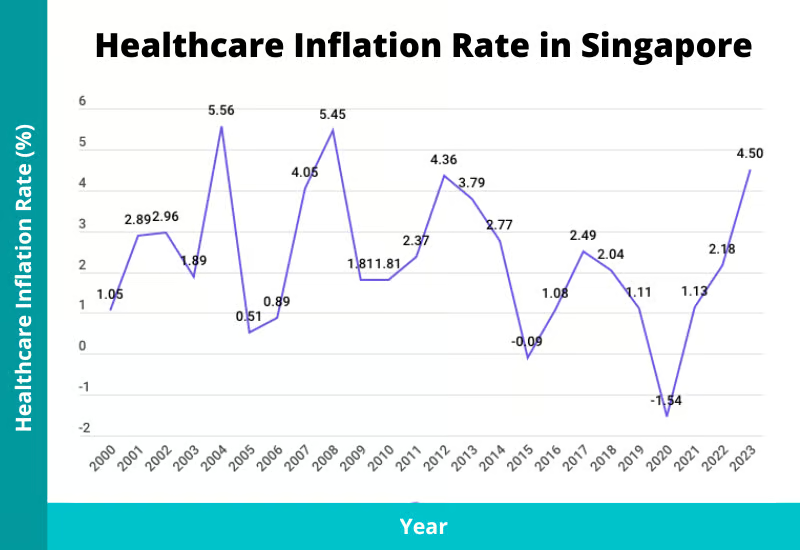

Adequate insurance coverage can help mitigate unexpected financial burdens, particularly in the face of medical emergencies. In Singapore, healthcare costs can be high, and many individuals face financial strain due to unforeseen medical expenses. Review your insurance policies regularly to ensure they align with your current needs, and consider supplemental plans to enhance your coverage.

A substantial number of residents are underinsured, which can lead to financial difficulties during health crises. By investing in comprehensive health and life insurance plans, you can protect your finances and secure your family's future, thus reducing the risk of debt caused by unexpected medical expenses.

10. Practice Financial Discipline

Cultivating financial discipline is critical for effective money management. Track your monthly expenses and income to gain insights into your spending habits. Consider using budgeting tools or financial apps to help you monitor your finances and identify areas for improvement. Taking these proactive steps empowers you to take control of your financial future and work towards becoming debt-free.

Research indicates that individuals who practice disciplined financial management tend to experience greater financial stability and less stress related to money matters. By implementing a budget and adhering to it, you can build a solid foundation for future financial growth.

Conclusion

In conclusion, navigating the financial landscape in Singapore requires vigilance and discipline. By following these ten essential strategies, you can effectively avoid the credit trap and build a solid financial foundation for your future. While the road to financial health may be challenging, the benefits of being debt-free and financially secure are well worth the effort. Embrace these principles, and remember that the key to successful financial management lies in preparation, awareness, and an ongoing commitment to your financial goals.

By taking these steps and staying informed about the latest financial trends, you can ensure that your financial future is not only stable but also prosperous in Singapore's dynamic economy.

Shaun

Founder

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

The Easiest Way Ever To Pass Your Financial Licensing Exam With Minimum Time And Money

Your career deserves the best tool

Disclaimer: Practice materials are 100% original by RealisedGains — unaffiliated with IBF, SCI, or MAS, for educational use only.

Founder, Analyst

With over a decade of expertise spanning investment advisory, investment banking analysis, oil trading, and financial advisory roles, RealisedGains is committed to empowering retail investors to achieve lasting financial well-being. By delivering meticulously curated investment insights and educational programs, RealisedGains equips individuals with the knowledge and tools to make sophisticated, informed financial decisions.

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

RealisedGains

The go to platform that keeps you informed on the financial markets. Best of all, it's free.

About

Products

Tools

Market News

Personal Finance

Socials

© 2025 RealisedGains | All Rights Reserved | www.realisedgains.com